- Stripe apple pay настройка

- How to Accept Apple Pay and Google Pay with Stripe Checkout (with Video)

- Stripe Checkout Adds Apple Pay and Google Pay Digital Wallet Support

- What are Digital Wallets?

- Consumer Benefits of Apple Pay

- Consumer Benefits of Google Pay

- Increase Your Membership Site Sales with Apple Pay and Google Pay

- Mobile Friendly

- Faster Checkouts

- Even More Benefits

- Enhanced Security

- Brandable Checkout

- How to Add Stripe Checkout to Your MemberPress Site

- How to Enable Apple Pay and Google Pay in Stripe

- Subscribing using Apple Pay #873

- Comments

- odedharth commented Dec 20, 2017

- Summary

- bg-stripe commented Dec 20, 2017

Stripe apple pay настройка

Cordova plugin for Stripe — Apple Pay integration

Updated to provide additional data access to the plugin, test calls, and compatibility with newer versions of Cordova. Uses a Promise based interface in JavaScript.

Get your merchant ID

Configure Apple Pay

Follow these instructions to get your merchant ID.

Configure Stripe account

Enable Apple Pay on xCode

You can find more information here.

Compile on Stripe Test/Production Mode

To switch between Stripe Test/Production mode, go to Build Settings on xCode and add NDEBUG/DNDEBUG like below:

The methods available all return promises, or accept success and error callbacks.

- ApplePay.canMakePayments

- ApplePay.makePaymentRequest

- ApplePay.completeLastTransaction

Detects if the current device supports Apple Pay and has any capable cards registered.

If in your catch you get the message This device can make payments but has no supported cards — you can decide if you want to handle this by showing the ‘Setup Apple Pay’ buttons instead of the normal ‘Pay with Apple Bay’ buttons as per the Apple Guidelines.

Request a payment with Apple Pay, returns a Promise that once resolved, has the payment token. In your order , you will set parameters like the merchant ID, country, address requirements, order information etc. See a full example of an order at the end of this document.

The paymentResponse is an object with the keys that contain the token itself, this is what you’ll need to pass along to your payment processor. Also, if you requested billing or shipping addresses, this information is also included.

Once the makePaymentRequest has been resolved successfully, the device will be waiting for a completion event. This means, that the application must proceed with the token authorisation and return a success, failure, or other validation error. Once this has been passed back, the Apple Pay sheet will be dismissed via an animation.

You can dismiss or invalidate the Apple Pay sheet by calling completeLastTransaction with a status string which can be success , failure , invalid-billing-address , invalid-shipping-address , invalid-shipping-contact , require-pin , incorrect-pin , locked-pin .

Payment Flow Example

The order request object closely follows the format of the PKPaymentRequest class and thus its documentation will make excellent reading.

Valid values for the shippingType are:

Valid values for the billingAddressRequirement and shippingAddressRequirement properties are:

This project is licensed under GNU General Public License v3.0.

Источник

How to Accept Apple Pay and Google Pay with Stripe Checkout (with Video)

Last modified on September 29, 2021 | Katelyn Gillis

In spite of the Coronavirus forcing many small businesses to close their doors, online marketers continue to thrive in ecommerce sales. By the end of 2020, online sales were up 44% as consumers spent over $861.12 billion. Experts say that these numbers will only go up from here.

By 2023, ecommerce retail is expected to rise from 14.1% to 22%, with the number of online shoppers jumping to 278.33 million. That’s 91% of the US population!

That’s why it’s never been more vital to have a solid payment gateway for your membership site.

Smart shoppers use extreme caution when it comes to shopping online – as they should. Many will go the extra mile to determine whether a website is safe to avoid credit card fraud, identity theft, and scams.

As a membership site owner, it’s your responsibility to provide a dependable payment gateway that your members can trust to keep their payment methods simple, secure, and protected.

Fortunately, our new integration upgrade has made that a cinch. We’re excited to announce that our existing Stripe Checkout plugin now supports Apple Pay and Google Pay!

MemberPress is among the few membership plugins that have successfully consolidated Stripe’s Apple Pay and Google Pay additions.

Stripe Checkout Adds Apple Pay and Google Pay Digital Wallet Support

Stripe is a MemberPress favorite when it comes to credit card payment gateways. Being a fully integrated online payment processor, Stripe provides multiple payment products to collect one-time and recurring payments safely, securely, and easily. Stripe also helps with invoicing, financing, managing expenses, fraud protection, and more.

Until now, MemberPress Stripe users have only been able to accept credit and debit card payments. While this method is both standard and efficient, it can be a time-consuming process for customers.

The rising popularity of digital wallets like Apple Pay and Google Pay has quickened the overall shopping experience.

What are Digital Wallets?

Digital wallets enable users to store their credit and debit card information digitally. While digital wallet software is more commonly downloaded as a mobile app, it can also be stored on a personal laptop or computer.

This payment method offers a quick and convenient way to pay. Instead of having to manually enter their billing information, customers can opt to use a digital wallet for a much faster and more secure purchasing process.

Consumer Benefits of Apple Pay

Apple Pay allows customers to pay using payment methods stored on their Apple Pay products – i.e., iPhone, iPad, iMac, or any device that uses the iOS operating system.

With Apple Pay, users can:

- Earn Rewards. Apple Pay users are awarded 2% cashback with daily transactions.

- Transfer Money. Apple Pay users can send and receive money from family and friends, and even split expenses with others.

- Enable Biometric Security. Apple Pay users can protect their financial details by guarding content behind a facial scan and fingerprint reader.

- Feel Secure. Credit card numbers are never stored on a device or Apple Pay Servers. Instead, Apple Pay uses a device-specific number and a unique transaction code. Additionally, Apple Pay doesn’t keep transaction information – transactions stay between the user, the merchant or developer, and the bank.

Consumer Benefits of Google Pay

Google pay is a bit more versatile compared to Apple Pay. Users can pay using any device that has their saved Google Pay payment methods.

With Google Pay, users enjoy:

- Cashback Rewards. Google Pay users can earn cashback on everyday business purchases.

- Money Transfers. Google Pay users can send money to family members and friends, as well as privately request money for split expenses.

- Business Connections. Google Pay users can keep track of their expenses at frequently shopped businesses. The platform also saves store loyalty and gift cards.

- Security. Google Pay uses a virtual account number rather than personal credit card information. Additional security measures include authentication, transaction encryption, and fraud protection.

In a contactless society, more and more businesses are accommodating the 51% of people who use digital wallets. And it makes sense. Digital wallets are considerably more beneficial to the online shopping experience.

Online businesses are profiting from the benefits and overall convenience of digital wallets to increase ecommerce sales and conquer cart abandonment challenges.

Increase Your Membership Site Sales with Apple Pay and Google Pay

Online businesses lose over $18 billion every year due to cart abandonment.

By enabling Apple Pay and Google Pay on your membership site, you can improve your members’ overall user experience to promise a quicker and more convenient checkout process.

Mobile Friendly

Perhaps the biggest challenge faced by online marketers is low mobile conversion rates. According to Truelist, the average cart abandonment rate on mobile phones is 85.65%. There’s a number of reasons why this is – lower accessibility, smaller screen, customer hesitancy, etc.

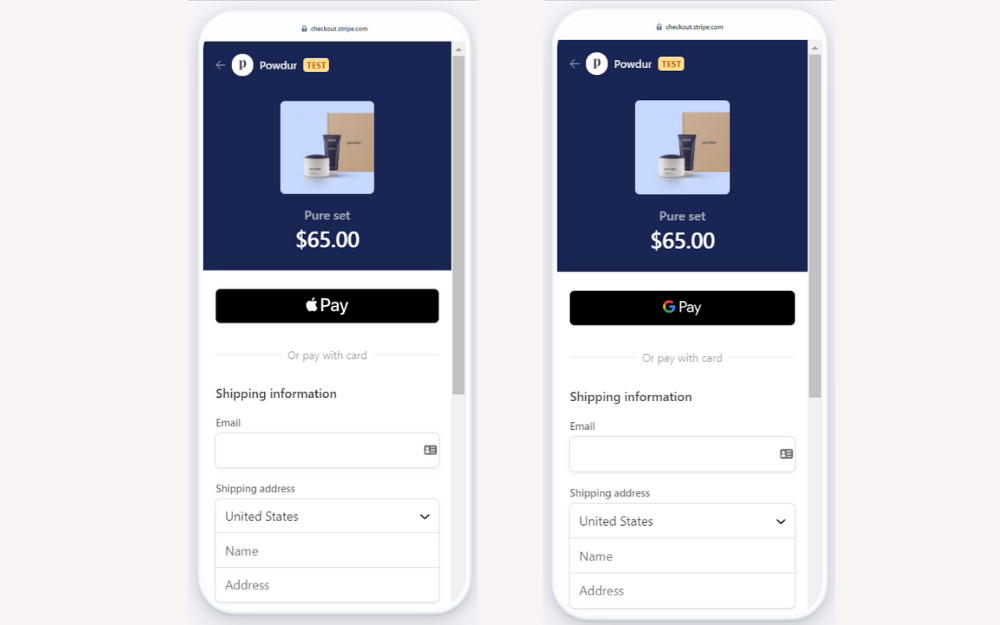

The mobile accommodative features of Apple Pay and Google Pay improve the cellular shopping experience by displaying a clear, easy-to-navigate payment page.

Your members can simply opt for the Apple Pay or Google Pay option, and with a single click, easily purchase a product with confidence and without having to leave their seat!

Online retailers who enable digital wallets see an average of 3X more mobile cart conversions.

Faster Checkouts

Nearly 30% of consumers fail to complete a purchase due to a long and complicated checkout process.

Before, when a member wanted to purchase your next available course content, they’d first have to find their wallet. Then, they’d have to dig out their credit or debit card and type in their lengthy card number (likely several times due to pesky typing errors). Next, they’d have to fill in their banking information before finally being able to complete their purchase. How exhausting!

Now, with Apple Pay and Google Pay, your members can checkout with just a few clicks!

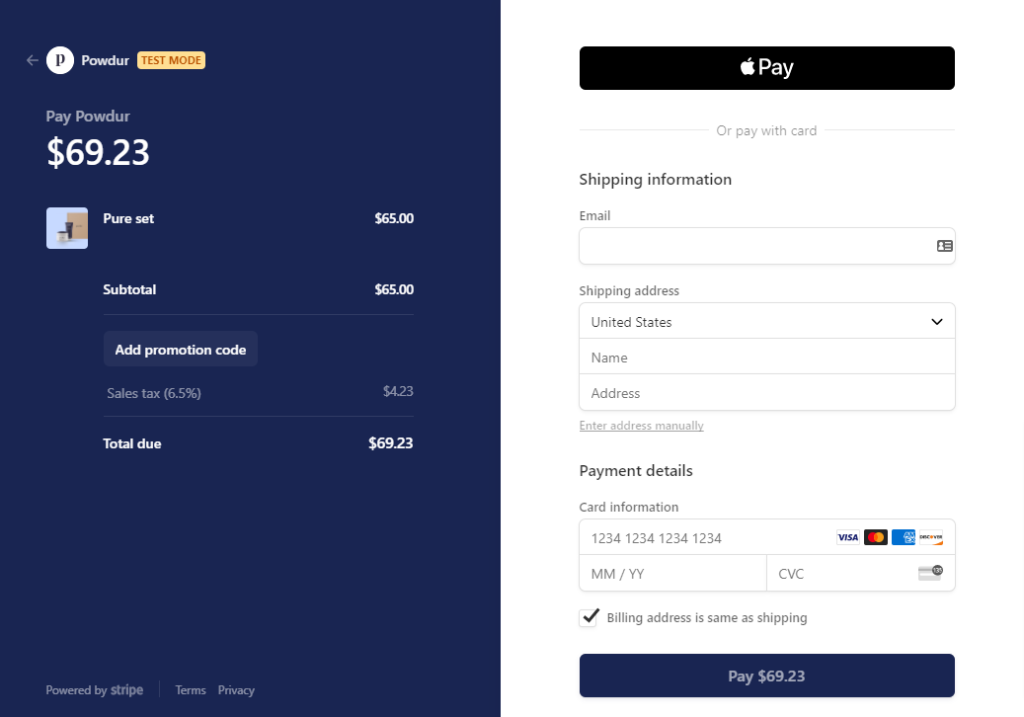

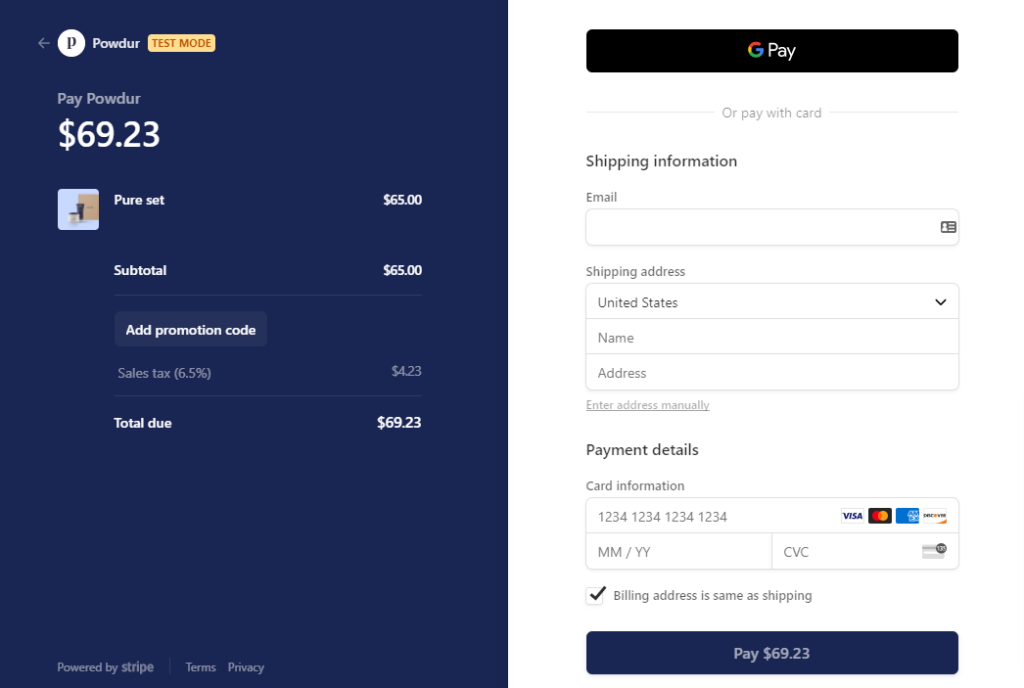

Upon arriving at your MemberPress checkout page, members can choose to pay using either their Apple Pay or Google Pay account via Stripe Checkout. With a single click, they’ll be redirected to Stripe Checkout where all their information has been pre-filled automatically.

After confirming their payment in Stripe Checkout, the member will be redirected back to your MemberPress Thank You page.

Even More Benefits

Enhanced Security

We’ve already discussed the advanced security features of Apple Pay and Google Pay. Because these digital wallets are supported through Stripe’s secure servers, both you and your members’ sensitive financial information is even more protected.

Stripe is a certified PCI Service Provider Level 1, the most stringent level of certification in the payments industry. All transactions through Stripe are Secure Socket Layer (SSL/TLS) protected, and credit card numbers are safely stored in an encrypted format.

With our enhanced Stripe checkout, you’ll be among the countless businesses, including Amazon, Pinterest, Slack, and Zoom, who trust Stripe Checkout for all their business’ billing needs.

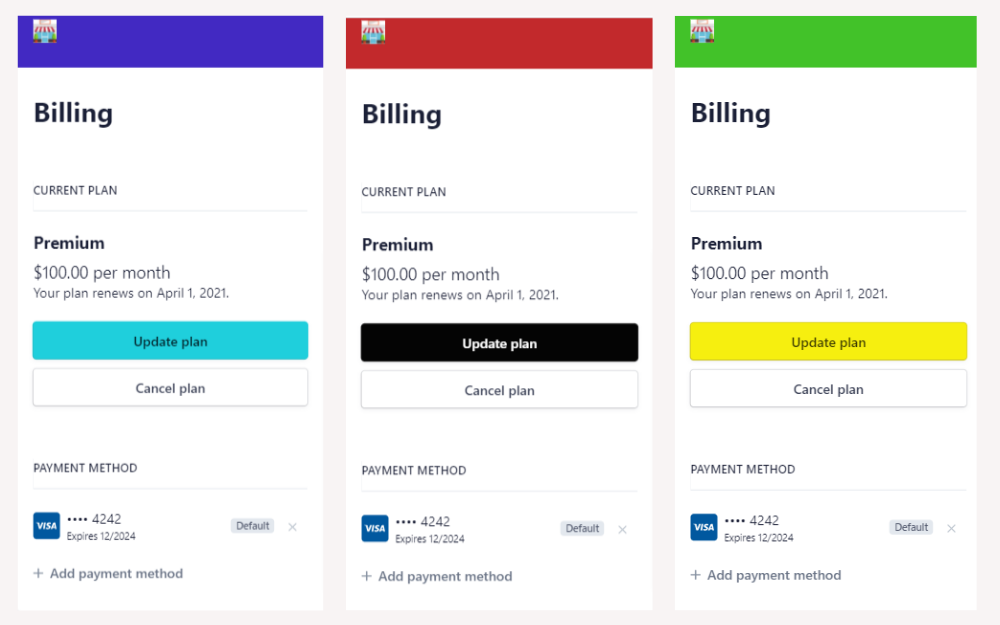

Brandable Checkout

Stripe’s customizable checkout guarantees brand visibility from the moment a customer begins shopping on your website, to the final payment confirmation message.

You can upload your company’s logo as well as choose a color scheme that matches your brand’s identity. You can also display your business policies to link your contact information, payment terms, return protocols, and more.

How to Add Stripe Checkout to Your MemberPress Site

Stripe Checkout is a free payment gateway for our MemberPress Basic, Plus, or Pro plans. If you don’t already have a Stripe account, you’ll need to create one here.

- Navigate to MemberPress > Settings > Payments page and add a new gateway. OR, if you’re updating your existing Stripe Checkout, skip to step 8 below.

- Click on the blue Connect with Stripe button.

- Authenticate your MemberPress account by entering your username and password.

- Next, you’ll be redirected to authenticate your Stripe account. If you’re not logged into Stripe, click Sign in at the top right corner.

- Select your Stripe Account and click the Connect my Stripe account button.

- Note: If your Stripe account has not been fully set up and enabled for “Live mode”, you will not be able to connect until you have verified your account.

- After connecting, you’ll be redirected back to your MemberPress dashboard.

- Locate your new Stripe gateway in the MemberPress Settings and check the Enable Stripe Checkout checkbox.

- Save the MemberPress Settings.

That’s it! You’ve successfully added (or updated) Stripe Checkout.

To learn more about how to configure your MemberPress site with Stripe Checkout, take a look at our Stripe Checkout Integration Support Docs.

For a great tutorial on using Stripe with MemberPress, check out our latest video:

How to Enable Apple Pay and Google Pay in Stripe

Start accepting Apple Pay and Google Pay on your membership site today with help from these Stripe Support Docs:

- To learn more about adding Apple Pay to your Stripe account, please visit this page.

- To learn more about adding Google Pay to your Stripe account, please visit this page.

Do you have any questions about the new Stripe integration? Let us know in the comments!

If you liked this article, be sure to follow us on Facebook, Twitter, Instagram, and LinkedIn! And don’t forget to subscribe in the box below.

Источник

Subscribing using Apple Pay #873

Comments

odedharth commented Dec 20, 2017

Summary

We’d like to add an option to subscribe using Apple Pay in addition to the regular credit card option. According to Stripe’s documentation, it’s supposed to be possible, but it’s not clear to us how to do it.

We’ve followed the Stripe Apple pay tutorial, and now when we run presentPaymentMethodsViewController()

It shows Apple pay as one of the options.

The question is how to initiate the subscription after the user has selected Apple Pay as the payment method.

With a regular credit card, it’s possible by subscribing the user using Stripe’s Ruby gem for example after he added a credit as a payment method in the ios app. How can we set Apple Pay as a payment method on iOS?

The text was updated successfully, but these errors were encountered:

bg-stripe commented Dec 20, 2017

Hey @odedharth – it currently isn’t possible to save an Apple Pay source as a customer’s default payment method using our pre-built UI components. PaymentContext is mainly intended for use with one-time purchases, and Apple Pay sources can only be re-used for subscriptions.

I’m sorry we don’t have a better answer for you right now. You may want to take a look at this PR [0], which adds an includeApplePaySources switch to CustomerContext . While this option shouldn’t be used with PaymentContext , you could use it to build your own subscriptions payment method UI driven by CustomerContext .

Источник