- Manage the cards that you use with Apple Pay

- Change your default card

- iPhone or iPad

- Apple Watch

- Mac models with Touch ID

- Update your billing and contact information

- iPhone or iPad

- Mac models with Touch ID

- Remove a card

- iPhone or iPad

- Apple Watch

- Mac models with Touch ID

- Manage your store or rewards cards

- Get help if your device is lost or stolen

- Learn more

- Credit Card Payment 4+

- Infinite Loop Development Ltd

- Для iPad

- Снимки экрана

- Описание

- Что нового

- Конфиденциальность приложения

- Нет сведений

- Nomod | Card Payment POS 4+

- Nomod Inc.

- Снимки экрана (iPhone)

- Описание

- ProPay Payments 4+

- Accept Credit Cards

- TSYS Acquiring Solutions

- Designed for iPad

- Screenshots

- Description

Manage the cards that you use with Apple Pay

After you add cards to Wallet, you can change your default card, update your information, or remove a card. 1

Managing your cards works differently depending on the device you’re using. 2

Change your default card

The first card that you add to Wallet is your default card. If you add more cards and want to change your default card, use these steps.

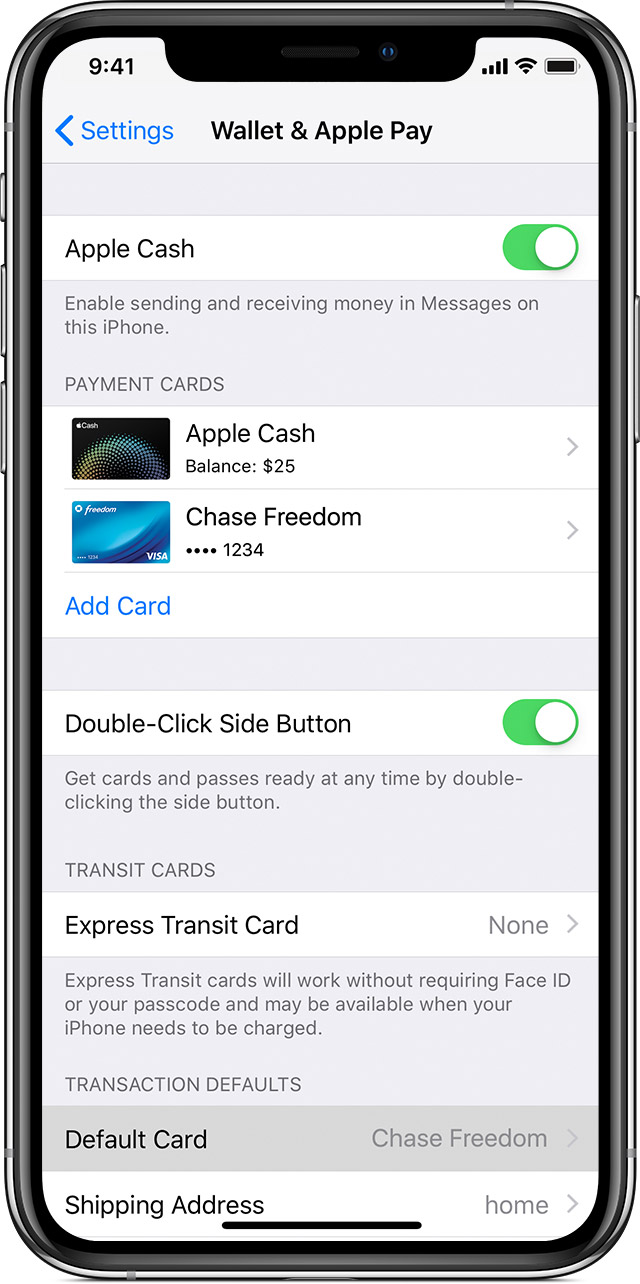

iPhone or iPad

Go to Settings > Wallet & Apple Pay on your iPhone or iPad, and scroll down to Transaction Defaults. Tap Default Card, then choose a new card.

On your iPhone, you can also open Wallet, touch and hold a card, then drag it to the front of your cards.

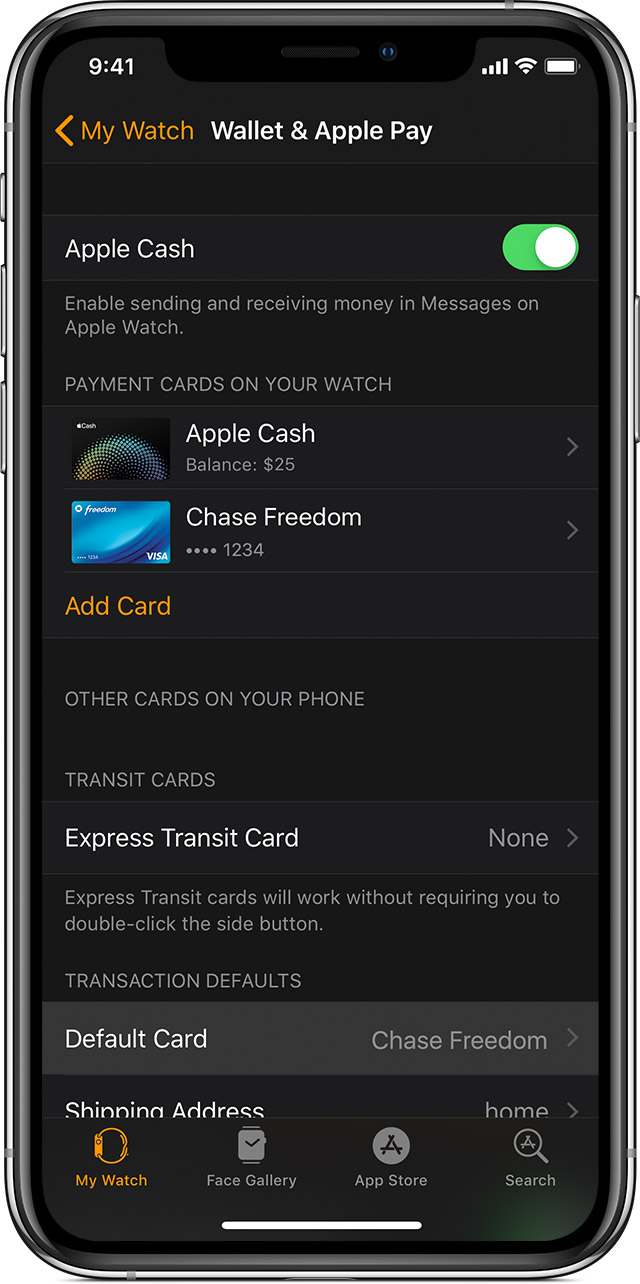

Apple Watch

Open the Apple Watch app on your iPhone. Tap the My Watch tab, tap Wallet & Apple Pay > Default Card, then choose a new card.

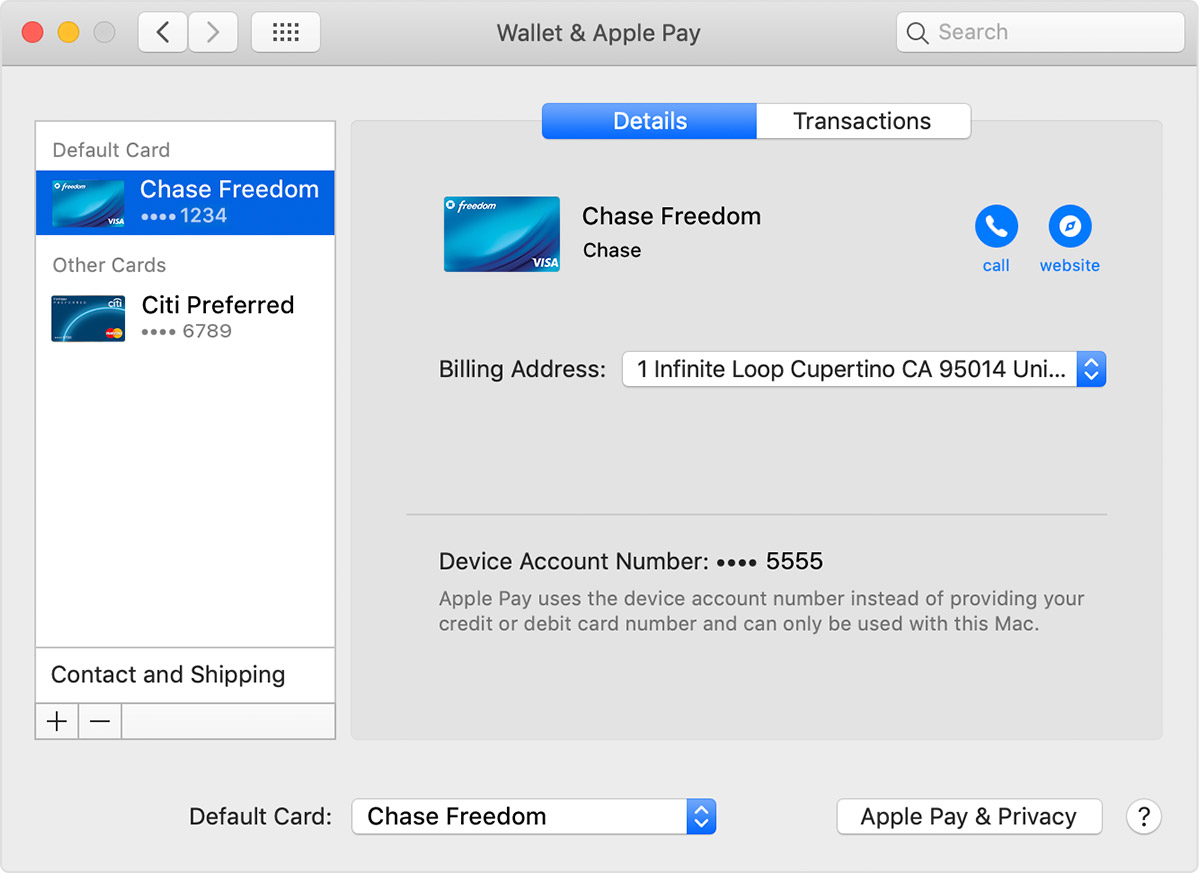

Mac models with Touch ID

Go to System Preferences > Wallet & Apple Pay. Choose a new card from the Default Card pop-up menu.

Person to person payments with Apple Pay and Apple Cash aren’t available on macOS. 3

Update your billing and contact information

Learn how to update your billing and shipping information for the cards that you use with Apple Pay. For Apple Card, 4 see how you can view and update your billing address and contact information.

iPhone or iPad

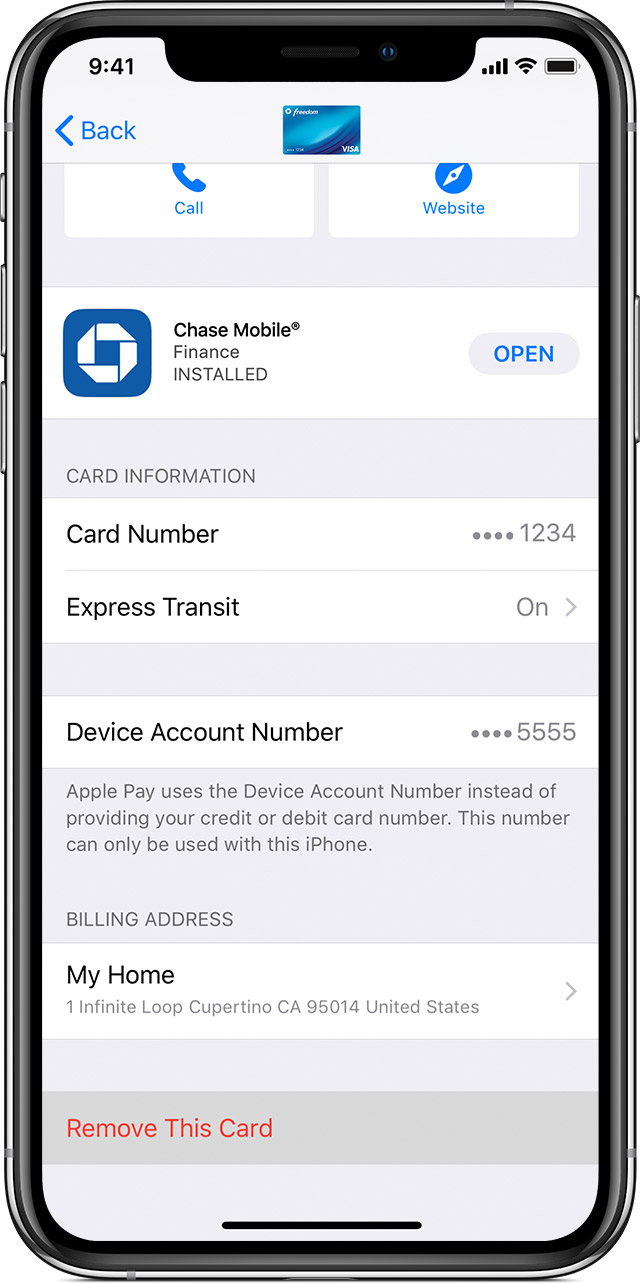

- To change your billing information, go to Settings > Wallet & Apple Pay, tap a card, then tap what you want to update.

- To update your email address, phone number, and shipping address, go to Settings > Wallet & Apple Pay, then choose what you want to update.

Mac models with Touch ID

- To change your billing information, go to System Preferences > Wallet & Apple Pay, click a card, then click the Billing Address pop-up menu.

- To update your email address, phone number, and shipping address, go to System Preferences > Wallet & Apple Pay, then click Contact and Shipping.

While you can’t change your card number or expiration date, it should update automatically when you get a new card. If your issuer doesn’t support updates, you might need to remove the card, then add it again.

Remove a card

If you need to, you can remove a card from your device. For Apple Card, 4 learn how you can close your account. For Apple Cash, 3 use these steps to close your Apple Cash account or turn off Apple Cash on a certain device.

iPhone or iPad

To remove a card that you use on your iPhone or iPad, go to Settings > Wallet & Apple Pay, tap the card that you want to remove, then scroll down and tap Remove This Card.

Or open Wallet, tap a card, tap , then scroll down and tap Remove This Card.

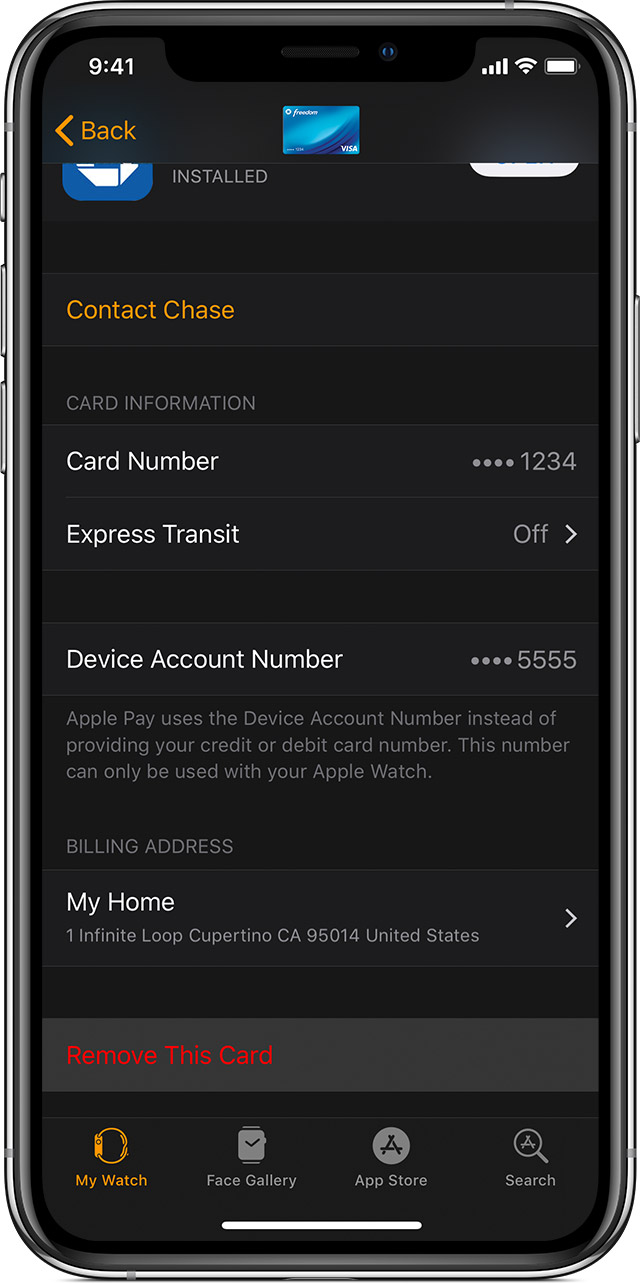

Apple Watch

To remove a card that you use on your Apple Watch, open the Watch app on your iPhone, go to the My Watch tab, scroll down, tap Wallet & Apple Pay, tap the card, then scroll down and tap Remove This Card.

Or tap Wallet on the Home screen of your Apple Watch, tap a card, touch and hold, then tap Delete.

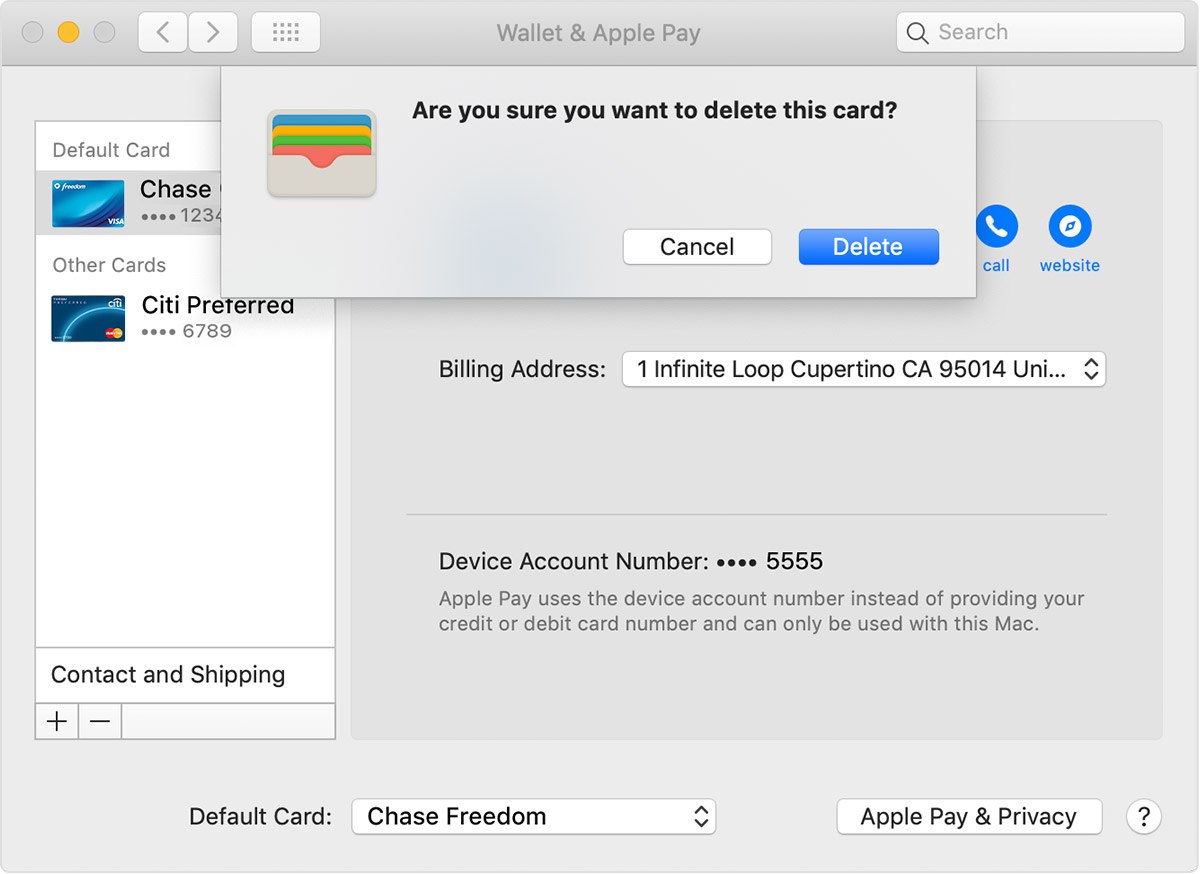

Mac models with Touch ID

To remove a card that you use on your Mac, go to System Preferences > Wallet & Apple Pay, click the card that you want to remove, then click the minus (–) sign to remove the card.

Manage your store or rewards cards

If you turn on Automatic Selection on a store card, the store card will be presented instead of your default card when you pay at the associated store. If you turn on Automatic Selection on a rewards card, your rewards information will be presented at the associated store when using Apple Pay.

When you add a store card or rewards card to Wallet, you might be asked if you want the card to be automatically selected. To turn Automatic Selection on or off:

- Open the Wallet app.

- Tap the store card or rewards card.

- Tap , then turn Automatic Selection on or off.

Get help if your device is lost or stolen

To use Apple Pay, you need to authorize each credit, debit, or prepaid card purchase with Face ID, Touch ID, or your passcode. Or on Apple Watch when Wrist Detection is on, you need to enter your passcode every time you put on your Apple Watch. These features help prevent other people from using Apple Pay on your iPhone, iPad, Apple Watch, or Mac.

Go to your Apple ID account page or use Find My iPhone to suspend or permanently remove the ability to pay from that device with Apple Pay. On your Apple ID account page, sign in and click your device. In the information that appears, go to the Apple Pay section and click either Remove or Remove all. Your card or cards will be suspended or removed from Apple Pay even if your device is offline and not connected to a cellular or Wi-Fi network.

You can also call your issuer to suspend or remove your cards from Apple Pay. Learn more about what to do if your iPhone is lost or stolen.

Learn more

- Learn which countries and regions support Apple Pay.

- Apple Pay isn’t available in China mainland for Mac models with Touch ID.

- Sending and receiving money with Apple Pay and the Apple Cash card are services provided by Green Dot Bank, Member FDIC. This feature is available only in the United States. Learn more about the Terms and Conditions.

- Apple Card is issued by Goldman Sachs Bank USA, Salt Lake City Branch. Apple Card is available only in the United States.

Information about products not manufactured by Apple, or independent websites not controlled or tested by Apple, is provided without recommendation or endorsement. Apple assumes no responsibility with regard to the selection, performance, or use of third-party websites or products. Apple makes no representations regarding third-party website accuracy or reliability. Contact the vendor for additional information.

Источник

Credit Card Payment 4+

Infinite Loop Development Ltd

Для iPad

Снимки экрана

Описание

Accept credit card payments from your iPhone or iPad with this app and Stripe.

Use this app to create an account with Stripe, a major US credit card processor, and once created, you can accept credit and debit card payments by simply scanning them with your device’s camera.

Bank settlements are handled automatically by Stipe directly into your bank account, once the payment has cleared.

Disclaimer: This app processes payments through the Stripe payment gateway, however the developers of this app (Infinite Loop Development Ltd) are not affiliated with Stripe Inc, Stripe Payments Europe, Ltd, or any of it’s subsidiaries.

Что нового

Support for latest version of iOS

Конфиденциальность приложения

Разработчик Infinite Loop Development Ltd не сообщил Apple о своей политике конфиденциальности и используемых им способах обработки данных. Подробные сведения доступны в политике конфиденциальности разработчика.

Нет сведений

Разработчик будет обязан предоставить сведения о конфиденциальности при отправке следующего обновления приложения.

Источник

Nomod | Card Payment POS 4+

Nomod Inc.

Снимки экрана (iPhone)

Описание

Nomod is a payment app that replaces your clunky credit card machine and card reader with a simple, intuitive way to accept card payments on your phone, anytime, anywhere!

If you’re looking for a simple POS or point of sale, an alternative credit card reader, or for a better payment app to help with credit card processing, we’ve got you covered!

◉ In-Person Payments

Process in-person payments using your keyboard, securely scan credit card details with your camera, or let your customers go contactless by scanning a QR code or sharing a link, to pay on their own device!

◉ Payment Links

Create and share payment links to let your customers pay online. Create a payment link with support for items, notes, shipping addresses, discounts, and tips in a few minutes. Tap to share over WhatsApp, Instagram, Telegram, email, or just about anywhere in a few seconds!

◉ Add your Team

Bring your whole team to Nomod to help you grow your business! Whether you’re a multi-store franchise, or have a fleet of delivery drivers who need to collect payments, invite and manage your entire team on Nomod

◉ Zero Monthly fees, Minimums or Subscriptions

Our pricing is super simple: 2.50% + AED 1 / 20p / €0.25 for AED, GBP, and EUR. 2.90% + $0.30 for USD, and a 1% FX fee on top for all other currencies. No setup fees, no monthly charges, no minimums, and absolutely nothing else on top!

◉ Every Card Network

Process Visa, MasterCard, American Express, Discover, JCB, Union Pay, and a bunch more with a few simple taps. Use QR codes or share a link to let your customers checkout fast with Apple Pay or Google Pay

◉ Multi Currency

Charge in over 135 currencies. Let customers pay in their native currency, you get paid in yours

◉ Discounts, Tips, & Taxes

Grant your most loyal customers a discount, go wild with tips for your team, and capture taxes to stay compliant

◉ Manage Customers

A simple CRM in your pocket. Import, capture, track, and and view all your customers. Never lose your customers details, and figure out who’s helping to propel your business forward

◉ Dive Into Transactions

Easy to use reporting that answers the who, what, and when of all your payments. Dive deep to get answers fast

◉ Send Receipts & Capture Notes

Add notes to your in-person payments and links for easy recall. Send out beautiful email receipts with a single tap to give your customers full transaction history, the information they’re after, and peace of mind

◉ Fast Payouts

Charge with Nomod, anytime, anywhere, and we’ll settle directly to your bank account anywhere on earth! No additional payment providers, hardware, or anything else required

◉ Works with Stripe

We’ve integrated with Stripe Connect to let you securely connect Nomod to your Stripe account, and use Stripe as your payment processor! Nomod charges zero extra fees on top of Stripe’s standard fees, and is a Stripe Verified Partner

◉ SCA-Ready to meet PSD2 regulations

With built in support for 3D Secure 2, we’ve got Secure Customer Authentication covered. OTP, password, or biometric, let your customers choose!

◉ Beautiful Software, No Extra Hardware

A simpler alternative to iZettle, Sumup and PayPal Here

Источник

ProPay Payments 4+

Accept Credit Cards

TSYS Acquiring Solutions

Designed for iPad

Screenshots

Description

Securely accept credit card payments on your phone or tablet using ProPay’s credit card processing app. Accept payments from all major credit card brands (Visa, MasterCard, Discover and American Express) at rates as low as 1.99% per transaction and no hidden fees.

Card Processing Solutions

• Quickly process credit card payments at low rates with a mobile card reader

• Accept chip cards (EMV) and swipe cards

• Manually enter card numbers if you aren’t near your card reader

• Securely store a customer’s payment information to be charged for future purchases

• Accept a credit card payment when you don’t have data coverage and process it as soon as you get back into coverage

• Even more processing options are available with your ProPay account online: http://www.propay.com/products-services/accept-payments/

Accessing Funds

• Access your funds with a ProPay Prepaid debit MasterCard

• Quickly transfer funds to your bank account within the mobile app

Monitor Your Business

• Check your available and pending account balances

• Review pending, completed and declined transactions

• Refund or cancel transactions

• Manage transfers to your bank account.

Additional Features:

• Include sales tax and allow customers to add a tip to their order

• Capture your customer’s signature and then e-mail them a receipt.

The ProPay App allows you to access all these features from any compatible smartphone or tablet and is available for all ProPay Merchants.

Источник