- Pre- and After-Hours Trading on the NYSE and the Nasdaq

- key takeaways

- Where to Find Off-Hours Market Data

- The Pre-Market

- The After-Market

- Apple Inc AAPL

- AAPL Stock Chart

- Ideas

- Apple Inc AAPL

- Morningstar’s Analysis

- Apple Not Immune to Supply Chain Constraints Despite Solid Fiscal Q4; No Change to $124 FVE

- Analyst Note

- Company Profile

- Related

- Sponsor Center

- Transparency is our policy. Learn how it impacts everything we do.

- How we make money

- How we use your personal data

- How we approach editorial content

Pre- and After-Hours Trading on the NYSE and the Nasdaq

The stock market or technically speaking, the U.S. stock market exchanges—particularly the New York Stock Exchange (NYSE) and Nasdaq—is traditionally open between 9:30 a.m. and 4 p.m. ET (Eastern Time). However, with the adoption of new technology and increased demand for trading, these hours have been extended to include what is known as pre-market and after-hours trading.

Some of the most important market moves can take place outside the NYSE and Nasdaq regular trading sessions.

key takeaways

- The rise of electronic trading networks and a desire to be competitive caused the major U.S. stock exchanges to allow trading before and after the regular market hours of 9:30 a.m. and 4 p.m. ET in the early 1990s.

- Pre-market trading typically occurs between 8:00 a.m. and 9:30 a.m., though it can begin as early as 4 a.m. ET.

- After-hours trading starts at 4 p.m. and can run as late as 8 p.m. ET.

- Known collectively as extended trading hours, the pre- and after-market sessions carry several risks: illiquidity, price volatility, and low volume/lack of participants.

- Pre-market and after-hours trading is done exclusively through electronic communication networks (ECNs).

Where to Find Off-Hours Market Data

The first place investors should look to find information about pre-market and after-market activity is their brokerage account’s data service if they have one. Often brokerage information services provide the most detailed off-hour market trading data, and they usually come free with a brokerage account. Investors will often be able to not only trade within this time period but also see the current bid and ask prices for specific securities and the change in price compared to a previous period’s close.

If you don’t have a brokerage account or your broker doesn’t provide this service, there are several free sites that give users access to pre- and after-hours market data. The Nasdaq website offers comprehensive quotes on shares listed on the Nasdaq, showing every trade – including the price, time and size of trades made in off-hours trading. For pre-market trading information, use the pre-market quotes service, and for after-hours information, use the after-hours quotes service. Although the NYSE’s website does not offer such a detailed service, in terms of depth of information, the quoting service on its site shows you the last movements of the stocks during the off-hours market.

Other services like Yahoo Finance will show the last trade made in the pre- and after-hours markets. These services will usually cover all stocks, whether they trade on the NYSE, Nasdaq, or another exchange.

Pre-market and after-hours trading are also known collectively as extended trading.

The Pre-Market

The pre-market is the period of trading activity that occurs before the regular market opens. While its trading session typically occurs between 8:00 a.m. and 9:30 a.m. ET each trading day, several direct-access brokers allow access to pre-market trading to commence as early as 4:00 a.m.

However, very little activity occurs for most stocks so early in the morning, unless there is news. The liquidity is also extremely thin, with most stocks only showing stub quotes. So, while pre-market trading allows for an early jump on reactions to news—especially events that occur in Europe or the U.K.—the limited amount of volume can furnish a deceptive perception of a stock’s strength or weakness. In fact, trading in the wee hours can be quite risky due to the possible slippage from exceptionally wide bid-ask spreads.

Most early birds wait to begin pre-market access at 8:00 a.m. Pre-market trading can only be executed with limit orders through electronic communication networks (ECNs), such as Archipelago (ARCA), Instinet (INCA), Island (ISLD), and Bloomberg Trade Book (BTRD).

The After-Market

The New York Stock Exchange introduced after-market trading in June 1991 by extending trading hours by an hour. The move was a response to increased competition from international exchanges in London and Tokyo and private exchanges, which offered more hours of trading.

Today, after-hours trading starts at 4 p.m. ET and can run as late as 8 p.m., although volume typically thins out much earlier in the session; the majority is done by 6:30 p.m. As in the pre-hours, trading in the after-hours is conducted through ECNs.

After-hours trading is something traders or investors can use if news breaks after the close of the stock exchange. The changes in share prices during the after-hours are a valuable barometer of the market reacts to the new information released. However, after-hours price changes are more volatile than regular-hours prices: As with the pre-market, illiquidity and lack of volume can be a problem. Institutional investors or certain major investors may choose simply not to participate in after-hours trading, regardless of the news or the event. As a result, it is quite possible for a stock to fall sharply in the after-hours only to rise once the regular trading session resumes the next day.

Источник

Apple Inc AAPL

See more on advanced chart

See more on advanced chart

See more on advanced chart

See more on advanced chart

AAPL Stock Chart

Ideas

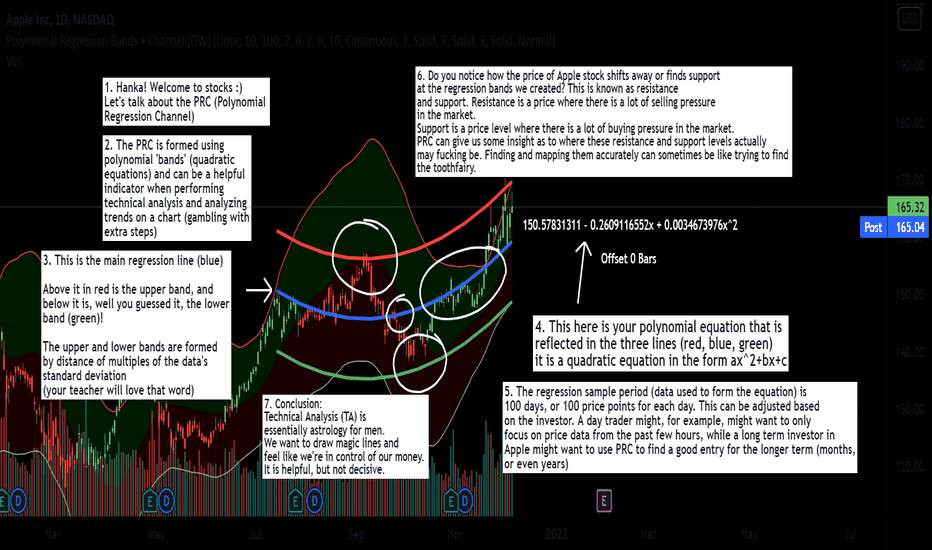

The «7» are defending yet another «Offsides» in Delta which presents the beginnings of a far larger selloff developing into Mid-Month. Fb is the laggard, the other 6 are up 3% on average with NVDA perfectly running the table after dunking all the Retail Call Buyers the Jumbos stepped in and took all they could at the Lows. Gamblers were stopped out for the.

After the COVID drop back in March of 2020, Apple entered into a new bullish Elliot wave cycle. I believe this wave cycle entered into the 5th cycle after the correction between September and October. This smaller wave cycle appears to be completing an extended 3rd wave. Based on the previous extension impulse correction, I’d estimate the price target to be.

AAPL close Monday: $165. Up $6 today to record high. Mkt cap over $2.8T. Nearly 900K WEEKLY calls traded today with strikes between 165 & 182.5. About 4x number of puts. Well-placed report last wk of iPhone DEMAND problem. P/E ratio over 30.Analysts expect F/Y ’22 EPS growth: +2% AAPL up another $2 after-hrs as punters continue their wilding, speculating on chat.

NASDAQ:AAPL formed a parellel channel up it will reach t1, t1

Since early September, AAPL’s price touched the top orange line on the Bollinger bands about 4 times. After it touches, price has the proclivity to retrace the previous low. A retracement towards $161 would be a 38% retracement. Previous high was broken after a higher low was made. Price has recently retraced 38% however, a lower high was made on the 1 hour timeframe.

Hanka this is a project I worked on a little bit after our convo, maybe it’ll inspire some cool math presentation lol. ima dip now cause its 1:30am

Apple will face a correction this week and will follow with a larger correction to 100$ this coming year 2022. Bear market ahead Prices are great to leave and watch

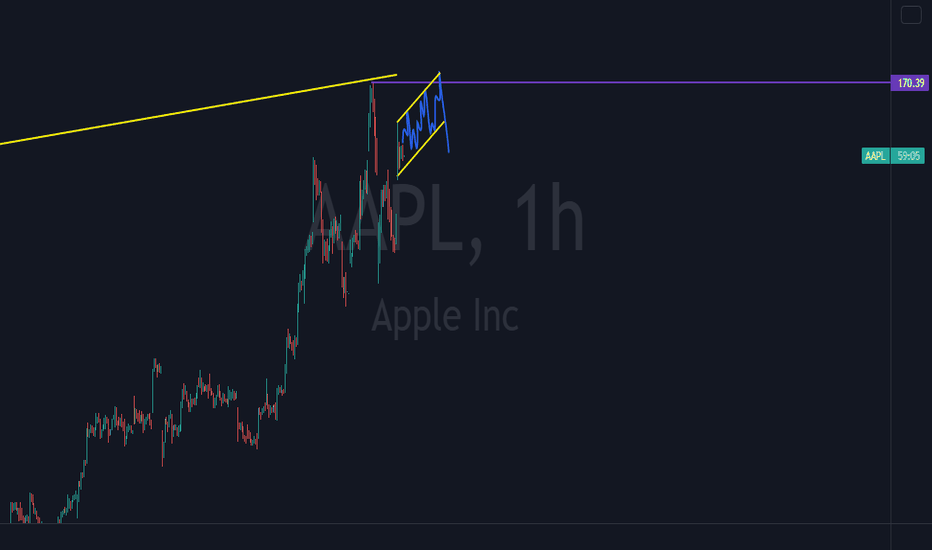

We are able to identify an ascending channel on the weekly chart. On the 1H Chart I am expecting for price to be bullish and create a double top before it changes direction.

Wave 5 looks to have completed. Looking for a pullback

AAPL: Outperforming another monday in the index following an initiated coverage from KeyBanc to a PT of $191 and a maintain on overweight position. AAPL is breaking out of a channel from March and seeing participants acceptance at higher price shelves. Monthly target favors breach of $170 level// ATR: 3.95, Beta: 1.20

All, I think we now can more easily see the AAPL diamond top. Need breaks of 164 to confirm, could spike few more times just keep an eye on it. This is a great example of being slightly biased or you can do 1:1 calls/puts and hold them and drop the other. If this drops and bounces 164s could see bull move. Hard to do on AAPL at this price lots of people don’t.

Hello TradingView. -Video Posted on 07-28-2021- This video is a detailed video overview of the CM MACD Custom Indicator — Multiple Time Frame — V2 Release. I will post the link to the Indicator within a few minutes after this video goes live on TradingView either in the Link to Related Ideas below, or I’ll post a comment below with the link. Thanks for.

Hello TradingView. -Video Posted on 08-23-2021- This video is a detailed video overview of the _CM_Ultimate_MA_MTF_V4 — Multiple Time Frame — V4 Release. I will post the link to the Indicator within a few minutes after this video goes live on TradingView either in the Link to Related Ideas below, or I’ll post a comment below with the link. Thanks for you.

For those of us who like to leverage the awesome charting capabilities of TradingView to visualize, analyze and track a portfolio of holdings, i wanted to share couple of ways i have been using in the past few months. I found that the ability to «chart» a portfolio adds a whole new dimension to my decision making — that looking at the portfolio in numbers on.

Things are looking very similar to how they did in October 2018. > In 2018 FAAMG fell by 25%. > If we correct 25% like we did in 2018, it would take us to the lower support of this ascending channel. > A 25% correction would also take us perfectly to the 100-week MA. > Bearish divergences are shaping up in similar ways as well. It’s interesting to note the.

Before this trading week, I published my target price analysis for AAPL, MSFT, GOOG, AMZN, TSLA, FB, NVDA, AMD, LCID, and the major indexes! I was bearish on all of them. While my apple analysis failed, others became right! and the statistics show 1 in 12, which is 91.5% correctness! .

AAPL ran into the close of the Nasdaq but it seems suspicious as if it’s planning to dump Next week or Tomorrow even i will be looking for it to fade all of it’s daily gains from the day. If it goes above 170 then i will exit this trade.

so far its getting rejected just like we expected in our previous analysis! on the smaller daily timeframe we can see the potential dip entry areas are 146-152. Look for bounces off these levels. Until then I’m bearish. like and follow for more, thanks! 💘

Источник

Apple Inc AAPL

Morningstar’s Analysis

Apple Not Immune to Supply Chain Constraints Despite Solid Fiscal Q4; No Change to $124 FVE

Analyst Note

Narrow-moat Apple reported fiscal fourth-quarter results that came in below FactSet consensus estimates for revenue, as the firm faced supply chain constraints that weighed on sales by about $6 billion. However, we expect Apple to recover in the long term and still foresee solid demand for the company’s products and services as these supply issues subside. We are maintaining our $124 fair value estimate and suggest investors wait for a wider margin of safety, as we anticipate the Mac and iPad segments will begin decelerating in the coming quarters, following a stretch of robust growth due to COVID-19-related working- and learning-from-home.

Company Profile

Apple designs a wide variety of consumer electronic devices, including smartphones (iPhone), tablets (iPad), PCs (Mac), smartwatches (Apple Watch), AirPods, and TV boxes (Apple TV), among others. The iPhone makes up the majority of Apple’s total revenue. In addition, Apple offers its customers a variety of services such as Apple Music, iCloud, Apple Care, Apple TV+, Apple Arcade, Apple Card, and Apple Pay, among others. Apple’s products run internally developed software and semiconductors, and the firm is well known for its integration of hardware, software and services. Apple’s products are distributed online as well as through company-owned stores and third-party retailers. The company generates roughly 40% of its revenue from the Americas, with the remainder earned internationally.

Related

Sponsor Center

Transparency is our policy. Learn how it impacts everything we do.

Transparency is how we protect the integrity of our work and keep empowering investors to achieve their goals and dreams. And we have unwavering standards for how we keep that integrity intact, from our research and data to our policies on content and your personal data.

We’d like to share more about how we work and what drives our day-to-day business.

How we make money

We sell different types of products and services to both investment professionals and individual investors. These products and services are usually sold through license agreements or subscriptions. Our investment management business generates asset-based fees, which are calculated as a percentage of assets under management. We also sell both admissions and sponsorship packages for our investment conferences and advertising on our websites and newsletters.

How we use your personal data

How we use your information depends on the product and service that you use and your relationship with us. We may use it to:

- Verify your identity, personalize the content you receive, or create and administer your account.

- Provide specific products and services to you, such as portfolio management or data aggregation.

- Develop and improve features of our offerings.

- Gear advertisements and other marketing efforts towards your interests.

To learn more about how we handle and protect your data, visit our privacy center.

How we approach editorial content

Maintaining independence and editorial freedom is essential to our mission of empowering investor success. We provide a platform for our authors to report on investments fairly, accurately, and from the investor’s point of view. We also respect individual opinions––they represent the unvarnished thinking of our people and exacting analysis of our research processes. Our authors can publish views that we may or may not agree with, but they show their work, distinguish facts from opinions, and make sure their analysis is clear and in no way misleading or deceptive.

To further protect the integrity of our editorial content, we keep a strict separation between our sales teams and authors to remove any pressure or influence on our analyses and research.

Read our editorial policy to learn more about our process.

Источник

:max_bytes(150000):strip_icc()/charles-potters-headshot-RebeccaPotters-9f7cd24033df45fd8b927eca37f9ab82.jpg)