Apple Inc AAPL

See more on advanced chart

See more on advanced chart

See more on advanced chart

See more on advanced chart

AAPL Stock Chart

Ideas

The «7» are defending yet another «Offsides» in Delta which presents the beginnings of a far larger selloff developing into Mid-Month. Fb is the laggard, the other 6 are up 3% on average with NVDA perfectly running the table after dunking all the Retail Call Buyers the Jumbos stepped in and took all they could at the Lows. Gamblers were stopped out for the.

Fresh ATHs, and this turned into a good overnight. good place to take some profit with all the divergences.

Hello, Welcome to this analysis about AAPL and the 2-day timeframe perspectives. In the recent times the stock market is showing quite differential signals with some stocks down and others are up and forming interesting formations. In this case now I discovered an important formation forming with AAPL in the structure that has some good potentials to complete.

After the COVID drop back in March of 2020, Apple entered into a new bullish Elliot wave cycle. I believe this wave cycle entered into the 5th cycle after the correction between September and October. This smaller wave cycle appears to be completing an extended 3rd wave. Based on the previous extension impulse correction, I’d estimate the price target to be.

AAPL close Monday: $165. Up $6 today to record high. Mkt cap over $2.8T. Nearly 900K WEEKLY calls traded today with strikes between 165 & 182.5. About 4x number of puts. Well-placed report last wk of iPhone DEMAND problem. P/E ratio over 30.Analysts expect F/Y ’22 EPS growth: +2% AAPL up another $2 after-hrs as punters continue their wilding, speculating on chat.

NASDAQ:AAPL formed a parellel channel up it will reach t1, t1

Apple INC shares have been moving upwards and personally feel it’s overdone. The GANN fan line break and break-away Gap no doubt shows the market concern buying into the stock heavily. the strategy for the medium-term is still sell between $ 165-175 for a move lower to $ 135. Stop-loss perhaps somewhere $ 180 above, however, would still be a seller at that level.

Apple company still has great conditions for growth, but at the moment there is an opportunity for short. This opportunity is great at a time when market fears are growing and there may be an unexpected and sharp decline not only here. Low volume as well as achieving the upper line of the parallel channel are good prerequisites for this decision.

Since early September, AAPL’s price touched the top orange line on the Bollinger bands about 4 times. After it touches, price has the proclivity to retrace the previous low. A retracement towards $161 would be a 38% retracement. Previous high was broken after a higher low was made. Price has recently retraced 38% however, a lower high was made on the 1 hour timeframe.

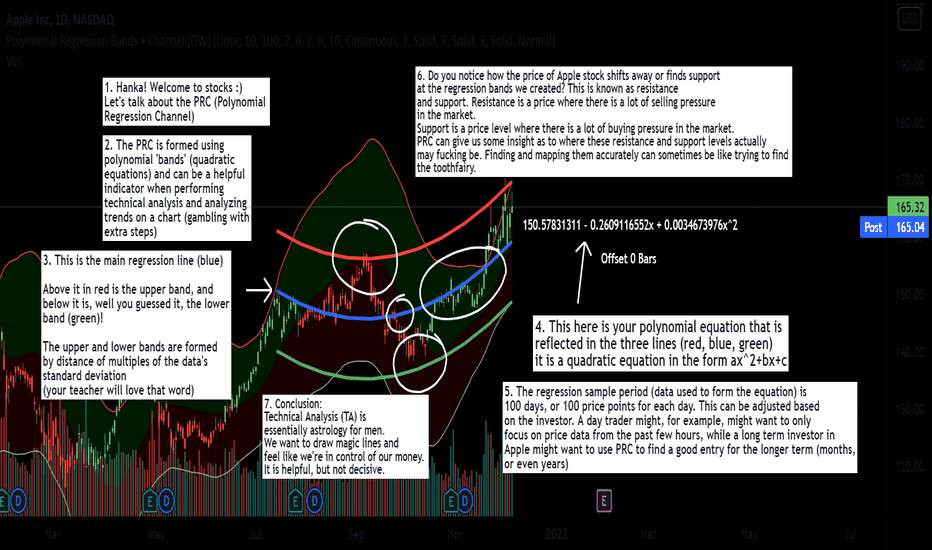

Hanka this is a project I worked on a little bit after our convo, maybe it’ll inspire some cool math presentation lol. ima dip now cause its 1:30am

Apple will face a correction this week and will follow with a larger correction to 100$ this coming year 2022. Bear market ahead Prices are great to leave and watch

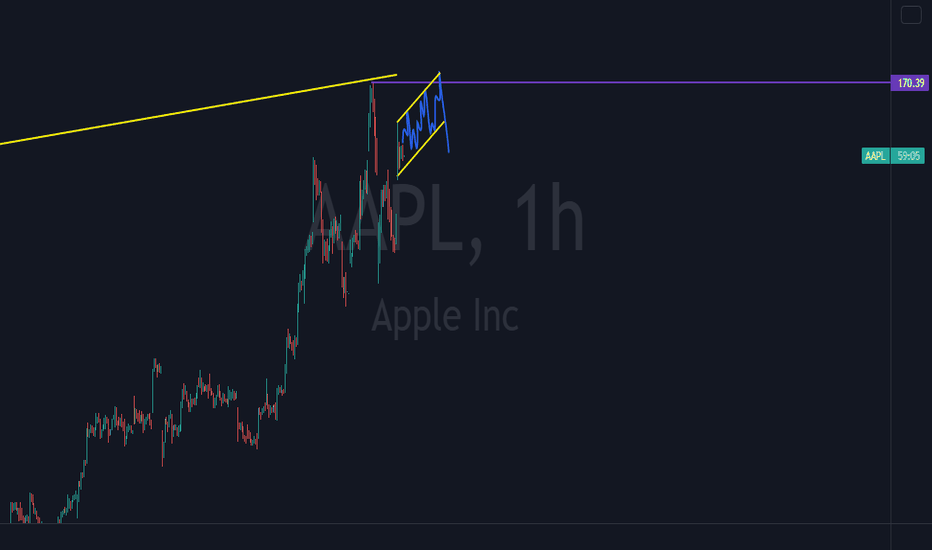

We are able to identify an ascending channel on the weekly chart. On the 1H Chart I am expecting for price to be bullish and create a double top before it changes direction.

Wave 5 looks to have completed. Looking for a pullback

Hello TradingView. -Video Posted on 07-28-2021- This video is a detailed video overview of the CM MACD Custom Indicator — Multiple Time Frame — V2 Release. I will post the link to the Indicator within a few minutes after this video goes live on TradingView either in the Link to Related Ideas below, or I’ll post a comment below with the link. Thanks for.

Hello TradingView. -Video Posted on 08-23-2021- This video is a detailed video overview of the _CM_Ultimate_MA_MTF_V4 — Multiple Time Frame — V4 Release. I will post the link to the Indicator within a few minutes after this video goes live on TradingView either in the Link to Related Ideas below, or I’ll post a comment below with the link. Thanks for you.

All, I think we now can more easily see the AAPL diamond top. Need breaks of 164 to confirm, could spike few more times just keep an eye on it. This is a great example of being slightly biased or you can do 1:1 calls/puts and hold them and drop the other. If this drops and bounces 164s could see bull move. Hard to do on AAPL at this price lots of people don’t.

For those of us who like to leverage the awesome charting capabilities of TradingView to visualize, analyze and track a portfolio of holdings, i wanted to share couple of ways i have been using in the past few months. I found that the ability to «chart» a portfolio adds a whole new dimension to my decision making — that looking at the portfolio in numbers on.

Things are looking very similar to how they did in October 2018. > In 2018 FAAMG fell by 25%. > If we correct 25% like we did in 2018, it would take us to the lower support of this ascending channel. > A 25% correction would also take us perfectly to the 100-week MA. > Bearish divergences are shaping up in similar ways as well. It’s interesting to note the.

Источник

Apple Stock Forecast NASDAQ: AAPL

Closed: Dec 07, 2021

Apple Stock Forecast

Closed: Dec 07, 2021

- Chart & Analysis

- Forecast

- Insider Trading

- Data & Signals

- Historical Prices

- Earnings Reports

- Predictions

- Statistics

- News

- Profile

- Premium

Key Stats

| P/E Ratio | 14.83 |

| Beta | 1.33 |

| Trailing Dividend Rate | 0.5% ($0.86) |

Green day on Tuesday for Apple

(Updated on Dec 07, 2021)

The Apple stock price gained 3.54% on the last trading day (Tuesday, 7th Dec 2021), rising from $165.32 to $171.18. , and has now gained 3 days in a row. It will be exciting to see whether it manages to continue gaining or take a minor break for the next few days. During the day the stock fluctuated 1.92% from a day low at $168.34 to a day high of $171.58. The price has risen in 6 of the last 10 days and is up by 6.31% over the past 2 weeks. Volume has increased on the last day along with the price, which is a positive technical sign, and, in total, 9 million more shares were traded than the day before. In total, 116 million shares were bought and sold for approximately $19.79 billion.

The stock lies in the upper part of a wide and strong rising trend in the short term, and this may normally pose a very good selling opportunity for the short-term trader as reaction back towards the lower part of the trend can be expected. A break-up at the top trend line at $172.85 will firstly indicate a stronger rate of rising. Given the current short-term trend, the stock is expected to rise 11.43% during the next 3 months and, with a 90% probability hold a price between $169.16 and $192.60 at the end of this 3-month period.

Signals & Forecast

Mostly positive signals in the chart today. The Apple stock holds buy signals from both short and long-term moving averages giving a positive forecast for the stock. Also, there is a general buy signal from the relation between the two signals where the short-term average is above the long-term average. On corrections down, there will be some support from the lines at $164.63 and $154.62. A breakdown below any of these levels will issue sell signals. A buy signal was issued from a pivot bottom point on Monday, October 04, 2021, and so far it has risen 23.03%. Further rise is indicated until a new top pivot has been found. Furthermore, there is a buy signal from the 3 month Moving Average Convergence Divergence (MACD). Volume is rising along with the price. This is considered to be a good technical signal.

Support, Risk & Stop-loss

Apple finds support from accumulated volume at $165.30 and this level may hold a buying opportunity as an upwards reaction can be expected when the support is being tested.

This stock has average movements during the day and with good trading volume, the risk is considered to be medium. During the last day, the stock moved $3.24 between high and low, or 1.92%. For the last week, the stock has had a daily average volatility of 2.99%.

The Apple stock is overbought on RSI14 and lies in the upper part of the trend. Normally this may pose a good selling opportunity for the short-term trader, but some stocks may go long and hard while being overbought and the RSI is still moving upwards. Regardless, the high RSI together with the trend position increases the risk and higher daily movements (volatility) should be expected. A correction down in the nearby future seems very likely, and it is of great importance that the stock manages to break the trend before that occurs.

Our recommended stop-loss: $165.26 (-3.46%) (This stock has medium daily movements and this gives medium risk. The RSI14 is 77 and this increases the risk substantially. There is a buy signal from a pivot bottom found 45 days ago.)

Is Apple Inc. stock A Buy?

Apple holds several positive signals and is within a strong rising trend. As the old saying says, «Let the trend be your friend.'». We therefore consider it to be a good choice at these current levels and we are expecting further gains during the next 3 months.

Current score: 6.923

Predicted Opening Price for Apple Inc. of Wednesday, December 8, 2021

The predicted opening price is based on yesterday’s movements between high, low, and the closing price.

Источник

Apple Inc (AAPL)

Volume totals reflect options traded during the current session.

Stocks: 15 20 minute delay (Cboe BZX is real-time), ET. Volume reflects consolidated markets. Futures and Forex: 10 or 15 minute delay, CT. Market Data powered by Barchart Solutions. Fundamental data provided by Zacks and Morningstar.

© 2021 Barchart.com, Inc. All Rights Reserved.

Barchart allows you to view options by Expiration Date (select the expiration month/year using the drop-down menu at the top of the page). Weekly expiration dates are labeled with a (w) in the expiration date list.

Options information is delayed a minimum of 15 minutes, and is updated at least once every 15-minutes through-out the day.

Select an options expiration date from the drop-down list at the top of the table, and select «Near-the-Money» or «Show All’ to view all options.

Note: Option quotes with an asterisk * after the strike price are «restricted options», typically created after spin-offs or mergers.

You can also view options in a Stacked or Side-by-Side view. The View setting determines how Puts and Calls are listed on the page. For both views, «Near-the-Money» Calls and Puts are highlighted:

Near-the-Money — Puts: Strike Price is greater than the Last Price

Near-the-Money — Calls: Strike Price is less than the Last Price

Logged in Barchart Members can set a preference for how this page displays.

- Select your desired number of strikes

- 5 Strikes +/-

- Near-the-Money (10 Strikes +/-)

- 20 Strikes +/-

- 50 Strikes +/-

- All Strikes

- Select the page layout (Stacked, Stacked OHLC, Side-by-Side, Side-by-Side HLC)

- Choose whether or not to show the Volume Graph. The Volume Graph highlights the comparative proportion of volume and open interest for selected strikes. It helps you easily see activity that may signal new positions or a potential move in the underlying asset.

- Sort the Strike column in ascending or descending order

- Finally, click the «Make this my default view» link top right of the page to save your preference for the next time you visit the page.

For the selected Options Expiration date, the information listed at the top of the page includes:

- Options Expiration: The last day on which an option may be exercised, or the date when an option contract ends. Also includes the number of days till options expiration (this number includes weekends and holidays).

- Implied Volatility: The average implied volatility (IV) of the nearest monthly options contract. IV is a forward looking prediction of the likelihood of price change of the underlying asset, with a higher IV signifying that the market expects significant price movement, and a lower IV signifying the market expects the underlying asset price to remain within the current trading range.

- Historic Volatility: The 20-day historic volatility for the underlying asset. Historic volatility is the standard deviation of the «price returns» over a given number of sessions, multiplied by a factor (260 days) to produce an annualized volatility level.

A Stacked view lists Puts and Calls one on top of the other, sorted by Strike Price.

- Strike: The price at which the contract can be exercised. Strike prices are fixed in the contract. For call options, the strike price is where the shares can be bought (up to the expiration date), while for put options the strike price is the price at which shares can be sold. The difference between the underlying contract’s current market price and the option’s strike price represents the amount of profit per share gained upon the exercise or the sale of the option. This is true for options that are in the money; the maximum amount that can be lost is the premium paid.

- Moneyness — the percent from the last price: (strike price — last / last). Moneyness refers to the relative position of the underlying asset’s last price to the strike price. When a call option’s Moneyness is negative, the underlying last price is less than the strike price; when positive, the underlying last price is greater than the strike price. When a put option’s Moneyness is negative, the underlying last price is greater than the strike price; when positive, the underlying last price is less than the strike price.

- Bid: The bid price for the option.

- Midpoint: The midpoint between the bid and ask.

- Ask: The ask price for the option.

- Last: The last traded price for the options contract.

- Change: The difference between the current price and the previous day’s settlement price.

- %Change: The difference between the current price and the previous day’s settlement price, expressed as a percent.

- Volume: The total number of option contracts bought and sold for the day, for that particular strike price.

- Open Interest: Open Interest is the total number of open option contracts that have been traded but not yet liquidated via offsetting trades for that date.

- Vol/OI — for the Strike Price: today’s volume / today’s open interest. A higher ratio indicates unusual activity for the option.

- Implied Volatility — Implied Volatility (IV) is the estimated volatility of the underlying stock over the period of the option. IV can help traders determine if options are fairly valued, undervalued, or overvalued. It can therefore help traders make decisions about option pricing, and whether it is a good time to buy or sell options. Implied volatility is determined mathematically by using current option prices in a formula that also includes Standard Volatility (which is based on historical data). The resulting number helps traders determine whether the premium of an option is «fair» or not. It is also a measure of investors’ predictions about future volatility of the underlying stock.

A Side-by-Side View lists Calls on the left and Puts on the right.

- Last: The last traded price for the options contract.

- %Change: The difference between the current price and the previous day’s settlement price, expressed as a percent.

- Bid: The bid price for the option.

- Ask: The ask price for the option.

- Volume: The total number of option contracts bought and sold for the day, for that particular strike price.

- Open Interest: Open Interest is the total number of open option contracts that have been traded but not yet liquidated via offsetting trades for that date.

- Strike: The price at which the contract can be exercised. Strike prices are fixed in the contract. For call options, the strike price is where the shares can be bought (up to the expiration date), while for put options the strike price is the price at which shares can be sold. The difference between the underlying contract’s current market price and the option’s strike price represents the amount of profit per share gained upon the exercise or the sale of the option. This is true for options that are in the money; the maximum amount that can be lost is the premium paid.

When checked, the Volume Graph highlights the comparative proportion of volume and open interest for selected strikes. It helps you easily see activity that may signal new positions or a potential move in the underlying asset.

The totals listed at the bottom of the page are calculated from all calls and puts, and not just Near-the-Money options. Volume totals reflect options traded during the current session.

- Put Volume Total: The total volume of all put option premiums.

- Call Volume Total: The total volume of all call option premiums.

- Put/Call Volume Ratio: Put Volume Total / Call Volume Total.

- Put Open Interest Total: The total open interest of all put options.

- Call Open Interest Total: The total open interest of all call options.

- Put/Call Open Interest Ratio: Put Open Interest Total / Call Open Interest Total.

Источник