- Можно ли в Google Pay использовать PayPal

- Предназначение PayPal в сервисе Google Pay

- Добавление оплаты в PayPal в Google Pay

- Возможности PayPal при подключении в Google Pay

- Google Pay vs. PayPal: Is Google Pay better than PayPal?

- Google Pay vs. PayPal: Introduction

- Google Pay

- PayPal

- Google Pay vs. PayPal: Quick overview

- Google Pay vs. PayPal: Sending money internationally

- Google Pay vs. PayPal: Features

- Google Pay

- What are the advantages of Google Pay?

- What are the disadvantages of Google Pay?

- PayPal

- PayPal Pros

- PayPal Cons

- Verdict: Is Google Pay better than PayPal?

- Send and receive money with the most international account

- Frequently Asked Questions

- Are PayPal and Google Pay the same?

- Is Google Pay Safe?

Можно ли в Google Pay использовать PayPal

Подключить PayPal Google можно с помощью мобильного телефона. Для выполнения транзакции нужно указать адрес электронной почты и ввести пароль, который используется в ПейПал.

Предназначение PayPal в сервисе Google Pay

С помощью Google Pay можно оплачивать товары в магазинах. Для этого нужен телефон с чипом NFC, установленным приложением и привязанными банковскими карточками. Технология работает в большинстве магазинах, на заправках, в кафе и других торговых организациях.

С помощью ГуглПей можно оплачивать товары в интернете. При международных покупках удобно использовать платежный сервис PayPal. Он автоматически конвертирует валюты и вернет деньги при покупке некачественного товара.

Привязать ПейПал можно на любое устройство, которое поддерживает ГуглПей. С помощью PayPal нельзя оплатить товар в обычных магазинах, но можно отправить деньги за покупку на онлайн-аукционе

Привязанный кошелек PayPal появится во встроенном магазине с приложениями Play Маркет. С виртуального счета можно оплатить приложения, книги, фильмы, музыку.

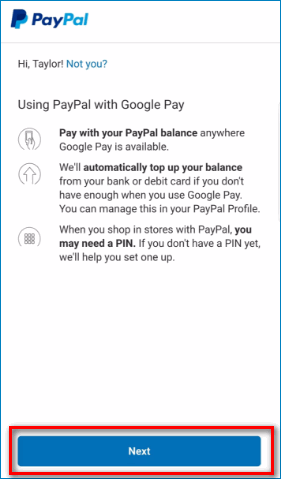

Добавление оплаты в PayPal в Google Pay

Способ оплаты через PayPal появился в ГуглПей недавно. С помощью платежной системы можно купить приложение или услугу во всех сервисах Google, установленных на телефоне.

Как привязать кошелек ПейПал к Google:

- Запустите приложение Google Pay.

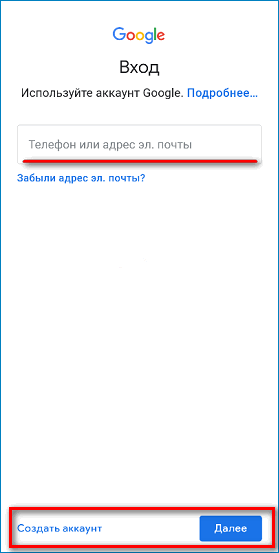

- Войдите в личный аккаунт.

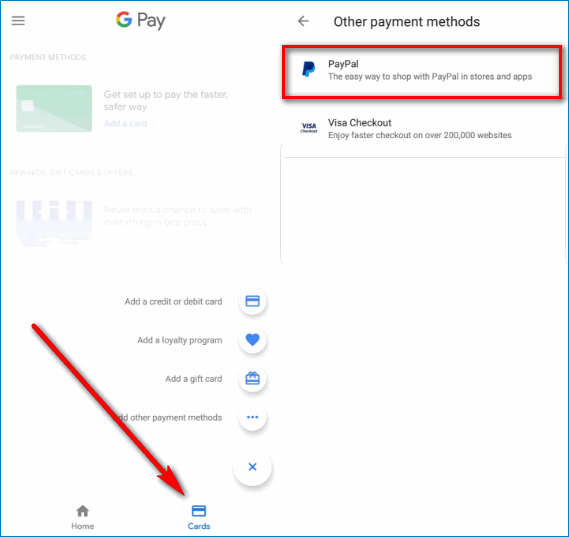

- Тапните по вкладке «Карточки».

- Для добавления нового способа оплаты нажмите на иконку в форме плюса.

- Нажмите на строчку «Добавить другие способы оплаты».

- Пролистайте список и найдите PayPal.

- Кликните по иконке платежной системы.

- В открывшейся форме напечатайте данные учетной записи ПейПал.

- Тапните по кнопке «Далее».

- Введите PIN-код.

- Ознакомьтесь с пользовательским соглашением.

- Нажмите на кнопку «Продолжить».

Добавленный платежный сервис появится во вкладке с банковскими карточками. С помощью Google Pay можно посмотреть последние платежи или задать ПейПал в качестве основного метода оплаты. Удалить виртуальную карту PayPal можно в любое время.

Если телефон не поддерживает мобильные платежи, установить ГуглПей невозможно. Приложение будет недоступно в магазине Play Маркет и выдаст ошибку при попытке установки с помощью файла apk.

Важно! Если возможность добавления PayPal отсутствует, обновите приложение ГуглПей. Получить новую версию можно с помощью магазина приложений

Возможности PayPal при подключении в Google Pay

Google Pay PayPal подходит для оплаты интернет-покупок. Сервис поддерживает международные переводы и перечисления на территории России.

При оплате с покупателя снимается комиссия. Кошелек снимает деньги с виртуального счета или с привязанных к нему банковских карт. Комиссия при покупках через ГуглПей не отличается от стандартных условий при перечислении с помощью официального сайта ПейПал.

Привязанный сервис работает в других официальных приложениях Google, например, в Плей Маркете. С помощью кошелька пользователь может оплатить подписку, приобрести книгу, музыку, фильм или приложение. Оплата осуществляется моментально. В некоторых случаях потребуется повторный ввод логина и пароля ПейПал.

Сервисом удобно пользоваться для покупок в сети. Служба безопасности PayPal поможет вернуть деньги за некачественный товар. Привязать электронный кошелек к Google Pay может любой пользователь. Для этого нужно добавить новый способ оплаты и ввести все запрашиваемые данные. Отследить покупки можно в приложении и на официальной страничке ПейПал.

Источник

Google Pay vs. PayPal: Is Google Pay better than PayPal?

Adam Rozsa

Wondering: is Google Pay like PayPal? Or, maybe more importantly: is Google Pay better than PayPal? This guide has you covered.

We’ll walk through both PayPal and Google Pay pros and cons, and take a look at Google Pay fees vs PayPal. We’ll also explore the limitations and costs involved when using PayPal or Google Pay to make international money transfers — and show you Wise — an alternative option to help you save.

| 📝 Table of contents |

|---|

|

Google Pay vs. PayPal: Introduction

Let’s start with a quick intro to the two different services before we get into a full PayPal vs Google Pay review.

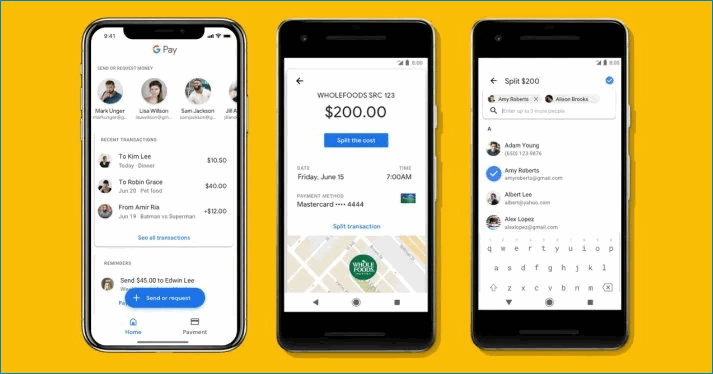

Google Pay

Google Pay¹ is a digital wallet which was formerly known as Google Wallet. Google Pay integrates with other Google services and products, and is Google’s mobile payment solution. You can download Google Pay on both Android and iOS devices, and transfer money to friends or businesses, connect your credit, debit and transit cards for mobile use, and manage and review your transactions. You’ll also be able to earn reward points on your spending to make the most of your money.

PayPal

PayPal is also a digital wallet, best known for powering a huge slice of the world’s ecommerce transactions every day. You can use a PayPal account to buy online and in apps, to send and receive money, and to make in person payments either using a PayPal debit or credit card, or by linking your PayPal account to a mobile payment service like Google Pay². You can use PayPal with Google Pay and Samsung Pay³ to make mobile payments a lot easier — but the options for using PayPal and Apple Pay⁴ are more limited.

Google Pay vs. PayPal: Quick overview

Here’s a quick overview of the PayPal vs Google Pay features and fees. Read on for a more detailed walkthrough.

| Google Pay | PayPal⁸ | |

|---|---|---|

| Compatibility | Android, iOS, web | Android, iOS, web |

| Available payment methods | Balance, credit and debit cards, linked bank account | |

| Money transfer fee | Fee based on method of funding the transfer | Fee based on method of funding the transfer |

| Debit card fee | Greater of 1.5% or 0.31 USD⁶ | |

| Withdrawal speed | Standard withdrawals take 1 — 3 business days⁵ | Standard withdrawals take several days Instant withdrawals for a fee |

| Transfer limit (USD) | 25,000 USD withdrawal limit for instant withdrawal to bank account — 5,000 USD limit for instant withdrawals to cards | |

| Notable features | PayPal Me: Learn more about PayPal Me here |

Google Pay vs. PayPal: Sending money internationally

Since 2021, Wise is integrated with Google Pay, giving access to Wise’s convenient service to send money abroad with to low, transparent fees without leaving the Google Pay app.

In this segment, therefore, we’ll compare Google Pay’s international money sending capabilities by setting up a theoretical transfer of 1000 USD to a friend in Singapore and comparing it to Xoom, PayPal’s service.

So, say you’re about to send 1000 dollars to your Singaporean friend, who’ll receive Singaporean dollars (SDG):

| Fee | Exchange rate | Recipient gets | |

|---|---|---|---|

| Xoom | 4.99 USD | 1.3195 | 1312.92 SGD |

| Google Pay (through Wise) | 9.40 USD | 1.3575 | 1344.79 SGD |

As you can see, your friend would get more Singaporean dollars with Google Pay’s Wise integration than with Xoom in this case: it appears that you could save 31.87 SGD with Wise and it’s low, and transparent fees, which always uses the mid-market rate.

Google Pay vs. PayPal: Features

After a quick overview of the features and fees of each, let’s see a detailed overview of Google Pay and PayPal features and their pros and cons..

Google Pay

Google Pay is a smart digital wallet to let you manage and review all you’re spending in one place. Because you can link several accounts, credit and debit cards, it’s easy to see where your money is going — and places you could save if you want to.

Use Google Pay for easy payments right from your smartphone, with the option to create a group or send to a single individual. That means you can split a restaurant bill with friends easily and have the payments added to your Google Pay balance, contribute to a shared pot to pay rent with your roommates, or send money to a family member — right from your phone.

Think Google Pay might be the one for you? Here’s what you can use your Google account for:

- Connect your Google Pay account to your bank account or card to send payments to a friend or a group of friends

- Pay businesses online and in person

- Link credit and debit cards, and even transit cards, to make mobile payments with just your smartphone

- Synch your bank accounts to review and analyze your spending

- Earn cashback and rewards — on top of any other loyalty programs you already participate in

One important point to note — you can’t use Google Pay for most international transfers without using a cross border payment provider as an intermediary⁹. Get a full guide to the options and limitations involved with using Google Pay for international payments here.

What are the advantages of Google Pay?

- Send easy payments to friends and family within the US

- Split bills using your smartphone for convenience

- Link credit, debit and transit cards for mobile payments

- Get insights into your spending patterns and transaction history

What are the disadvantages of Google Pay?

- Depending on the transactions you make, fees may apply

- Limited options for international transfers

PayPal

PayPal is one of the most established of all digital wallet and online payment services. You can use your PayPal account to shop online, make payments to friends, family and businesses, and even get a linked PayPal credit or debit card to spend in person when you need to. You can also use some types of PayPal account to make mobile in person payments by linking your account to Google Pay or Samsung Pay. That lets you pay with just a tap when you’re out shopping in a physical store.

Here’s a rundown of what you can do with your PayPal account:

- Shop online, in apps and using your smartphone, depending on which PayPal account type you choose

- Split bills with friends easily

- Send and receive money in USD and a range of international currencies

- Hold a balance in several currencies, including crypto, to spend online or make payments

- Access credit and personal financing through PayPal

As you’ll have read above, you can’t usually use Google Pay to make international transfers directly — but you can send money abroad with PayPal if you’d like. However, the fees and charges when sending international payments with PayPal are quite different to PayPal domestic transfers. Get a guide to PayPal international transfers, and check out the PayPal currency conversion costs before you get started.

PayPal Pros

- One of the most established online payment providers

- Broad range of PayPal services including online accounts, physical payment cards, balance accounts and financing

- International payments are possible for a fee

- Use PayPal with Google Pay if you have a PayPal Cash account

PayPal Cons

- Transaction fees apply, which may add up when dealing with international payments

- You can’t use PayPal with Apple Pay for most transactions

Verdict: Is Google Pay better than PayPal?

There’s not really a straight answer to which comes out on top on the Google Pay vs PayPal debate. It depends on how you expect to use your account, and the type of transactions you’ll likely make.

Google Pay has a lower fee for debit card transactions compared to PayPal, which may edge it ahead if you’re anticipating funding payments that way. But you can only use Google Pay for sending money within the US, India and Singapore, which may be a limiting factor if you’re planning on making more international transactions.

The best way to get the right digital wallet for you is to shop around — Google Pay and PayPal aren’t the only options out there, so you might find one which works better for you. Here are some other helpful resources — and keep reading for more on how you can save on spending and sending money abroad with Wise:

| 💡 Useful articles to check out |

|---|

|

Send and receive money with the most international account

If you’ll be making a lot of international transactions, you could save with Wise and the Wise multi-currency account.

Get a free Wise account online to hold 50+ currencies, send payments to friends, family and businesses, and shop online and in person with a linked debit card. Wise currency conversion always uses the real mid-market exchange rate with no hidden fees — just a low, transparent charge per transaction. You could save 7x compared to using a regular bank account, or an alternative like PayPal when you shop and send payments internationally.

See how much you can save with Wise today.

Frequently Asked Questions

Are PayPal and Google Pay the same?

PayPal and Google Pay are both digital wallets which let you hold, send and receive payments, as well as shopping online and in person. However, they are different products, and Google Pay and PayPal accounts aren’t automatically linked.

Is Google Pay Safe?

Google Pay has a focus on customer safety with advanced authentication, security and fraud detection.

For example, the company offers several safety features for such as sending a virtual card number to the merchant instead of your real card number. Moreover, payment information are encrypted on Google’s servers.

As more and more of life moves online, being able to make virtual and mobile payments can make day to day transactions easier than ever. Find the best digital wallet for you by researching and comparing some of the options out there — and don’t forget to look at the Wise multi-currency account as a perfect solution for sending and spending internationally.

All sources checked on 23 September 2021

This publication is provided for general information purposes only and is not intended to cover every aspect of the topics with which it deals. It is not intended to amount to advice on which you should rely. You must obtain professional or specialist advice before taking, or refraining from, any action on the basis of the content in this publication. The information in this publication does not constitute legal, tax or other professional advice from TransferWise Limited or its affiliates. Prior results do not guarantee a similar outcome. We make no representations, warranties or guarantees, whether express or implied, that the content in the publication is accurate, complete or up to date.

Источник