- Manage the cards that you use with Apple Pay

- Change your default card

- iPhone or iPad

- Apple Watch

- Mac models with Touch ID

- Update your billing and contact information

- iPhone or iPad

- Mac models with Touch ID

- Remove a card

- iPhone or iPad

- Apple Watch

- Mac models with Touch ID

- Manage your store or rewards cards

- Get help if your device is lost or stolen

- Learn more

- How your Apple Card application is evaluated

- Requirements to get Apple Card

- Conditions that might cause your application to be declined

- Apple Card

- Created by Apple. Powered by iPhone.

- Built for iPhone

- No Fees

- The first credit card that actually encourages you to pay less interest.

- Pay Less Interest

- Unlimited Daily Cash back.

- Unlimited Daily Cash

- Get 3% Daily Cash back when you shop at Apple.

- 3% Daily Cash at Apple

- Get 2% Daily Cash back

- 2% Daily Cash

- Shop with select merchants and get even more Daily Cash.

- 3% Daily Cash

- Healthy finances. Family style.

- Apple Card Family

- Goodbye, plastic. Hello, titanium.

- Titanium Card

- Privacy and Security

- Privacy and Security

- Pay for your new Apple products over time, interest‑free

- Apple Card Monthly Installments

- Tools to help you make financially healthy choices.

- Financial Health

- Trusted partners for a different kind of credit card.

- Partnerships

- Get started with Apple Card.

- Wallet

- Apple Pay

Manage the cards that you use with Apple Pay

After you add cards to Wallet, you can change your default card, update your information, or remove a card. 1

Managing your cards works differently depending on the device you’re using. 2

Change your default card

The first card that you add to Wallet is your default card. If you add more cards and want to change your default card, use these steps.

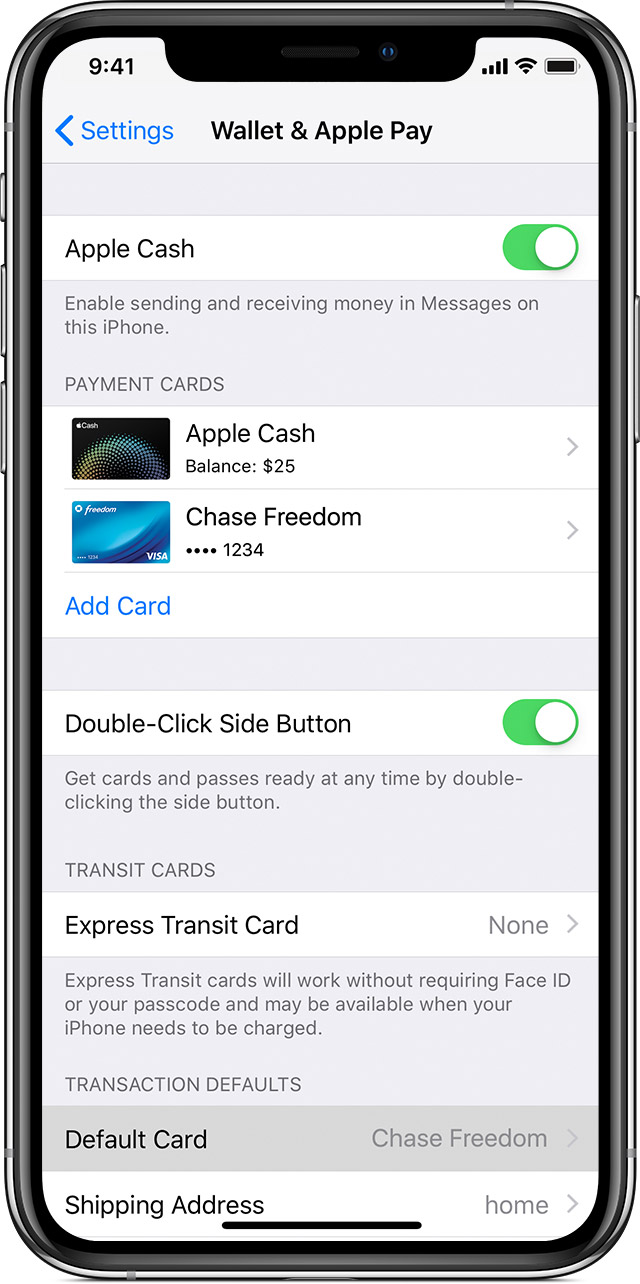

iPhone or iPad

Go to Settings > Wallet & Apple Pay on your iPhone or iPad, and scroll down to Transaction Defaults. Tap Default Card, then choose a new card.

On your iPhone, you can also open Wallet, touch and hold a card, then drag it to the front of your cards.

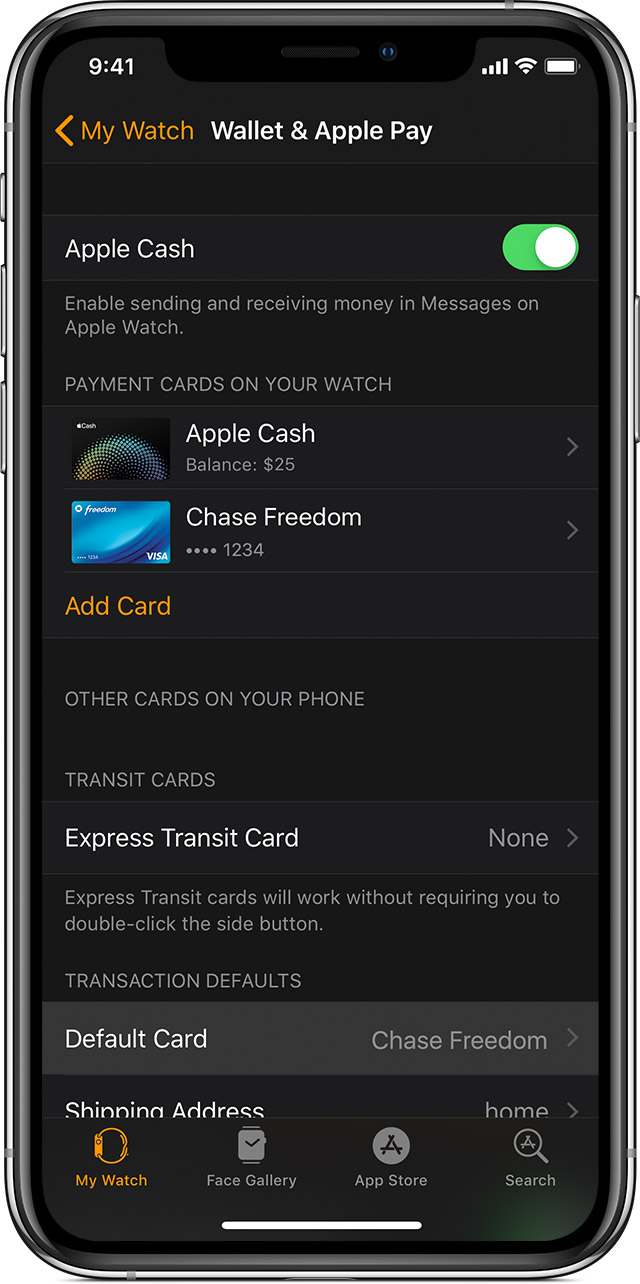

Apple Watch

Open the Apple Watch app on your iPhone. Tap the My Watch tab, tap Wallet & Apple Pay > Default Card, then choose a new card.

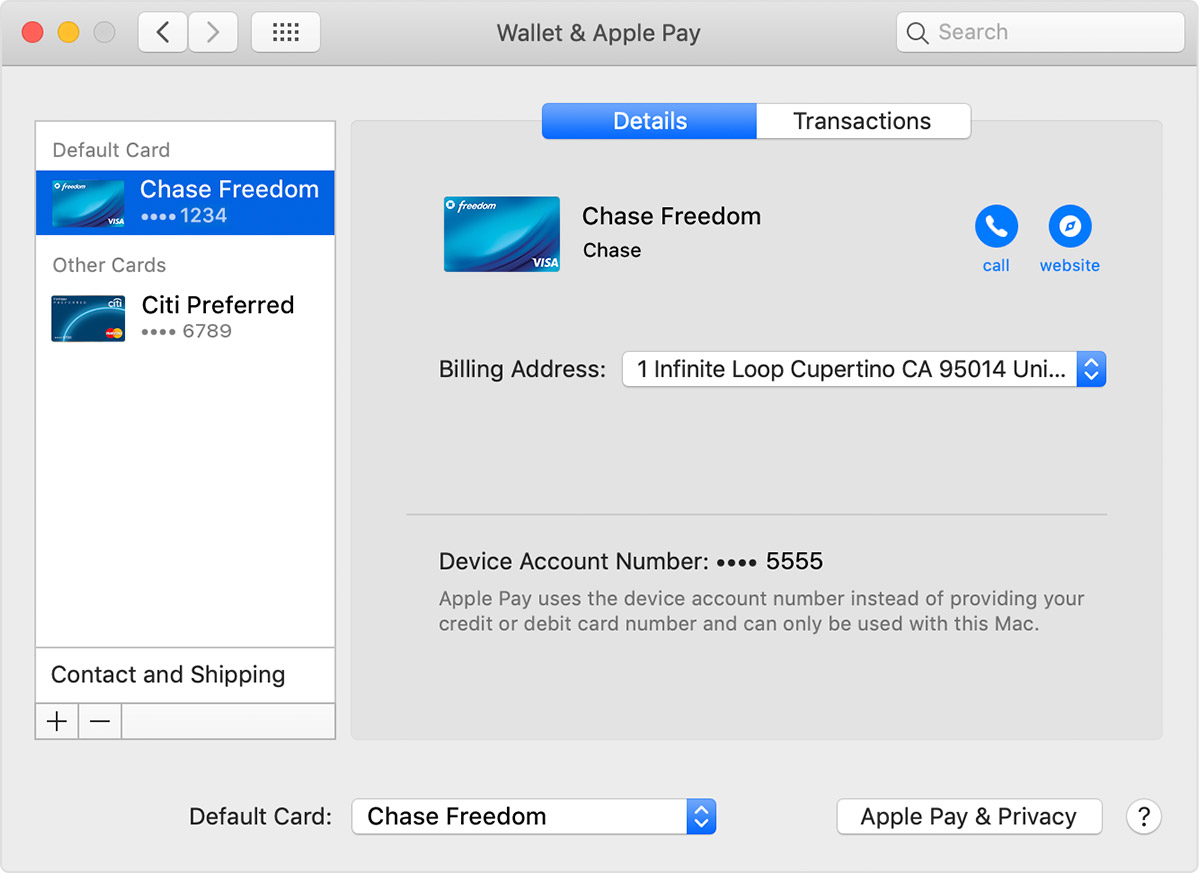

Mac models with Touch ID

Go to System Preferences > Wallet & Apple Pay. Choose a new card from the Default Card pop-up menu.

Person to person payments with Apple Pay and Apple Cash aren’t available on macOS. 3

Update your billing and contact information

Learn how to update your billing and shipping information for the cards that you use with Apple Pay. For Apple Card, 4 see how you can view and update your billing address and contact information.

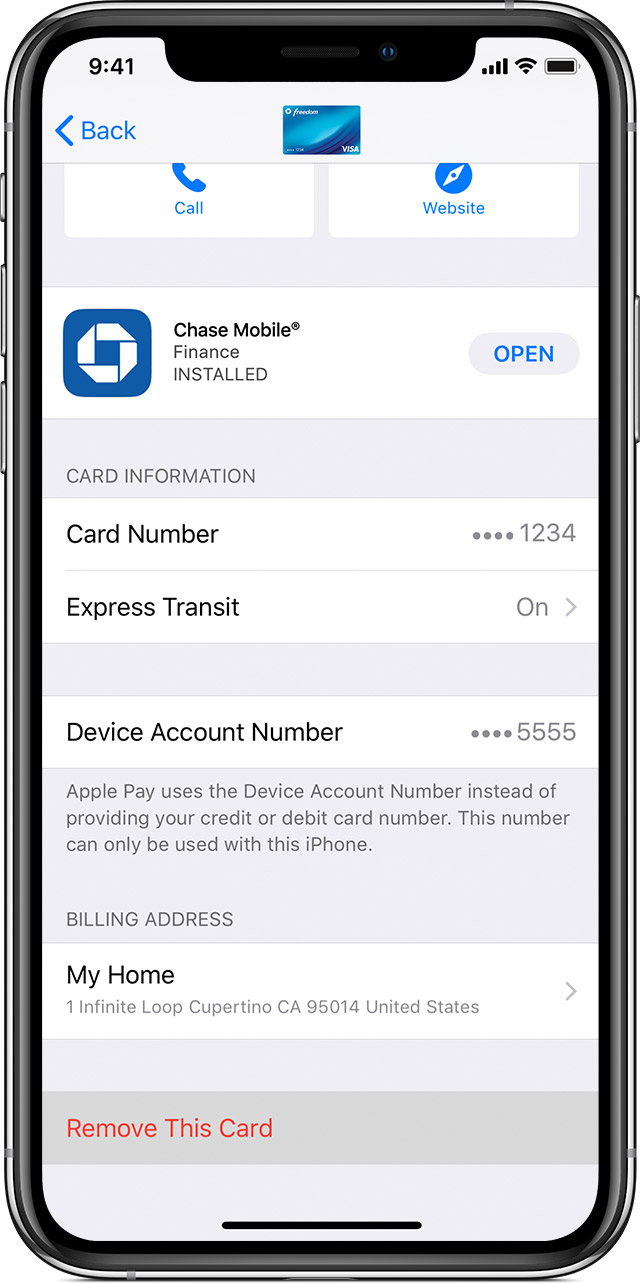

iPhone or iPad

- To change your billing information, go to Settings > Wallet & Apple Pay, tap a card, then tap what you want to update.

- To update your email address, phone number, and shipping address, go to Settings > Wallet & Apple Pay, then choose what you want to update.

Mac models with Touch ID

- To change your billing information, go to System Preferences > Wallet & Apple Pay, click a card, then click the Billing Address pop-up menu.

- To update your email address, phone number, and shipping address, go to System Preferences > Wallet & Apple Pay, then click Contact and Shipping.

While you can’t change your card number or expiration date, it should update automatically when you get a new card. If your issuer doesn’t support updates, you might need to remove the card, then add it again.

Remove a card

If you need to, you can remove a card from your device. For Apple Card, 4 learn how you can close your account. For Apple Cash, 3 use these steps to close your Apple Cash account or turn off Apple Cash on a certain device.

iPhone or iPad

To remove a card that you use on your iPhone or iPad, go to Settings > Wallet & Apple Pay, tap the card that you want to remove, then scroll down and tap Remove This Card.

Or open Wallet, tap a card, tap , then scroll down and tap Remove This Card.

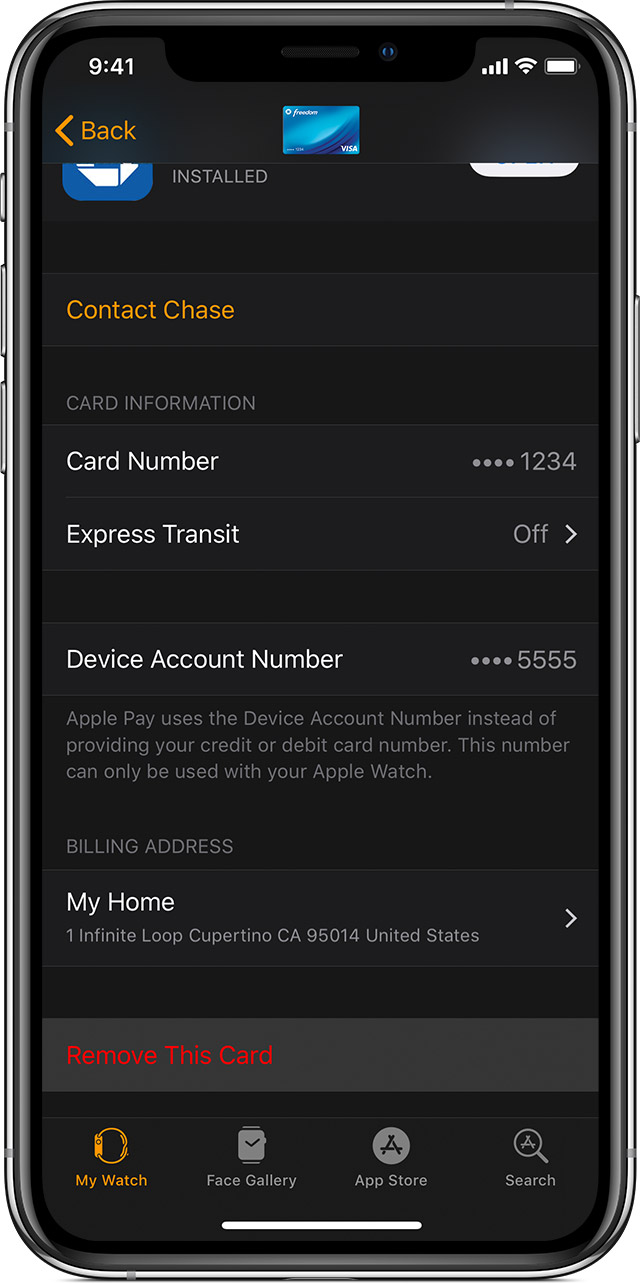

Apple Watch

To remove a card that you use on your Apple Watch, open the Watch app on your iPhone, go to the My Watch tab, scroll down, tap Wallet & Apple Pay, tap the card, then scroll down and tap Remove This Card.

Or tap Wallet on the Home screen of your Apple Watch, tap a card, touch and hold, then tap Delete.

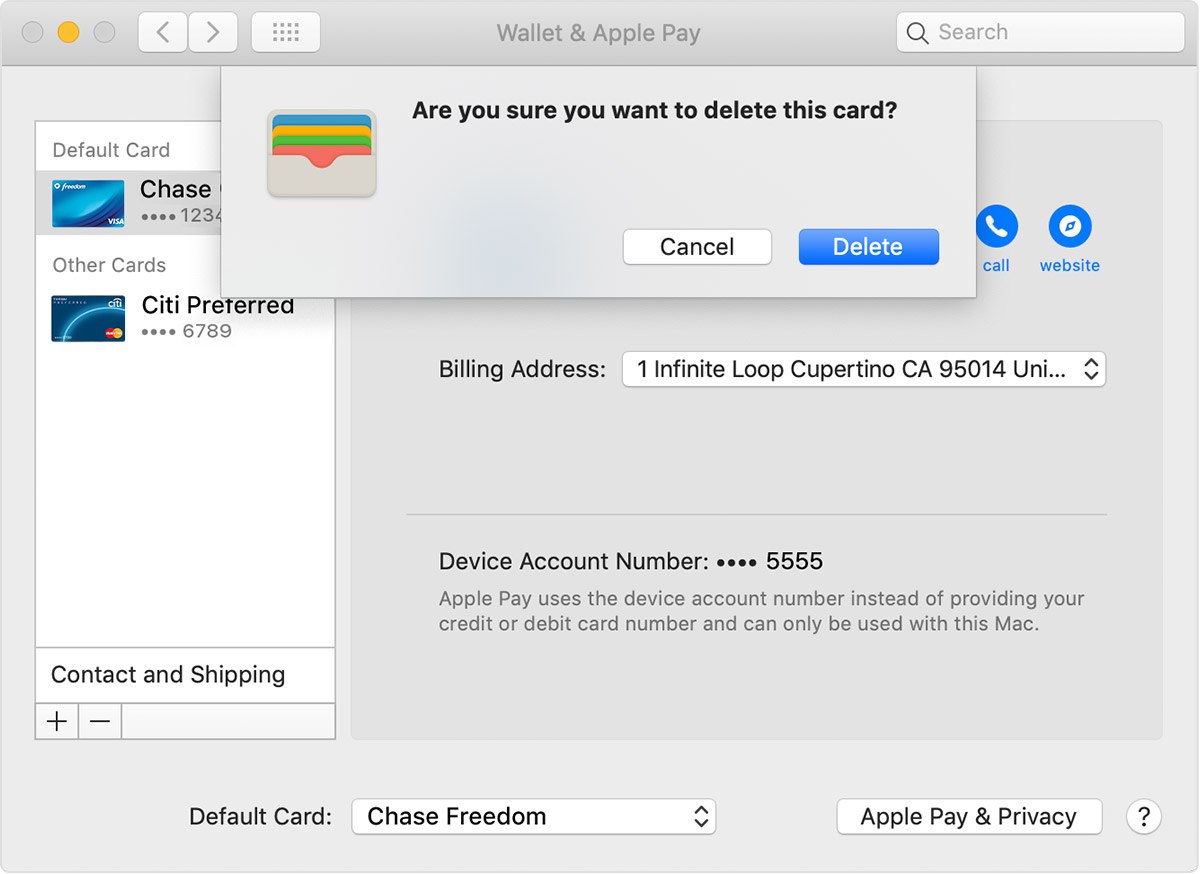

Mac models with Touch ID

To remove a card that you use on your Mac, go to System Preferences > Wallet & Apple Pay, click the card that you want to remove, then click the minus (–) sign to remove the card.

Manage your store or rewards cards

If you turn on Automatic Selection on a store card, the store card will be presented instead of your default card when you pay at the associated store. If you turn on Automatic Selection on a rewards card, your rewards information will be presented at the associated store when using Apple Pay.

When you add a store card or rewards card to Wallet, you might be asked if you want the card to be automatically selected. To turn Automatic Selection on or off:

- Open the Wallet app.

- Tap the store card or rewards card.

- Tap , then turn Automatic Selection on or off.

Get help if your device is lost or stolen

To use Apple Pay, you need to authorize each credit, debit, or prepaid card purchase with Face ID, Touch ID, or your passcode. Or on Apple Watch when Wrist Detection is on, you need to enter your passcode every time you put on your Apple Watch. These features help prevent other people from using Apple Pay on your iPhone, iPad, Apple Watch, or Mac.

Go to your Apple ID account page or use Find My iPhone to suspend or permanently remove the ability to pay from that device with Apple Pay. On your Apple ID account page, sign in and click your device. In the information that appears, go to the Apple Pay section and click either Remove or Remove all. Your card or cards will be suspended or removed from Apple Pay even if your device is offline and not connected to a cellular or Wi-Fi network.

You can also call your issuer to suspend or remove your cards from Apple Pay. Learn more about what to do if your iPhone is lost or stolen.

Learn more

- Learn which countries and regions support Apple Pay.

- Apple Pay isn’t available in China mainland for Mac models with Touch ID.

- Sending and receiving money with Apple Pay and the Apple Cash card are services provided by Green Dot Bank, Member FDIC. This feature is available only in the United States. Learn more about the Terms and Conditions.

- Apple Card is issued by Goldman Sachs Bank USA, Salt Lake City Branch. Apple Card is available only in the United States.

Information about products not manufactured by Apple, or independent websites not controlled or tested by Apple, is provided without recommendation or endorsement. Apple assumes no responsibility with regard to the selection, performance, or use of third-party websites or products. Apple makes no representations regarding third-party website accuracy or reliability. Contact the vendor for additional information.

Источник

How your Apple Card application is evaluated

Learn about the key criteria used to determine whether your Apple Card application is approved or declined.

Goldman Sachs 1 uses your credit score, your credit report (including your current debt obligations), and the income you report on your application when reviewing your Apple Card application. This article highlights a number of factors that Goldman Sachs uses, in combination, to make credit decisions but doesn’t include all of the details, factors, scores or other information used to make those decisions.

If you apply for Apple Card and your application is approved, there’s no impact to your credit score until you accept your offer. If you accept your offer, a hard inquiry is made. This may impact your credit score. If your application is declined or you reject your offer, your credit score isn’t impacted by the soft inquiry associated with your application.

If your application was declined, learn what you can do to try and improve your next application.

If you’re combining accounts for Apple Card Family, some of the credit factors mentioned above may be considered for both co-owners when evaluating a combined credit limit for a co-owned Apple Card. 2

Personal finance companies, like Credit Karma, might display various credit scores, like TransUnion VantageScore. While these scores can be informative, if they’re not the FICO score that’s used for your Apple Card application, they may not be as predictive of your approval.

You can also contact Apple Support if you have questions about applying for Apple Card.

Requirements to get Apple Card

To get Apple Card, you must meet these requirements:

- Be 18 years or older, depending on where you live.

- Be a U.S. citizen or a lawful U.S. resident with a U.S. residential address that isn’t a P.O. Box. You can also use a military address.

- Use two-factor authentication with your Apple ID.

- Sign in to iCloud with your Apple ID. 3

- If you have a freeze on your credit report, you need to temporarily lift the freeze before you apply for Apple Card. Learn how to lift your credit freeze with TransUnion.

- You might need to verify your identity with a Driver license or State-issued Photo ID.

Conditions that might cause your application to be declined

When assessing your ability to pay back debt, Goldman Sachs 1 looks at multiple conditions before making a decision on your Apple Card application.

If any of the following conditions apply, Goldman Sachs might not be able to approve your Apple Card application.

If you’re behind on debt obligations 4 or have previously been behind

- You are currently past due or have recently been past due on a debt obligation.

- Your checking account was closed by a bank (for example, due to repeatedly spending more than your available account balance).

- You have two or more non-medical debt obligations that are recently past due.

If you have negative public records

- A tax lien was placed on your assets (for example, due to a failure to pay sufficient taxes on time).

- A judgement was passed against you (for example, as a result of litigation).

- You have had a recent bankruptcy.

- Your property has been recently repossessed.

If you’re heavily in debt or your income is insufficient to make debt payments

- You don’t have sufficient disposable income after you pay existing debt obligations.

- Your debt obligations represent a high percentage of your monthly income (for example, your unsecured debt obligations, such as loans that aren’t backed by collateral, are 50% or more of your total income).

- You have fully utilized all of your credit card lines in the last three months and have recently opened a significant amount of new credit accounts.

If you frequently apply for credit cards or loans

- You have a high number of recent applications for credit.

If your credit score is low

Goldman Sachs uses TransUnion and other credit bureaus to evaluate your Apple Card application. If your credit score is low (for example, if your FICO9 score is lower than 600), 4 Goldman Sachs might not be able to approve your Apple Card application.

Источник

Apple Card

The simplicity of Apple.

In a credit card.

With Apple Card, we completely reinvented the credit card. Your information lives on your iPhone, beautifully laid out and easy to understand. We eliminated fees 1 and built tools to help you pay less interest, and you can apply in minutes to see if you are approved with no impact to your credit score. 2 Advanced technologies like Face ID, Touch ID, and Apple Pay give you a new level of privacy and security.

And with every purchase you get Daily Cash back. Apple Card. It’s everything a credit card should be.

Created by Apple.

Powered by iPhone.

Built for iPhone

Apple Card lives on your iPhone, in the Wallet app. You can sign up in as little as a minute and start using it right away with Apple Pay. 3 Your transactions, payments, and account details are all in one place, where only you can see them. 4 You even make your payments right in the Wallet app — just select your amount, tap, and it’s done.

No Fees

We want to make it easier to pay down your balance, not harder. So Apple Card doesn’t have any fees. No annual, over-the-limit, foreign-transaction, or late fees. 5 No fees. Really. And our goal is to provide interest rates that are among the lowest in the industry. Because your credit card should work for you, not against you.

The first credit card that actually encourages you to pay less interest.

Pay Less Interest

Most credit cards emphasize your minimum amount due. But when you pay only your minimum each month, it costs you a lot in interest over time. Apple Card is different. When you’re ready to make a payment, Apple Card estimates the interest you’ll wind up paying, based on any payment amount you choose. 6 And it does that in real time, so you can make an informed decision about how much of your balance to pay down.

Unlimited

Daily Cash back.

Real cash you can use right away. 7

Unlimited Daily Cash

When you buy something using Apple Card, you get a percentage of your purchase back in Daily Cash. It’s real cash, so unlike rewards, it never expires or loses its value. Your cash is deposited right onto your Apple Cash card in the Wallet app — not a month from now, but every day. And there’s no limit to how much you can get. Use it to buy things in stores, on websites, and in apps. Make a payment on your Apple Card. Pay back a friend in Messages. Or send it straight to your bank account and watch it add up.

Get 3% Daily Cash back when you shop at Apple.

3% Daily Cash at Apple

Apple Card gives you unlimited 3% Daily Cash back on everything you buy at Apple — whether it’s a new Mac, an iPhone case, games from the App Store, or even a service like Apple Music or Apple TV+.

Get 2%

Daily Cash

back

2% Daily Cash

The best way to use Apple Card is with Apple Pay — the secure payment technology built into iPhone, Apple Watch, iPad, and Mac and accepted at 85 percent of merchants in the United States. Apple Pay is a safer way to pay that helps you avoid touching buttons or exchanging cash. And with every purchase you make using your Apple Card with Apple Pay, you get 2% Daily Cash back. No points to calculate. No limits or deadlines. Just real cash that’s ready to spend whenever, wherever, and however you want.

Shop with select merchants and get even more Daily Cash.

3% Daily Cash

Apple Card gives you unlimited 3% Daily Cash back on purchases you make at select merchants when you use Apple Card with Apple Pay. ◊

- Duane Reade

- Exxon

- Mobil

- Nike

- Panera Bread

- T-Mobile

- Uber

- Uber Eats

- Walgreens

Apple Card Family

Healthy finances.

Family style.

Apple Card Family

Apple Card Family brings all the great features and benefits of Apple Card to your entire family — whether that’s your immediate family, extended family, or whoever you call family. 8 It allows two partners to merge credit lines 9 to form a single co-owned account 10 , manage that account together, and build credit as equals. 11 Participants 12 18 and older can choose to start building their own credit history, 13 and teens can learn better spending habits. And, family members receive Daily Cash back on their own purchases. 14

Goodbye, plastic.

Hello, titanium.

Titanium Card

With laser etching and clean styling, Apple Card is designed with the same craftsmanship we bring to all our products. And it’s the only credit card made of titanium — a sustainable metal known for its beauty and durability. When you use the card, you’ll get 1% Daily Cash back on every purchase. Since Mastercard is our global payment network, you can use it all over the world. For apps and websites that don’t take Apple Pay yet, just enter the virtual card number stored securely in your Wallet app. And when you’re using Safari, it even autofills for you.

Privacy and Security

Privacy and Security

Apple takes your privacy and security seriously. It’s not just a philosophy, it’s built into all our products. And Apple Card is no different. With advanced security technologies like Face ID, Touch ID, and unique transaction codes, Apple Card with Apple Pay is designed to make sure you’re the only one who can use it. The titanium card has no visible numbers. Not on the front. Not on the back. Which gives you a whole new level of security. And while Goldman Sachs uses your data to operate Apple Card, your transaction history and spending habits belong to you and you alone. Your data isn’t shared or sold to third parties for marketing or advertising.

Pay for your

new Apple products

over time,

interest‑free

when you choose to

check out with Apple Card Monthly Installments. 15

Open to read more about Apple Card Monthly Installments

Apple Card Monthly Installments

You can buy a new Mac, iPhone, iPad, Apple Watch, and more with interest-free monthly payments on purchases at Apple. Just choose Apple Card Monthly Installments and then check out. Your installment automatically appears on your Apple Card statement alongside your everyday Apple Card purchases in the Wallet app. If you have an eligible device to trade in, you’ll pay even less per month. 16 And you’ll get 3% Daily Cash back on the purchase price of each product, all up front. If you have Apple Card already, there’s no additional application. If you don’t, you can apply in as little as a minute during checkout, from the privacy of your iPhone.

Tools to help

you make

financially

healthy

choices.

Financial Health

To see how much you’re spending, there’s no need to log in to a separate website or app. Your totals are automatically added up in the Wallet app, ready to view by week or by month. Color-coded categories make it easy to spot trends in your spending so you can decide if you want to change them. And Apple Card uses Maps to pinpoint where you bought something. 17 No mysterious merchant codes. No guessing.

Trusted partners for a different kind of credit card.

Partnerships

To create Apple Card, we needed an issuing bank and a global payment network. Apple Card is the first consumer credit card Goldman Sachs has issued, and they were open to doing things in a new way. And the strength of the Mastercard network means Apple Card is accepted all over the world.

Get started

with Apple Card.

Apply in minutes to see if you are approved with no impact to your credit score. **

Wallet

All your credit and debit cards,

transit cards, boarding passes,

and more. All in one place.

Apple Pay

The safer way to make

secure,

contactless purchases

in stores and online.

Источник