- Apple Card

- Created by Apple. Powered by iPhone.

- Built for iPhone

- No Fees

- The first credit card that actually encourages you to pay less interest.

- Pay Less Interest

- Unlimited Daily Cash back.

- Unlimited Daily Cash

- Get 3% Daily Cash back when you shop at Apple.

- 3% Daily Cash at Apple

- Get 2% Daily Cash back

- 2% Daily Cash

- Shop with select merchants and get even more Daily Cash.

- 3% Daily Cash

- Healthy finances. Family style.

- Apple Card Family

- Goodbye, plastic. Hello, titanium.

- Titanium Card

- Privacy and Security

- Privacy and Security

- Pay for your new Apple products over time, interest‑free

- Apple Card Monthly Installments

- Tools to help you make financially healthy choices.

- Financial Health

- Trusted partners for a different kind of credit card.

- Partnerships

- Get started with Apple Card.

- Wallet

- Apple Pay

- A simpler, smarter credit card.

- Get started with Apple Card.

- Apple Card Support

- Use Advanced Fraud Protection with Apple Card

- Share Apple Card with your family

- Activate your card

- Make purchases

- Get Daily Cash

- COVID-19 Customer Assistance Program for Apple Card

- Manage your account

- How to make payments

- Check your spending activity

- Sign in online

- Financial health and education

- Iphone and credit card

- Carrier Financing

- Pay monthly, enjoy daily.

- Buying an iPhone is easier with Apple.

- Need some help?

- Buy your new iPhone from Apple. Pay for it with your carrier.

- Small-business financing

- Get help buying

Apple Card

The simplicity of Apple.

In a credit card.

With Apple Card, we completely reinvented the credit card. Your information lives on your iPhone, beautifully laid out and easy to understand. We eliminated fees 1 and built tools to help you pay less interest, and you can apply in minutes to see if you are approved with no impact to your credit score. 2 Advanced technologies like Face ID, Touch ID, and Apple Pay give you a new level of privacy and security.

And with every purchase you get Daily Cash back. Apple Card. It’s everything a credit card should be.

Created by Apple.

Powered by iPhone.

Built for iPhone

Apple Card lives on your iPhone, in the Wallet app. You can sign up in as little as a minute and start using it right away with Apple Pay. 3 Your transactions, payments, and account details are all in one place, where only you can see them. 4 You even make your payments right in the Wallet app — just select your amount, tap, and it’s done.

No Fees

We want to make it easier to pay down your balance, not harder. So Apple Card doesn’t have any fees. No annual, over-the-limit, foreign-transaction, or late fees. 5 No fees. Really. And our goal is to provide interest rates that are among the lowest in the industry. Because your credit card should work for you, not against you.

The first credit card that actually encourages you to pay less interest.

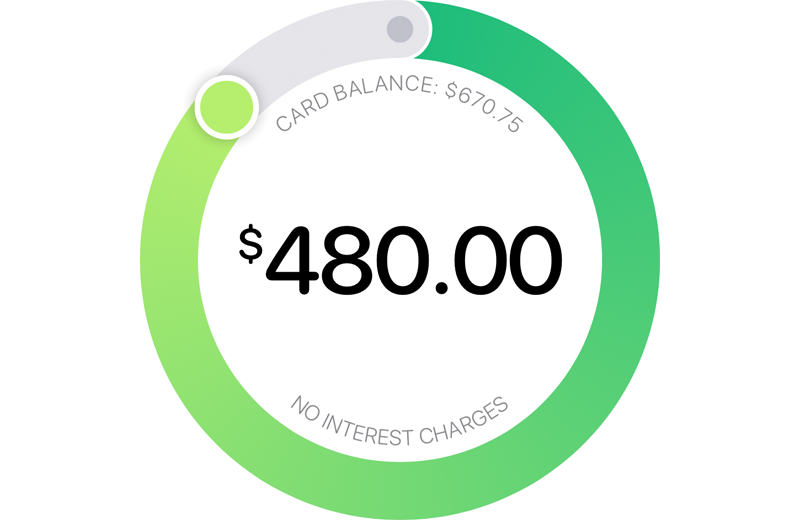

Pay Less Interest

Most credit cards emphasize your minimum amount due. But when you pay only your minimum each month, it costs you a lot in interest over time. Apple Card is different. When you’re ready to make a payment, Apple Card estimates the interest you’ll wind up paying, based on any payment amount you choose. 6 And it does that in real time, so you can make an informed decision about how much of your balance to pay down.

Unlimited

Daily Cash back.

Real cash you can use right away. 7

Unlimited Daily Cash

When you buy something using Apple Card, you get a percentage of your purchase back in Daily Cash. It’s real cash, so unlike rewards, it never expires or loses its value. Your cash is deposited right onto your Apple Cash card in the Wallet app — not a month from now, but every day. And there’s no limit to how much you can get. Use it to buy things in stores, on websites, and in apps. Make a payment on your Apple Card. Pay back a friend in Messages. Or send it straight to your bank account and watch it add up.

Get 3% Daily Cash back when you shop at Apple.

3% Daily Cash at Apple

Apple Card gives you unlimited 3% Daily Cash back on everything you buy at Apple — whether it’s a new Mac, an iPhone case, games from the App Store, or even a service like Apple Music or Apple TV+.

Get 2%

Daily Cash

back

2% Daily Cash

The best way to use Apple Card is with Apple Pay — the secure payment technology built into iPhone, Apple Watch, iPad, and Mac and accepted at 85 percent of merchants in the United States. Apple Pay is a safer way to pay that helps you avoid touching buttons or exchanging cash. And with every purchase you make using your Apple Card with Apple Pay, you get 2% Daily Cash back. No points to calculate. No limits or deadlines. Just real cash that’s ready to spend whenever, wherever, and however you want.

Shop with select merchants and get even more Daily Cash.

3% Daily Cash

Apple Card gives you unlimited 3% Daily Cash back on purchases you make at select merchants when you use Apple Card with Apple Pay. ◊

- Duane Reade

- Exxon

- Mobil

- Nike

- Panera Bread

- T-Mobile

- Uber

- Uber Eats

- Walgreens

Apple Card Family

Healthy finances.

Family style.

Apple Card Family

Apple Card Family brings all the great features and benefits of Apple Card to your entire family — whether that’s your immediate family, extended family, or whoever you call family. 8 It allows two partners to merge credit lines 9 to form a single co-owned account 10 , manage that account together, and build credit as equals. 11 Participants 12 18 and older can choose to start building their own credit history, 13 and teens can learn better spending habits. And, family members receive Daily Cash back on their own purchases. 14

Goodbye, plastic.

Hello, titanium.

Titanium Card

With laser etching and clean styling, Apple Card is designed with the same craftsmanship we bring to all our products. And it’s the only credit card made of titanium — a sustainable metal known for its beauty and durability. When you use the card, you’ll get 1% Daily Cash back on every purchase. Since Mastercard is our global payment network, you can use it all over the world. For apps and websites that don’t take Apple Pay yet, just enter the virtual card number stored securely in your Wallet app. And when you’re using Safari, it even autofills for you.

Privacy and Security

Privacy and Security

Apple takes your privacy and security seriously. It’s not just a philosophy, it’s built into all our products. And Apple Card is no different. With advanced security technologies like Face ID, Touch ID, and unique transaction codes, Apple Card with Apple Pay is designed to make sure you’re the only one who can use it. The titanium card has no visible numbers. Not on the front. Not on the back. Which gives you a whole new level of security. And while Goldman Sachs uses your data to operate Apple Card, your transaction history and spending habits belong to you and you alone. Your data isn’t shared or sold to third parties for marketing or advertising.

Pay for your

new Apple products

over time,

interest‑free

when you choose to

check out with Apple Card Monthly Installments. 15

Open to read more about Apple Card Monthly Installments

Apple Card Monthly Installments

You can buy a new Mac, iPhone, iPad, Apple Watch, and more with interest-free monthly payments on purchases at Apple. Just choose Apple Card Monthly Installments and then check out. Your installment automatically appears on your Apple Card statement alongside your everyday Apple Card purchases in the Wallet app. If you have an eligible device to trade in, you’ll pay even less per month. 16 And you’ll get 3% Daily Cash back on the purchase price of each product, all up front. If you have Apple Card already, there’s no additional application. If you don’t, you can apply in as little as a minute during checkout, from the privacy of your iPhone.

Tools to help

you make

financially

healthy

choices.

Financial Health

To see how much you’re spending, there’s no need to log in to a separate website or app. Your totals are automatically added up in the Wallet app, ready to view by week or by month. Color-coded categories make it easy to spot trends in your spending so you can decide if you want to change them. And Apple Card uses Maps to pinpoint where you bought something. 17 No mysterious merchant codes. No guessing.

Trusted partners for a different kind of credit card.

Partnerships

To create Apple Card, we needed an issuing bank and a global payment network. Apple Card is the first consumer credit card Goldman Sachs has issued, and they were open to doing things in a new way. And the strength of the Mastercard network means Apple Card is accepted all over the world.

Get started

with Apple Card.

Apply in minutes to see if you are approved with no impact to your credit score. **

Wallet

All your credit and debit cards,

transit cards, boarding passes,

and more. All in one place.

Apple Pay

The safer way to make

secure,

contactless purchases

in stores and online.

Источник

A simpler,

smarter

credit card.

Whether you buy things with Apple Pay or with the laser‑etched titanium card, Apple Card can do lots of things no other credit card can do.

Apply in as little as a minute to see if you are approved with no impact to your credit. *

Get 2% Daily Cash back every time you pay with your iPhone or Apple Watch.

See each purchase go through right away. No waiting. No wondering.

No foreign-transaction fees.

No over-the-limit fees.

No returned-payment fees.

No maintenance fees.

No reward-redemption fees.

Get unlimited Daily Cash back with every purchase.

Tap to see your summary — by week, by month, or by year.

Easily pin down your spending with Maps. 3

Find any transaction with a quick and easy search.

See your spending by color and category.

View item-by-item receipts from your Apple services.

Your Daily Cash lives in the Wallet app. Use it right away or save it for a rainy day. 4

Simple, secure, magical card activation.

It’s hard to steal a credit card number when it’s locked away.

Your purchase history.

For your eyes. 5 Not ours.

Stop fraudulent activity in its tracks.

Take the guesswork out of interest payments.

Pay off your balance faster with smart payment suggestions.

End-of-the-month payment due dates. Not wait-did-I-miss-it due dates.

Payment reminders. (Just in case you need them.)

See full details of your Apple Card Monthly Installments right in the Wallet app. 6

You decide

who’s in your

Apple Card Family. 7

They can use Apple Card right away. 8

Co‑Owners. 9

Build credit as equals. 10

Apple Card Family Participants 11 18 and over can build their own credit. 12 Score!

Apple Card Family. Daily Cash back for all. 13

Ask us anything, 24/7. Just call or text.

Get started

with Apple Card.

Apply in minutes to see if you are approved with no impact to your credit score. *

Источник

Apple Card Support

It takes just minutes to apply for Apple Card in the Wallet app on your iPhone.

Use Advanced Fraud Protection with Apple Card

Turn on a security code that changes periodically for even more secure Apple Card purchases.

Share Apple Card with your family

Build credit together, create spending limits, and teach smart and safe financial habits. All on iPhone and with a single monthly bill.

Activate your card

Request a titanium Apple Card and see how to activate it on your iPhone when it arrives in the mail.

Make purchases

See how to pay with Apple Card using Apple Pay, or how to use your virtual card number or physical card.

Get Daily Cash

Learn how you can receive a percentage of every purchase you make with Apple Card back as Daily Cash.

COVID-19 Customer Assistance Program for Apple Card

If you are experiencing financial hardship due to the COVID-19 pandemic, you can enroll in our Customer Assistance Program.

Manage your account

You can update your billing address, manage your transaction alerts and notifications, and more.

How to make payments

Learn how to set up bill payments, choose a payment source, and view your payment history.

Check your spending activity

See transactions, see your balance, and track how much you spend. If you use Apple Card Family and you’re the account owner or co-owner, you can see each person’s spending.

Sign in online

If you don’t have access to the Wallet app, you can manage your account, view statements, make a payment, and more by visiting card.apple.com.

Financial health and education

See how interest can affect your financial health and learn how to lower interest charges with Apple Card’s payment options.

Источник

Iphone and credit card

Unlimited Daily Cash back with every purchase, including 3% at Apple and 2% when you use Apple Card with Apple Pay.

No fees.⁵ Not even hidden ones.

The privacy and security you expect from iPhone.

An Apple-designed titanium card that can be used anywhere Mastercard is accepted.

See if you’re approved without impacting your credit score.⁶

Already have Apple Card? There’s no additional application needed. Just choose Apple Card Monthly Installments when you check out.

Carrier Financing

Pay monthly, enjoy daily.

Buy your next iPhone directly from Apple to take advantage of special deals and the simplicity of paying for your new iPhone on your regular carrier bills. Whether you upgrade online or in-store, we make it simple to connect your new iPhone to a plan that works for you.

Buying an iPhone is easier with Apple.

Compare carrier deals and choose the one that’s best for you — we even make it simple to switch carriers or plans.

Trade in your current smartphone to lower your monthly payments.

Activate your new iPhone on the carrier of your choice. Keep your number and rate plan or even choose a new one — and save yourself a trip to the carrier store.

Need some help?

Chat now, call 1-800-MY-APPLE, or find a store.

Buy your new iPhone from Apple. Pay for it with your carrier.

Choose from select carrier plans when you buy online. Or visit an Apple Store for even more options.

Small-business financing

Get the Apple products you need with financing options that work for you.

Get help buying

Have a question? Call a Specialist or chat online. Call 1‑800‑MY‑APPLE.

T-Mobile/Sprint Special Deal: Buy an iPhone 13 Series or iPhone 12 series and trade in a qualifying device (iPhone X, iPhone XS, iPhone XS Max, iPhone XR, iPhone 11, iPhone 11 Pro, iPhone 11 Pro Max, iPhone 12, iPhone 12 mini, iPhone 12 Pro 128GB) to receive (i) Apple instant trade-in credit and (ii) an additional $200 back in bill credits on your T-Mobile/Sprint rate plan. Bill credits will be applied over 24 months toward your rate plan charges; must be active and in good standing to receive credits; allow 2 bill cycles from valid submission and validation of trade in. If you cancel or downgrade your wireless service before receiving 24 bill credits, credits will stop. Tax on pre-credit price due at sale. Limited-time offer; subject to change. Qualifying credit, service, and trade-in in good condition required. T-Mobile/Sprint in stores and on customer service calls, $30 assisted or upgrade support charge may be required. Max 4/account. May not be combinable with some offers or discounts. Price for iPhone 13, iPhone 13 mini, iPhone 12, and iPhone 12 mini includes $30 T-Mobile/Sprint instant discount. Activation required.

Verizon Special Deal: Offer pricing will reflect application of Verizon’s trade-in credit up to $440 (iPhone 13, iPhone 13 Pro, and iPhone 13 Pro Max) or $412 (iPhone 13 mini) or $425 (iPhone 12) or $375 (iPhone 12 mini) after trade-in of eligible smartphone. Savings comprised of (i) Apple instant trade-in credit at checkout and (ii) Verizon monthly bill credits applied over 24 months (iPhone 13 mini and iPhone 13) or 30 months (iPhone 13 Pro and iPhone 13 Pro Max). Customer must remain in the Verizon Device Payment Program for 24 months (iPhone 12 mini, iPhone 12, iPhone 13 mini, and iPhone 13) or 30 months (iPhone 13 Pro and iPhone 13 Pro Max) to receive the full benefit of the Verizon bill credits. Bill credits may take 1-2 bill cycles to appear. If it takes two cycles for bill credits to appear, you’ll see the credit for the first cycle on your second bill in addition to that month’s credit. Requires purchase and activation of a new iPhone 12 mini, iPhone 12, iPhone 13 mini, iPhone 13, iPhone 13 Pro, or iPhone 13 Pro Max with the Verizon Device Payment Program at 0% APR for 24 months (iPhone 12 mini, iPhone 12, iPhone 13 mini, and iPhone 13) or 30 months (iPhone 13 Pro and iPhone 13 Pro Max), subject to carrier credit qualification, and iPhone availability and limits. Taxes and shipping not included in monthly price. Sales tax may be assessed on full value of new iPhone. Requires eligible unlimited service plan. Requires trade-in of eligible device in eligible condition. Must be at least 18 to trade-in. Apple or its trade-in partners reserve the right to refuse or limit any trade-in transaction for any reason. In-store trade-in requires presentation of a valid, government-issued photo ID (local law may require saving this information). In-store promotion availability subject to local law; speak to a Specialist to learn more. Limited-time offer; subject to change. Additional terms from Apple, Verizon, and Apple’s trade-in partners may apply. Price for iPhone 12 mini, iPhone 12, iPhone 13 mini, and iPhone 13 includes $30 Verizon instant discount. Activation required.

- Apple Card Monthly Installments (ACMI) is a 0% APR payment option available to select at checkout for certain Apple products purchased at Apple Store locations, apple.com (Opens in a new window) , the Apple Store app, or by calling 1-800-MY-APPLE, and is subject to credit approval and credit limit. See https://support.apple.com/kb/HT211204 (Opens in a new window) for more information about eligible products. Variable APRs for Apple Card other than ACMI range from 10.99% to 21.99% based on creditworthiness. Rates as of April 1, 2020. If you choose the pay-in-full or one-time-payment option for an ACMI eligible purchase instead of choosing ACMI as the payment option at checkout, that purchase will be subject to the variable APR assigned to your Apple Card. Taxes and shipping are not included in ACMI and are subject to your card’s variable APR. See the Apple Card Customer Agreement (Opens in a new window) for more information. ACMI is not available for purchases made online at the following special stores: Apple Employee Purchase Plan; participating corporate Employee Purchase Programs; Apple at Work for small businesses; Government, and Veterans and Military Purchase Programs, or on refurbished devices. iPhone activation required on iPhone purchases made at an Apple Store with one of these national carriers: AT&T, Sprint, Verizon, or T-Mobile.

- Trade-in values will vary based on the condition, year, and configuration of your eligible trade-in device. Not all devices are eligible for credit. You must be at least 18 years old to be eligible to trade in for credit or for an Apple Gift Card. Trade-in value may be applied toward qualifying new device purchase, or added to an Apple Gift Card. Actual value awarded is based on receipt of a qualifying device matching the description provided when estimate was made. Sales tax may be assessed on full value of a new device purchase. In-store trade-in requires presentation of a valid photo ID (local law may require saving this information). Offer may not be available in all stores, and may vary between in-store and online trade-in. Some stores may have additional requirements. Apple or its trade-in partners reserve the right to refuse or limit quantity of any trade-in transaction for any reason. More details are available from Apple’s trade-in partner for trade-in and recycling of eligible devices. Restrictions and limitations may apply.

- Available to qualified customers and requires 24-month installment loan when you select Citizens One or Apple Card Monthly Installments (ACMI) as payment type at checkout at Apple. iPhone activation required with AT&T, T-Mobile, Sprint, or Verizon for purchases made with ACMI at an Apple Store. Subject to credit approval and credit limit. Taxes and shipping are not included in ACMI and are subject to your card’s variable APR. Additional Apple Card Monthly Installments terms are in the Customer Agreement. Additional iPhone Payments terms are here. ACMI is not available for purchases made online at special storefronts. The last month’s payment for each product will be the product’s purchase price, less all other payments at the monthly payment amount.

- Monthly pricing is available when you select Apple Card Monthly Installments (ACMI) as payment type at checkout at Apple, and is subject to credit approval and credit limit. Financing terms vary by product. Taxes and shipping are not included in ACMI and are subject to your card’s variable APR. See the Apple Card Customer Agreement for more information. ACMI is not available for purchases made online at special storefronts. The last month’s payment for each product will be the product’s purchase price, less all other payments at the monthly payment amount.

- Variable APRs range from 10.99% to 21.99% based on creditworthiness. Rates as of April 1, 2020.

- Accepting an Apple Card after your application is approved will result in a hard inquiry, which may impact your credit score.

To access and use all the features of Apple Card, you must add Apple Card to Wallet on an iPhone or iPad with the latest version of iOS or iPadOS. Update to the latest version by going to Settings > General > Software Update. Tap Download and Install.

Available for qualifying applicants in the United States.

Apple Card is issued by Goldman Sachs Bank USA, Salt Lake City Branch.

Источник