- 100vh problem with iOS Safari

- If You Purchased $100 of Apple in 2002

- Apple’s IPO

- Gradual Ascent to Prominence and Profits

- A Stock Split and Continuing Climb

- Another Split and a Steeper Uptrend

- How Does Apple Stock Look Now?

- How to Take a Bite out of the Apple

- The Bottom Line

- Apple buys a company every three to four weeks

- Self-driving, podcasts and more

- If your Mac starts up to an Apple logo or progress bar

- If your Mac is stuck on this screen

- If your iPhone or iPod touch won’t charge

- Plug into power

- Wall power outlet

- Computer

- Power accessory

- If your device charges slowly or won’t charge

- If your device stopped charging at 80 percent

- If an alert says that your accessory isn’t supported or certified

100vh problem with iOS Safari

The web content it’s outside the viewport although we used 100vh (the red opacity box with 100vh text).

The problem you have been receiving after adding the height: 100vh to mobile resolutions. It happens due to the calculation method which Safari and Chrome are using. Mobile devices calc browser viewport as ( top bar + document + bottom bar) = 100vh. I had a hard time with 100vh when the page have to have a section filled the whole screen. After a couple of hours, I’ve found the solutions that I show you.

They are two solutions, the first needs JavaScript and CSS, the second solution required only CSS.

1. JS & CSS solution

Let’s get started first with the JS file:

appHeight function has sets new style property var(` — app-height`) including current window height, — app-height it is necessary for next steps.

In the previous step I’ve created the reference — app-height, wrapping in the var() I’ve received CSS variable var( — app-height). This variable is allowed to read values created by JS.

2. CSS solution (not recommend)

The last, but not the least solution is ` — webkit-fill-available`, this solution works only on Apple devices, it won’t solve the problem on Android devices. I don’t recommend this solution, but it’s worth showing.

Thank you for your attention! I’ll appreciate your feedback.

Источник

If You Purchased $100 of Apple in 2002

Amanda Bellucco-Chatham is an editor, writer, and fact-checker with years of experience researching personal finance topics. Specialties include general financial planning, career development, lending, retirement, tax preparation, and credit.

The incredible run of Apple stock has been well-documented along with most of the company’s history and ground-breaking products. As daunting as it may seem now, imagine what a small investment in a company like Apple several years ago would be worth today. A mere $100 investment in the company’s stock at the beginning of 2002 would have grown to more than 130 times the original investment by mid-October 2019.

All Apple stock price quotes in this article are outright prices, not prices adjusted for dividends and splits. The effect of stock splits is noted and calculated into the total result. But the effect of dividends, which would slightly enhance the value of the investment, is not reflected.

Apple’s IPO

Apple launched its initial public offering (IPO) on Dec. 12, 1980, selling 46 million shares at $22. The company’s shares sold out almost immediately and generated more capital with its public offering than any other company since Ford went public in 1956. Because of the large number of shareholders, the company had to hold its first shareholder meeting as a public company at De Anza College’s Flint Center in Cupertino. The theater holds about 2,300 people.

Gradual Ascent to Prominence and Profits

It’s easy to view Apple as a monumental success story now, but the truth of the matter is that the beginning of this investment adventure would not have started out too well.

The closing share price quoted for Apple for Jan. 2, 2002, the first trading day of the year, was $23.30. Rounding to the nearest whole share, a $100 investment would have secured four shares of Apple stock.

But by the end of 2002, the stock price declined to $14.33 a share, which represented an approximately 40% loss in the hypothetical $100 stock purchase made at the start of the year. However, the next couple of years were refreshingly lucrative for Apple investors as the company continued to advance in the marketplace with more advanced versions of its popular iPod, and the opening of the iTunes store in 2003. By the end of 2004, Apple’s stock price climbed to $64.40 per share, making an original four share investment worth $257.60.

A Stock Split and Continuing Climb

In February 2005, Apple initiated a two-for-one stock split, which would have transformed the original four share investment into a total of eight shares. In 2006, Apple debuted the MacBook Pro, the second Apple desktop computer product with Intel’s core duo processor. In 2007, it followed up with the launch of the now-famous iPhone, which revolutionized the cell phone industry. The iPhone 3G followed in 2008 and in 2010 the iPhone 4 was introduced, along with another soon-to-be wildly successful product, the iPad.

The stock’s closing price at the end of 2005 was $71.89, giving a total eight-share value of $575.12. Two years later, the 2007 closing price was $198.08, making the hypothetical investment worth $1,584.64. The stock suffered approximately a 50% downside retracement in 2008, closing out the year at $85.35 a share. However, in 2009 Apple stock resumed its long-term uptrend, and closed out 2010 at $46.08 a share, which, multiplied by eight shares, equals $368.64. It may have been tempting for an investor to sell at that point, having more than tripled their original investment. But that would have been a short-sighted mistake, as there was more good fortune in store for Apple shareholders.

Another Split and a Steeper Uptrend

Apple’s status as a leading firm in the technology sector has only enhanced and solidified in the past decade as the company regularly introduced new and improved versions of the iPhone and the iPad and unveiled the Apple Watch.

Apple stock began a steep uptrend between mid-2010 and 2015. During this period, the stock only suffered one major downside correction which extended from late 2012 through mid-2013 when stock price retraced from $100.01 on Sept. 17, 2012, down to $56.65 a share on June 24, 2013. Following that corrective retracement, the stock resumed an even sharper uptrend, one that lasted into the first half of 2015.

In June 2014, Apple did a seven-for-one stock split, so at that time, eight shares would have become 56, which sold for $93.70 per share immediately following the split. That would make the hypothetical investment worth $5,247.20. When the stock price hit its 2015 high closing price of $133.00 a share, 56 shares were worth $7,448. Subsequent price action saw Apple stock in another downside correction.

On Oct. 16, 2019, Apple closed at $235.67. Multiplied by 56 shares, the total value is $13,197.52. That’s not a bad return on a $100 investment.

How Does Apple Stock Look Now?

Going forward, Apple is still a leading technology firm. In all likelihood, it will continue to outperform in the sector. As of Oct. 16, 2019, Apple had a market capitalization value of $1.07 trillion. Apple’s market cap hit $1 trillion on Aug. 2, 2018 — the first publicly-traded company to ever reach that mark. The company’s share prices rose as high as $233.47 after it reached that milestone. Apple has a price/earnings ratio (P/E) of 19.31. Apple’s return on assets (ROA) and return on equity (ROE) figures are also substantially above average.

How to Take a Bite out of the Apple

Because Apple stock comes at such a premium, it may not be feasible for most retail investors to buy shares in the company outright. But that doesn’t mean you can’t take part in the action. After all, it’s one of the most recognized brands in the world.

Consider investing in a mutual fund or an ETF that has a position in Apple. Unlike mutual funds, ETFs don’t require a minimum investment and many are commission and/or fee-free. But if you’re really set on buying actual shares in the company, consider setting a minimum aside in your brokerage account and buy fractional shares. You can buy a little at a time until you secure a full set of shares.

The Bottom Line

While it certainly would have been wonderful to acquire Apple stock for just a little over $20 a share in hindsight, that doesn’t mean the stock isn’t now also worth buying at a just under $200 a share. Apple’s financials look strong across the board, and the company has more than established its ability to introduce quality products and win in the marketplace. Therefore, investors may do well to consider buying Apple for future returns on investment.

Источник

Apple buys a company every three to four weeks

By Justin Harper

Business reporter, BBC News

Apple has acquired about 100 companies over the last six years, the company’s chief executive Tim Cook has revealed.

That works out at a company every three to four weeks, he told Apple’s annual meeting of shareholders on Tuesday.

Apple recently delivered its largest quarter by revenue of all time, bringing in $111.4bn (ВЈ78.7bn) in the first-quarter of its fiscal year 2021.

Mr Cook told the shareholders meeting that the acquisitions are mostly aimed at acquiring technology and talent.

Apple’s largest acquisition in the last decade was its $3bn purchase of Beats Electronics, the headphone maker founded by rapper and producer Dr Dre.

Another high profile purchase was music recognition software company Shazam, for $400m in 2018.

Most often, Apple buys smaller technology firms and then incorporates their innovations into its own products.

One example is PrimeSense, an Israeli 3D sensing company whose technology contributed to Apple’s FaceID.

Apple has also invested in back-end technology that wouldn’t be so obvious to iPhone or Macbook users.

Self-driving, podcasts and more

Apple’s list of acquisitions and investments is extremely varied.

In the past year, Apple has bought several artificial intelligence (AI) companies, a virtual reality events business, a payments startup and a podcast business, among others.

Источник

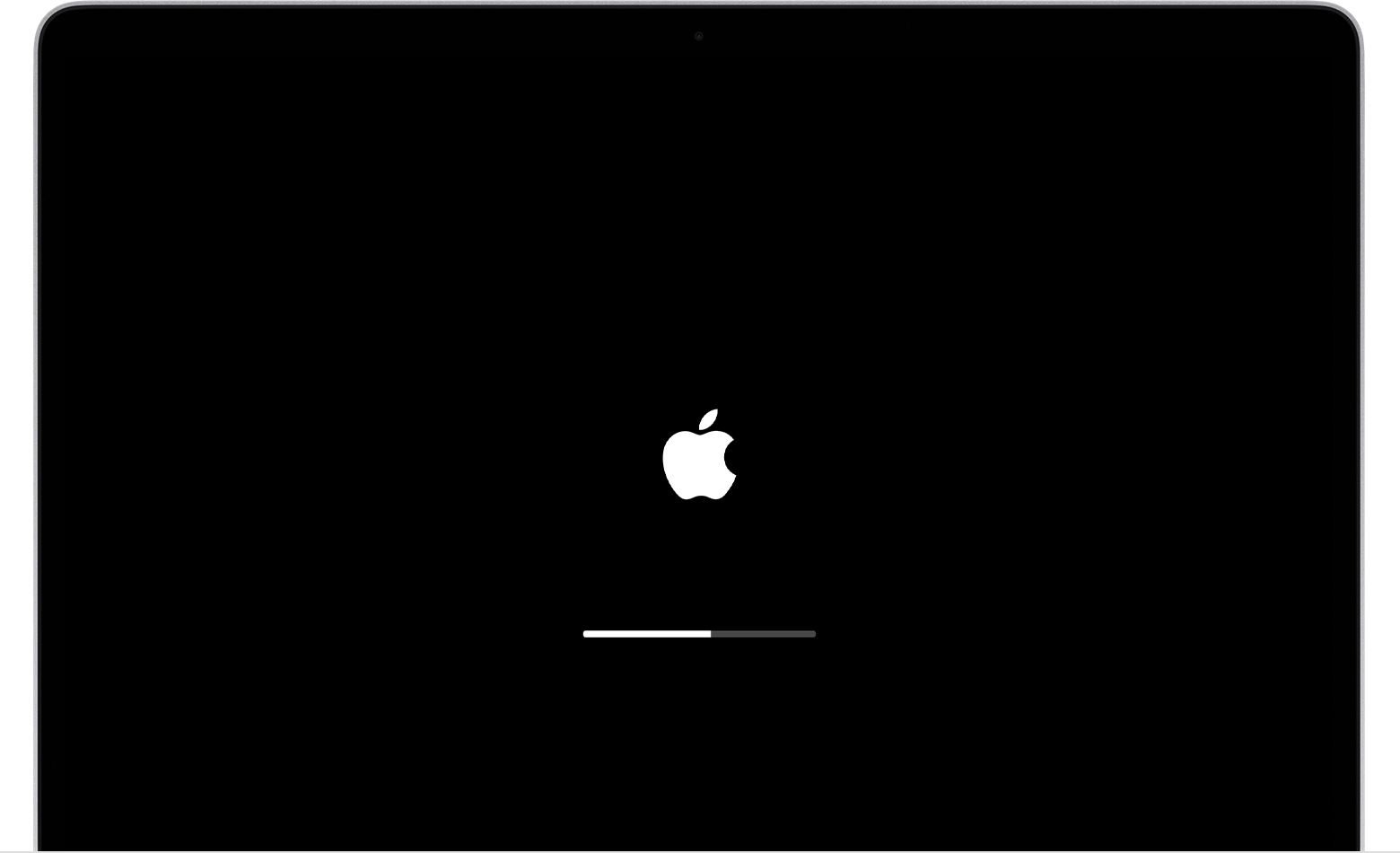

If your Mac starts up to an Apple logo or progress bar

Your Mac shows an Apple logo when it finds your local startup disk, then shows a progress bar as the macOS startup or installation process continues.

Your Mac shows an Apple logo when it finds your startup disk, which is usually the disk built into your Mac. As startup continues, you should see a progress bar, with or without the Apple logo. This screen might alternate with a blank screen several times.

If you’re installing macOS, the Apple logo or progress bar might persist for much longer than usual. As installation continues, the progress bar might move slowly and pause for long periods. That’s why Apple recommends beginning macOS installation in the evening—so that it can complete overnight, if needed.

If your Mac is stuck on this screen

If you think you’ve waited long enough to know that your Mac is stuck on this screen, follow these steps.

- Press and hold the power button on your Mac for up to 10 seconds, until your Mac turns off. Then turn your Mac back on.

- If the issue persists, press and hold the power button until your Mac turns off. Then unplug all accessories from your Mac, including printers, drives, USB hubs, and other nonessential devices. You could have an issue with one or more of those devices or their cables. Then turn your Mac back on.

- If the issue persists, once again press and hold the power button until your Mac turns off. Then use Disk Utility to repair your startup disk.

- If Disk Utility found no errors, reinstall macOS.

- If Disk Utility found errors and repaired them, restart your Mac. If the issue returns after restarting, reinstall macOS.

- If you still need help, please contact Apple Support.

Источник

If your iPhone or iPod touch won’t charge

If your battery won’t charge or charges slowly, or if you see an alert message, learn what to do.

Plug into power

To charge your device, follow these steps:

- Connect your device to the USB cable that comes with it.

- Plug into one of these three power sources:

Wall power outlet

Plug your USB charging cable into a USB power adapter, then plug the adapter into the wall.

Computer

Plug your charging cable into a USB 2.0 or 3.0 port on a computer that’s on and not in sleep mode. Don’t use the USB ports on your keyboard.

Power accessory

Plug your cable into a powered USB hub, docking station, or other Apple-certified accessory.

If you’re trying to charge wirelessly with an iPhone 8 or later, first make sure that you can charge with the USB adapter and cable that came with your device. If that works, then get help with wireless charging. For a third-party accessory, check that it’s Apple certified.

As your device charges, you’ll see a lightning bolt beside the battery icon in the status bar, or a large battery icon on your Lock screen.

My device charges slowly or won’t charge

My device stopped charging at 80 percent

I see Accessory Not Supported or Certified

If your device charges slowly or won’t charge

Follow these steps and try again after each:

- Check your charging cable and USB adapter for signs of damage, like breakage or bent prongs. Don’t use damaged accessories.

- Use a wall power outlet and check for firm connections between your charging cable, USB wall adapter, and wall outlet or AC power cable, or try a different outlet.

- Remove any debris from the charging port on the bottom of your device, then firmly plug your charging cable into your device. If the charging port is damaged, your device probably needs service.

- Let your device charge for a half hour.

- If your device is still unresponsive, force restart your device:

- iPhone 8 or later and iPhone SE (2nd generation): Press and quickly release the Volume Up button. Press and quickly release the Volume Down button. Press and hold the Side button until you see the Apple logo.

- iPhone 7, iPhone 7 Plus, and iPod touch (7th generation): Press and hold both the Side (or Top) button and the Volume Down button until you see the Apple logo.

- iPhone 6s or earlier, iPhone SE (1st generation), and iPod touch (6th generation) or earlier: Press and hold both the Side (or Top) button and the Home button until you see the Apple logo.

- Let your device charge for another half hour.

- If your device still won’t power on or charge, take your device, charging cable, and charging adapter to an Apple Retail Store or Apple Authorized Service Provider for evaluation. You can also contact Apple Support.

If your device stopped charging at 80 percent

Your iPhone might get slightly warmer while it charges. To extend the lifespan of your battery, if the battery gets too warm, software might limit charging above 80 percent. Your iPhone will charge again when the temperature drops. Try moving your iPhone and charger to a cooler location.

iOS 13 and later uses Optimized Battery Charging to slow the rate of battery aging by reducing the time that your iPhone spends fully charged. Your iPhone uses on-device machine learning to understand your daily charging routine so that it can wait until you need to use your iPhone to finish charging past 80 percent.* Optimized Battery Charging is active only when your iPhone predicts that it will be connected to a charger for a long period of time.

* Information regarding your charging routine is stored only on your iPhone. The information isn’t included in backups and isn’t shared with Apple.

If an alert says that your accessory isn’t supported or certified

These alerts can appear for a few reasons: Your iOS device might have a dirty or damaged charging port, your charging accessory is defective, damaged, or non Apple-certified, or your USB charger isn’t designed to charge devices. Follow these steps:

- Remove any debris from the charging port on the bottom of your device.

- Restart your device:

- iPhone

- iPod touch

- Try a different USB cable or charger.

- Make sure that you have the latest version of iOS.

- Contact Apple Support to set up service.

Источник

:max_bytes(150000):strip_icc()/picture-53889-1440688003-5bfc2a8846e0fb0083c04dc5.jpg)