- Apple Inc AAPL

- AAPL Stock Chart

- Ideas

- Apple Stock Forecast NASDAQ: AAPL

- Apple Stock Forecast

- Apple stock downgraded to Buy Candidate (Updated on Dec 09, 2021)

- Signals & Forecast

- Support, Risk & Stop-loss

- Is Apple Inc. stock A Buy?

- Predicted Opening Price for Apple Inc. of Friday, December 10, 2021

- Apple stock price today

- Premium Research Tools

- Market Data and Calendars

- Investing Education and Resources

- The share price of Apple Inc. (AAPL) now

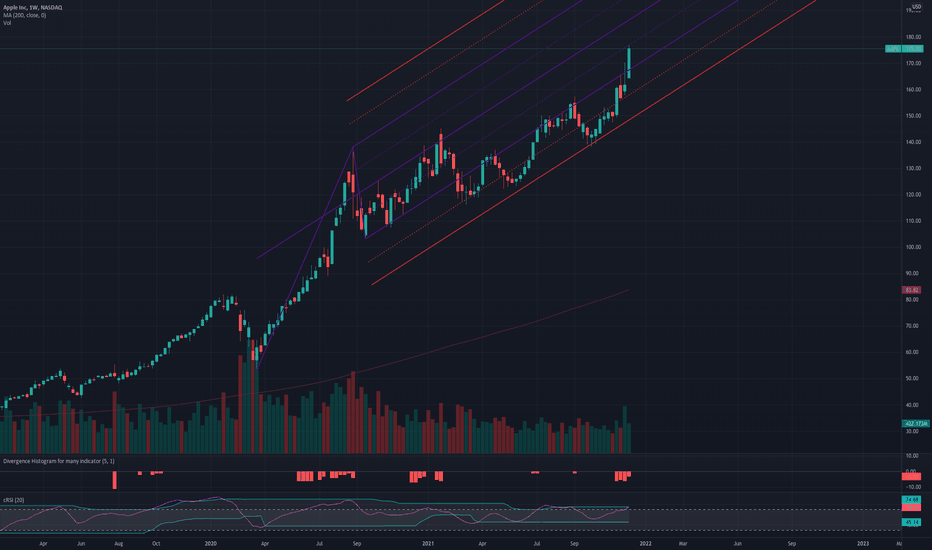

- Historical and forecast chart of Apple stock

Apple Inc AAPL

See more on advanced chart

See more on advanced chart

See more on advanced chart

See more on advanced chart

AAPL Stock Chart

Ideas

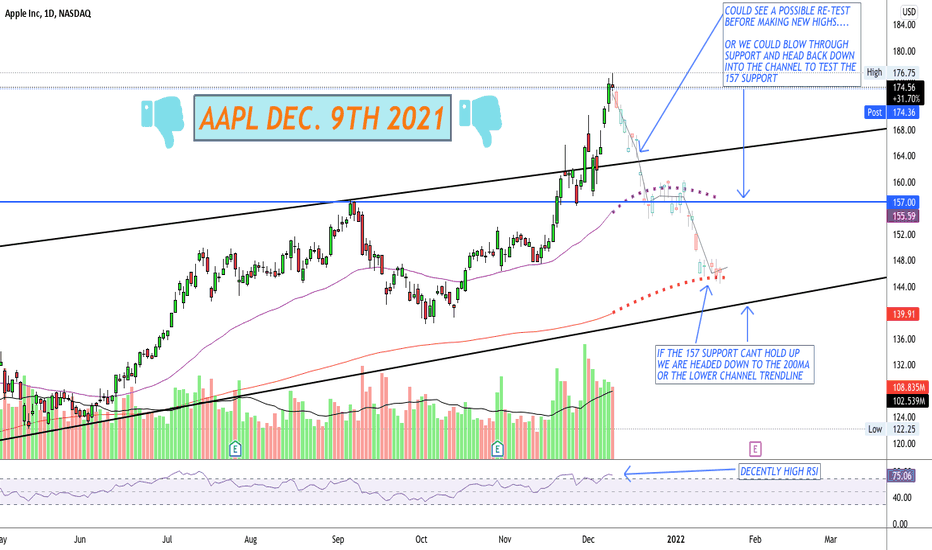

This is what I’m looking at, whether it’s true or not, I think the opportunity is to the downside. We’ll see how the end of the day shakes out.

WATCHING $AAPL for 152 I you’re buying this high up — good for you. I wish you the best… but for me it makes no sense to be long this high up. I have target 1 as 164, but I’m ignoring that one and going straight to target 2, at 152…. But going further out into time, I’m looking at 140, 123, and even 117… those are levels I would be much more comfortable.

Apple bearish AB=CD pattern short term and bounced of SL level.

NASDAQ:AAPL APPL We may see it uptrend $3-4 more. Then small correction to 166-170 area. Stop loss if close above 181.

See this.. that is what will be happening. Count on it. For now.. a pump is on its way.. options are stacked with calls for Apple. It will do a nice big drop in the coming months. It will. nobody is buying up here. Nobody. It’s a bubble. Patience. Sub 100, Sub 90 is on its way.

Reached overbought on RSI Period 30, wait for bearish divergence before adding shorts for safe entry.

AAPL is overextended, getting some puts ending next week for a pullback.

This thing keep running on strength, once it settles down or even if money shifts elsewhere, I would like to see a pull back to $170. Trying a $170 12/17 put at $1.67.

Schiff Pitchford matching the trend perfectly. Hit resistance at 175.00 it should correct now (surely), to match the correction in the NQ and SPY.

Today we made a nice doji on the daily chart. Right now there is no resistance as far as the eye can see, but a pull back is in the near future. Whether it happens tomorrow, or next week it is bound to happen. If we pull back, we could see a re-test of the upper channel trendline. It used to be a very solid resistance when aapl was in the channel, but now that.

Rising Parallel Channel. Price hit resistance and looking back in time, price seems to bounce off that ascending level. I expect a 3% dip and bounce back up off the EMA cloud. Confirmation on that volume decrease plus u got a doji-type candle at the peak just as it touched resistance. Happy Trading, Stefan Owner of A-Stock Trading

Apple needs to cool down. SPY and QQQ way behind of AAPL

5 strong fibs in this area. Scroll back to see them all. More interesting as a signal than a trade. Both AAPL and TSLA looking toppy. Could they be indicating an index top also. Could overshoot but this will see $110 at least down the road I think, maybe more or even much more. Not advice.

I have been watching AAPL for a while now and it has been respecting a channel for quiet a while. I would want to see a big move down with volume as confirmation to short it. however my analysis is solely based on technical analysis I would really love to hear you opinion tho.

This is a near term update to my bigger picture (click) . New ATH with a surge defying the market. Into no-mans land between major levels. Sings of possible blow off top or bull trap. Last bounce on a major, and I mean MAJOR, level at $159.31 So this surge could well be the result of a HIGH ENERGY fib. Time of Year and Market Conditions DO favor an upward.

Apple driving SPY and Friday morning with CPI data we will see more volatile price actions here. 148 or 190

Short $AAPL Rejection from upper channel (Expect pull back) Target $170

— We have a strong bullish trend, the yellow trendline is a strong support, the blue area is also a strong support. 1- In case the chart breaks the yellow trendline, it is quite possible that the chart will descend and retreat into a support area. 2 — if the chart has not broken the yellow trendline, it is very likely that it will continue to rise. — The chart.

Источник

Apple Stock Forecast NASDAQ: AAPL

Closed: Dec 09, 2021

Apple Stock Forecast

Closed: Dec 09, 2021

- Chart & Analysis

- Forecast

- Insider Trading

- Data & Signals

- Historical Prices

- Earnings Reports

- Predictions

- Statistics

- News

- Profile

- Premium

Key Stats

| P/E Ratio | 15.17 |

| Beta | 1.33 |

| Trailing Dividend Rate | 0.49% ($0.86) |

Apple stock downgraded to Buy Candidate

(Updated on Dec 09, 2021)

The Apple stock price fell by -0.30% on the last day (Thursday, 9th Dec 2021) from $175.08 to $174.56. During the day the stock fluctuated 1.63% from a day low at $173.92 to a day high of $176.75. The price has been going up and down for this period, and there has been a 7.79% gain for the last 2 weeks. Volume fell on the last day along with the stock, which is actually a good sign as volume should follow the stock. On the last day, the trading volume fell by -8 million shares and in total, 109 million shares were bought and sold for approximately $18.94 billion.

The stock lies in the upper part of a wide and strong rising trend in the short term, and this may normally pose a very good selling opportunity for the short-term trader as reaction back towards the lower part of the trend can be expected. A break-up at the top trend line at $175.44 will firstly indicate a stronger rate of rising. Given the current short-term trend, the stock is expected to rise 15.04% during the next 3 months and, with a 90% probability hold a price between $178.07 and $201.83 at the end of this 3-month period.

Signals & Forecast

The Apple stock holds buy signals from both short and long-term moving averages giving a positive forecast for the stock. Also, there is a general buy signal from the relation between the two signals where the short-term average is above the long-term average. On corrections down, there will be some support from the lines at $168.07 and $156.09. A breakdown below any of these levels will issue sell signals. Furthermore, there is a buy signal from the 3 month Moving Average Convergence Divergence (MACD). Some negative signals were issued as well, and these may have some influence on the near short-term development. A sell signal was issued from a pivot top point on Wednesday, December 08, 2021, and so far it has fallen -0.30%. Further fall is indicated until a new bottom pivot has been found. Volume fell together with the price during the last trading day and this reduces the overall risk as volume should follow the price movements.

Support, Risk & Stop-loss

On the downside, the stock finds support just below today’s level from accumulated volume at $165.30 and $164.77. There is natural risk involved when a stock is testing a support level, since if this is broken, the stock then may fall to the next support level. In this case, Apple finds support just below today’s level at $165.30. If this is broken, then the next support from accumulated volume will be at $164.77 and $148.97.

This stock has average movements during the day and with good trading volume, the risk is considered to be medium. During the last day, the stock moved $2.83 between high and low, or 1.63%. For the last week, the stock has had a daily average volatility of 2.42%.

Our recommended stop-loss: $168.22 (-3.63%) (This stock has medium daily movements and this gives medium risk. There is a sell signal from a pivot top found 1 days ago.)

Is Apple Inc. stock A Buy?

Several short-term signals, along with a general good trend, are positive and we conclude that the current level may hold a buying opportunity as there is a fair chance for Apple stock to perform well in the short-term. Due to some small weaknesses in the technical picture we have downgraded our analysis conclusion for this stock since the last evaluation from a Strong Buy to a Buy candidate.

Current score: 1.729

Predicted Opening Price for Apple Inc. of Friday, December 10, 2021

The predicted opening price is based on yesterday’s movements between high, low, and the closing price.

Источник

Apple stock price today

Premium Research Tools

MarketBeat All Access subscribers can access stock screeners, the Idea Engine, data export tools, research reports, and other premium tools.

Market Data and Calendars

Looking for new stock ideas? Want to see which stocks are moving? View our full suite of financial calendars and market data tables, all for free.

Investing Education and Resources

Receive a free world-class investing education from MarketBeat. Learn about financial terms, types of investments, trading strategies and more.

MarketBeat empowers individual investors to make better trading decisions by providing real-time financial data and objective market analysis. Whether you’re looking for analyst ratings, corporate buybacks, dividends, earnings, economic reports, financials, insider trades, IPOs, SEC filings or stock splits, MarketBeat has the objective information you need to analyze any stock. Learn more about MarketBeat.

© American Consumer News, LLC dba MarketBeat® 2010-2021. All rights reserved.

326 E 8th St #105, Sioux Falls, SD 57103 | U.S. Based Support Team at [email protected] | (844) 978-6257

MarketBeat does not provide personalized financial advice and does not issue recommendations or offers to buy stock or sell any security.

© 2021 Market data provided is at least 10-minutes delayed and hosted by Barchart Solutions. Information is provided ‘as-is’ and solely for informational purposes, not for trading purposes or advice, and is delayed. To see all exchange delays and terms of use please see disclaimer. Fundamental company data provided by Zacks Investment Research.

Источник

Last update: 12-10-2021, 7:29

The share price of Apple Inc. (AAPL) now

What analysts predict:: $168.95

52-week high/low: $170.3 / $115.67

50/200 Day Moving Average: $150.1 / $138.97

This figure corresponds to the average price over the previous 50/200 days. For Apple stocks, the 50-day moving average is the support level today.

For Apple stocks, the 200-day moving average is the support level today.

Are you interested in Apple Inc. stocks and want to buy them, or are they already in your portfolio? If yes, then on this page you will find useful information about the dynamics of the Apple stock price in 2022, 2023, 2024, 2025, 2026. How much will one Apple share be worth in 2022 — 2026?

When should I take profit in Apple stock? When should I record a loss on Apple stock? What are analysts’ forecasts for Apple stock? What is the future of Apple stock?

We forecast Apple stock performance using neural networks based on historical data on Apple stocks. Also, when forecasting, technical analysis tools are used, world geopolitical and news factors are taken into account.

Apple stock prediction results are shown below and presented in the form of graphs, tables and text information, divided into time intervals. (Next month, 2022, 2023, 2024, 2025 and 2026)

The final quotes of the instrument at the close of the previous trading day are a signal to adjust the forecasts for Apple shares. This happens once a day.

Historical and forecast chart of Apple stock

The chart below shows the historical price of Apple stock and a prediction chart for the next month. For convenience, prices are divided by color. Forecast prices include: Optimistic Forecast, Pessimistic Forecast, and Weighted Average Best Forecast. Detailed values for the Apple stock price can be found in the table below.

Источник