- Tax Free, или как купить iPhone, одежду, продукты питания за границей намного дешевле, чем у нас

- Tax Free (возврат НДС (VAT)): как это работает?

- За покупку каких товаров можно вернуть Tax Free?

- Как покупать, чтобы потом вернуть НДС?

- Какой должна быть минимальная сумма чека для возврата Tax Free?

- Как правильно рассчитать сумму возврата Tax Free?

- Дальнейшие действия на границе

- Где вернуть Tax Free и как это сделать максимально выгодно?

- В самом магазине

- Доверенность на получение Tax Free

- Компания-посредник

- В России хотят ввести tax free. Как это скажется на технике Apple

- Что такое tax free

- Как это влияет на покупку техники Apple в России

- Итог: США — невыгодно, Европа — выгодно

- Tax Free при покупке в Apple Store в Европе?

- Payment & Pricing

- Payment

- Payment methods

- Using more than one payment method

- Credit Cards or Debit Cards

- Troubleshooting credit card & debit card payment errors

- Account verification

- Security codes

- Daily spending limits for Debit Cards

- When Apple charges your account

- Credit cards accepted

- PayPal

- Apple Gift Cards

- How to Use Apple Gift Cards

- Checking Your Apple Gift Card Balance

- How to Use Apple Store Gift Cards

- How to Use Apple Gift Cards and App Store & iTunes Gift Cards

- Lost or Stolen Cards

- Apple Account Balance

- Tax rate

- Tax-exempt orders

- Education Pricing

- U.S. Government Pricing

- Shop for yourself

- Federal Employee Store

- State and Local Government Employees

- Shop for your agency

- GSA Schedule and Federal Contracts

- Federal SmartPay Store

- State and Local Government Store

- Promotions, Rebates, and Coupons

- Check Eligibility & Request a Rebate

- Check the status of a rebate

- Stay in the know

- SALES & REFUND TERMS AND CONDITIONS (“TERMS”)

- U.S. Sales and Refund Policy

- Standard Return Policy

- Return of AppleCare+ under an iPhone Upgrade Program

- iPhone, iPad and Watch Returns — Wireless Service Cancellation

- Apple Watch Returns

- Additional Apple Product Terms

- Pricing and Price Reductions/Corrections

- Order Acceptance/Confirmation

- Shipping & Delivery

- In-Store Pickup and Return

- Pickup Contact

- Consumers Only

- U.S. Shipping Only

- Product Availability and Limitations

- Gift Cards

- Looking for something?

Tax Free, или как купить iPhone, одежду, продукты питания за границей намного дешевле, чем у нас

Вряд ли найдется хотя бы один человек, который не хотел бы, чтобы ему возвращали часть денег за покупки. Думаете, так не бывает? Еще как бывает! Приобретая товар, мы также платим налог на добавленную стоимость (НДС), который включен в цену. Если покупать товар за рубежом, этот налог можно вернуть, и мы расскажем вам как.

Tax Free (возврат НДС (VAT)): как это работает?

Выставляя цену на свой товар, продавец учитывает НДС, который идет в государственный бюджет. Иностранцы не пользуются услугами бюджетных организаций, поэтому и не обязаны платить дополнительный налог. Это не значит, что продавцы должны делать иностранным покупателям скидку. Иностранцы оплачивают покупку точно так же, как и все остальные, зато по возвращении домой могут вернуть часть потраченной суммы. Система возврата НДС, уплаченного при покупке товара, называется Tax Free.

В зависимости от страны, где была совершена покупка, вы сможете вернуть от 8% (Япония) до 27% (Венгрия) от ее стоимости. Однако имейте в виду, что возвращенная сумма может оказаться меньше, чем та, на которую вы рассчитывали. Как правило, магазины возвращают деньги через своих партнеров, которые взимают с этой суммы комиссию за услуги.

За покупку каких товаров можно вернуть Tax Free?

Возместить деньги, потраченные на еду, медицинское обслуживание или книги, в рамках Tax Free у вас не получится. Зато вы можете вернуть часть стоимости приобретенных за границей ювелирных украшений, электроники, бытовой техники, одежды, обуви и часов.

Если вы всерьез вознамерились воспользоваться Tax Free, ищите магазины с соответствующей наклейкой. Надпись на ней всегда на английском языке, независимо от страны. Кроме того, должно быть указано название компании, через которую будет осуществляться возврат денег.

Как покупать, чтобы потом вернуть НДС?

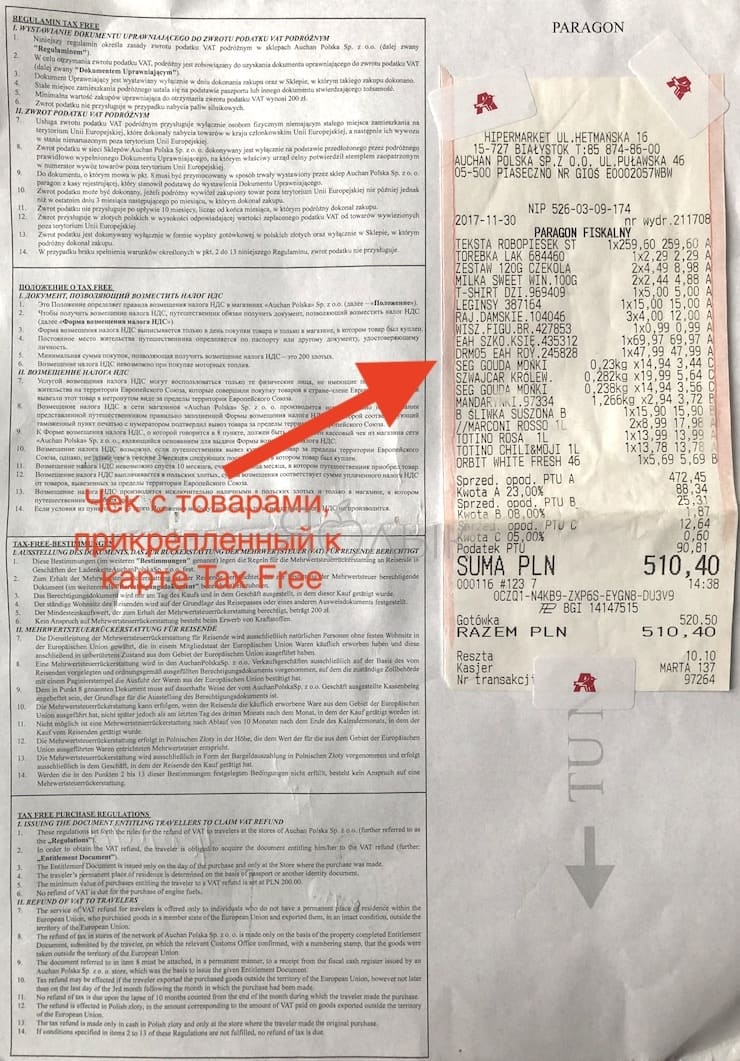

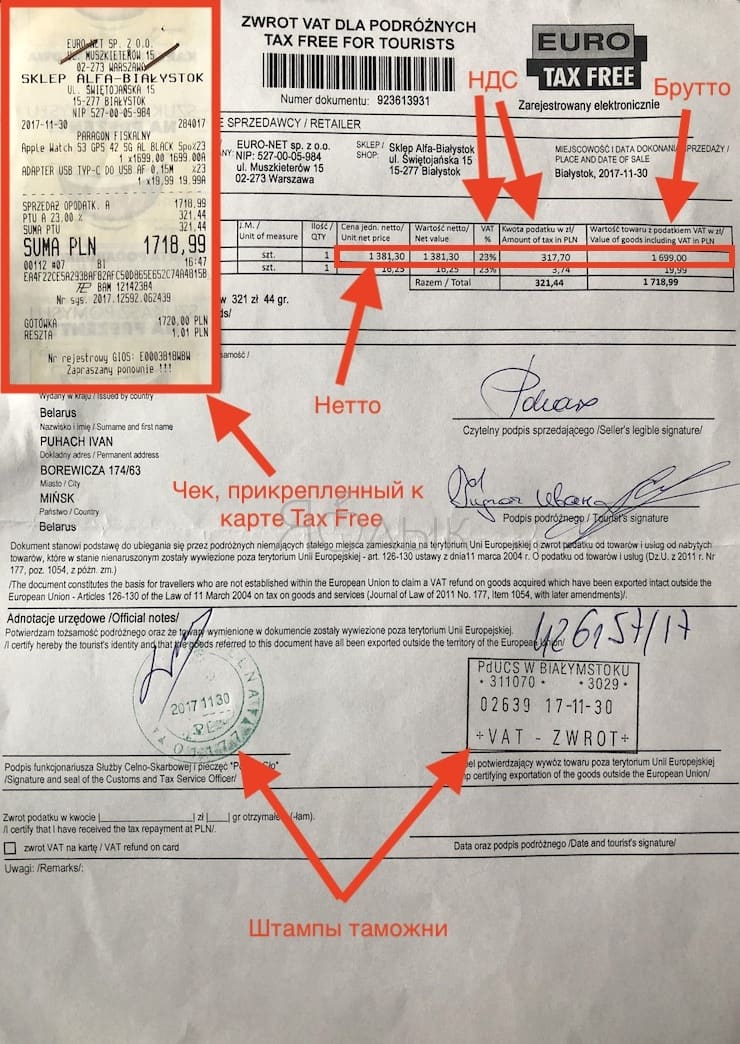

Итак, вы нашли нужный магазин. Что дальше? При оплате покупки попросите у продавца чек Tax Free, который будет прикреплен к стандартному чеку об оплате. Помните, что для получения такого чека вы должны будете предъявить заграничный паспорт или его ксерокопию, поэтому позаботьтесь об этом заранее.

Все покупки должны быть внесены в один чек. Если вы отоваривались в большом торговом центре, то должны найти специальный отдел, где все покупки из разных магазинчиков будут оформлены в один документ.

Совет: внимательно проверяйте все внесенные в бланк данные, ведь ошибки могут послужить причиной для отказа в возврате средств.

Кроме того, имейте ввиду, что все товары из чека Tax Free должны быть вывезены из Евросоюза в целостности и сохранности.

Приведем пример из жизни: Вы провели целый день шопинга в торговом центре и в конце концов рассчитались с покупками на кассе с просьбой оформить единый чек Tax Free. За время пути до границы Вы захотели перекусить и вспомнили, что среди купленных товаров была коробка конфет и напиток, ну и незадумываясь скушали это… Этого делать категорически нельзя! Дотошный таможенный инспектор может проверить наличие всех товаров из чека, и в случае, если товаров будет меньше или целостность упаковки некоторых из них будет нарушена, имеет полное право отказать в оформлении чека Tax Free (не поставит штампы таможни).

Какой должна быть минимальная сумма чека для возврата Tax Free?

В каждой стране установлена своя минимальная сумма чека, которая подлежит возврату по системе Tax Free. К примеру, в Германии вам достаточно купить что-то на 25 евро, Польше 200 злотых (около 50 евро), а вот во Франции вы не сможете получить деньги обратно, если сумма покупки будет менее 175 евро.

Как правильно рассчитать сумму возврата Tax Free?

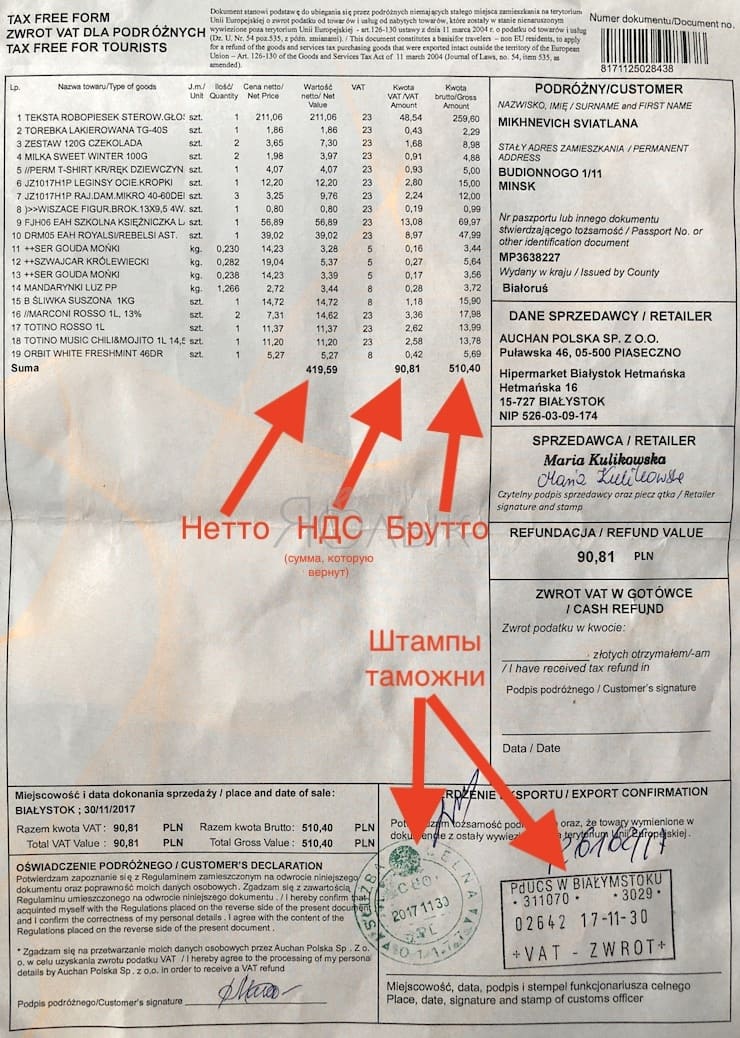

Для понимания процесса расчета суммы возврата Tax Free, приведем пример на покупке часов Apple Watch в Польше.

Стоимость часов в Польше за вычетом Tax Free составляет 1 381,3 злотых (около 23 500 руб на февраль 2018 года), тогда как в России такие часы обойдутся покупателю в 27 000 руб. Выгода на одних часах — 3 500 рублей!

- Сумма «брутто»: стоимость часов Apple Watch, указанная в магазине с учетом ставки НДС — 1699,99 злотых.

- Ставка НДС (в Польше называется VAT): на электронику составляет 23% и в нашем случае равна — 317,7 злотых.

- Сумма «нетто»: стоимость часов без НДС — 1 381,3 злотых (около 23 500 руб).

Формула точного расчета:

Сумма «брутто» (1699,99 злотых) — Сумма нетто (1 381,30 злотых) = Ставка НДС (317,7 злотых)

К возврату — 317,7 злотых

В то же время, сумма 317,7 злотых равна примерно 18,7% (а не 23%, как ошибочно считают многие) от общей стоимости часов.

Но по факту, из-за того что покупатели не знают цену нетто, самой распространенной ошибкой при расчете суммы возврата является вычитание ставки НДС (в нашем примере 23%) от стоимости товара, указанной на ценнике в магазине, т.е. «брутто». Цена в магазине формируется от суммы «нетто» + ставка НДС.

В нашем случае, сумма возврата не равна 23% от суммы брутто, а приблизительно равна 18,7%

Для получения приблизительной универсальной процентной ставки или суммы для возврата (в нашем случае при покупке электроники в Польше — это 18,7% ) можно воспользоваться такой формулой:

Первое действие:

X (стоимость 1%) = Сумма «брутто» × размер ставки НДС / (100 + ставка НДС)

Второе действие:

Сумма возврата Tax Free = X × размер ставки НДС

Дальнейшие действия на границе

Выезжая из страны, вы должны поставить на таможне штамп о вывозе покупок. Найдите табличку Tax Free office и смело обращайтесь туда. Сотрудники таможни должны будут проверить чек и указанные в нем товары. Все покупки должны быть в упаковке без следов использования. Если вы оформляете Tax Free впервые, лучше уточните процедуру прохождения у соседей по очереди или у представителей таможни.

Если вы выезжаете из Евросоюза, ставить штамп нужно в той стране, через которую вы покидаете ЕС. При путешествии по Евросоюзу ставить штампы Tax Free в каждой стране не надо. У чеков есть свой срок годности, который зачастую составляет три месяца с момента покупки. Правда, в некоторых странах он сокращен до месяца — это означает, что товар должен быть вывезен из страны в течение этого срока.

Где вернуть Tax Free и как это сделать максимально выгодно?

В самом магазине

Теперь мы подошли к самому интересному — возврату денег. Наиболее выгодным вариантов возврата Tax Free является повторное посещение магазина (иногда достаточно прислать в магазин чек со штампами по почте), в котором была осуществлена покупка. В этом случае, вам вернут 100% суммы Tax Free.

Доверенность на получение Tax Free

Если вы не собираетесь посещать страну и магазин, где была осуществлена покупка, но вы знаете близкого человека, который может приехать в магазин в ближайшее время, напишите доверенность на его имя (попросите бланк доверенности у продавца). В этом случае, всю сумму Tax Free получит за вас этот человек. Заверять у нотариуса доверенность не требуется.

Пример доверенности, на получение Tax Free:

Компания-посредник

В иных случаях, вы можете получить деньги в аэропорту, у КПП (если путешествуете наземным транспортом), по почте или в своем банке. В этом случае вам нужно обратиться в офис Tax Refund компании-посредника (например «Global Blue»). Деньги могут быть выданы вам наличными или переведены на банковскую карту. При выдаче средств на руки будет взиматься комиссия, а на карту средства будут переведены без вычетов. Иногда в аэропортах установлены специальные почтовые ящики, куда вы можете опустить ваши чеки, и деньги придут вам на карту. Внимательно следите за тем, в ящик какой компании бросаете чеки (это должна быть компания, название которой указано на вашем чеке).

Если вы путешествуете наземным транспортом, офис Tax Refund может располагаться у контрольно-пропускных пунктов. Сначала получите штамп, а затем обращайтесь за возвратом.

Отправить чек компании-посреднику можно по почте. Внимательно проверьте чек – там должен быть указан соответствующий адрес. Приготовьтесь к тому, что деньги поступят на ваш счет только через 1-2 месяца.

Совет: отправляя документ по почте, не забудьте указать номер своей банковской карты.

Получить назад НДС можно в банках, сотрудничающих с компаниями-посредниками. Посмотрите на чек и узнайте название своей компании-посредника, а затем зайдите на ее сайт и ознакомьтесь с полным списком сотрудничающих с нею финорганизаций.

Будьте внимательны на каждом этапе оформления и получения Tax Free, иначе вы рискуете так и не увидеть свои деньги. Вам могут отказать в возврате НДС, если форма в магазине была заполнена неправильно, на чеке отсутствует штамп таможни или истек срок действия чека.

Источник

В России хотят ввести tax free. Как это скажется на технике Apple

Госдума приняла в первом чтении законопроект о введении в России системы tax free. Об этом говорится на сайте Думы.

Что такое tax free

По сути, это система возврата налога на добавленную стоимость (НДС). Она возвращается иностранными гражданами при пересечении границы.

Суммы «скидок» обычно составляют 8-25% от цены товара. Правда, работает это не везде, а только в специальных магазинах.

Что касается России, то у нас tax free будет действовать при покупке от 10 000 рублей. Компенсацию получат граждане не из Евразийского экономического союза.

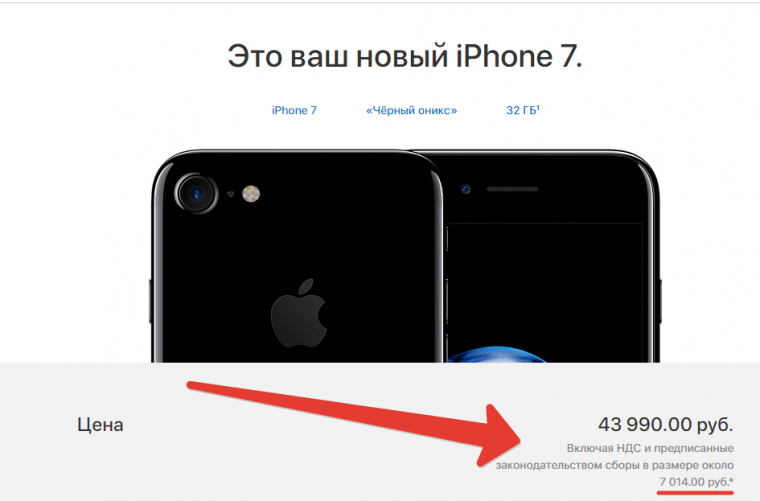

Как это влияет на покупку техники Apple в России

Иностранцы смогут приезжать в Россию и покупать технику Apple дешевле, возвращая себе НДС.

У нас iPhone 7 стоит 43 990 рублей с учетом НДС. С вычетом НДС разница будет следующей:

Важно: цены ниже изначально указаны без НДС как в США, так и для России.

iPhone 7 US — $549 (31 942 руб.)

iPhone 7 RU — €635 (36 976 руб.)

В России MacBook Pro 13″ 2017 стоит 94 990 рублей. Разница с вычетом НДС:

MacBook Pro 13″ US – $1 299 (75 573 руб.)

MacBook Pro 13″ RU – $1 373 (79 880 руб.)

Тем не менее, это зависит от страны и текущего налога в ней. Так, в Германии покупать дороже:

iPhone 7 DE — €629 (43 750 руб.)

iPhone 7 RU — €530 (36 976 руб.)

Итог: США — невыгодно, Европа — выгодно

Выходит, что тем же американцам невыгодно покупать у нас технику Apple, пускай она и дешевле, чем в российском розничном магазине.

Но вот странам Европы жить становится легче. Даже если вычитать налог в Германии, все равно в России такая покупка выходит дешевле. Конкретно на примере iPhone 7 это €7. Очевидно, что с MacBook или iMac эта разница будет более существенной.

В итоге, при введении tax free техника Apple может стать выгоднее приезжим из других стран. Вполне вероятно, что многие перекупщики после введения закона отправятся в Россию.

Источник

Tax Free при покупке в Apple Store в Европе?

Господа, кто-нибудь наверняка возвращал налог при покупке в Apple Store в странах Европы (через инет-магазитн даже больше интересует).

Они при этом весь налог возвращают или делают это через посредников? И если так, то как можно их избежать, чтобы получить полное возмещение налога?

Буду благодарен за ответы, ибо даже 10% — это хорошая «скидка».

- Вопрос задан более трёх лет назад

- 42455 просмотров

Оценить 1 комментарий

Прошу прощение, что путано излагаю, дело было достаточно давно — все нюансы уже не упомню.

Пару лет назад в Чехии покупал тайм-капсулу у местного реселлера. Попросил оформить tax refund. Выдали бумажек — денег не дали, сказали либо в аэропорту при отлете, либо в специальных магазинах со значком tax refund. То есть оформить возврат налога и получить этот возврат физически на руки не всегда можно в одном и том-же месте.

Далее с этими бумажками и чеком сходил в совершенно сторонний магазин, который собственно и осуществлял tax refund (в ювелирную лавку, если интересно). Там потребовали еще и номер моей кредитки, но в итоге выдали живых денег. Оставшуюся часть бумажек засунул в специальный ящик в аэропорту при отлете (если этого не сделать — то где-то через месяц с кредитки спишется штраф).

В принципе можно было не морочится и получить деньги на руки уже в аэропорту перед отлетом, но тут есть один минус. Налог возвращается в валюте той страны, где осуществлена покупка. В моем случае в чешских кронах. Обменные курсы в аэропортах совершенно не интересны, впрочем как и везти кроны назад в РФ. Поэтому мне было выгоднее получить возврат налога в середине моего пребывания в стране (ну и потратить там эти деньги), чем в конце моего путешествия уже в аэропорту.

Источник

Payment & Pricing

Read about the variety of payment options you can choose from when you purchase from apple.com, and learn how the tax on your order is calculated. Also, get more information about special pricing, offers, promotions, and other great deals with limited time availability.

Payment

Payment methods

Apple accepts a variety of payment methods online. Click on a payment method below to find out more:

Note: Business lease, wire transfers, and money orders are ineligible payment methods for pickup items.

Some payment types are ineligible for orders that ship to multiple addresses. If you are using an ineligible payment type for an order shipping to multiple addresses, you will either need to change the payment method, or ship your order to a single address.

Some customers may qualify for other forms of payment. Please call 1-800-MY-APPLE and speak to an Apple Specialist for more information.

Using more than one payment method

You can also combine payment methods to pay for your purchase. Choose from the following combinations of credit cards and gift cards:

- Credit card(s) — up to two

- Apple Gift Card(s) — up to eight

- Apple Gift Card(s) — up to eight + one credit card

- Apple Gift Card(s) — up to eight + Apple Account Balance

- Apple Gift Card(s) — up to eight + Apple Account Balance + one credit card

- Apple Account Balance + one credit card

Apple Gift Cards and Apple Account Balance cannot be used with Apple Pay, PayPal, or split credit card payments. Please note that you can use the value from all types and generations of Apple gift cards. For more details, see:

- How to use Apple Gift Cards and App Store & iTunes Gift Cards

- How to use Apple Store Gift Cards

During checkout, if you are paying with a gift card issued by a credit card company, you can combine it with one credit card.

Credit Cards or Debit Cards

Troubleshooting credit card & debit card payment errors

- If your card is new or recently reissued, make sure it has been activated.

- Double check the card type (for example, American Express), the account number and expiration date.

- Remove dashes or spaces from the account number.

- If everything seems to be correct, call the card issuer’s customer service 800 number on the back of your card. Your credit card company may need to speak with you before they authorize your purchase.

Account verification

To prevent any unnecessary delays processing your order, please ensure that the billing addresses on your order matches the information on your credit card account. If you have recently moved or are unsure whether you receive your credit card statement at your work or home address, please contact your card-issuing bank using the 800 number on the back of your credit card to confirm.

Security codes

The card security code is a unique three or four digit number printed on the front (American Express) or back (Visa/MasterCard/Discover) of your card, in addition to the account number.

Daily spending limits for Debit Cards

Most debit and check cards have daily spending limits that may substantially delay the processing of an order — even if there is enough money in an account. When using a debit card, funds are immediately reserved in your bank account at the time you place your order. Please consult your card-issuing bank for information about your daily spending limits if you are having trouble placing your order.

When Apple charges your account

Apple receives authorization to charge your account prior to shipping your item(s). However, your card will only be charged after your order has shipped. If your order contains multiple items and they ship at different times, you may see multiple charges on your credit card statement.

Credit cards accepted

In the U.S., we accept:

- American Express

- Discover

- MasterCard

- UnionPay

- Visa

If you are paying for your order with an international Visa, MasterCard, American Express, or UnionPay credit card, please note that the purchase price may fluctuate with exchange rates. In addition, your bank or credit card issuer may also charge you foreign conversion charges and fees, which may also increase the overall cost of your purchase. Please contact your bank or credit card issuer regarding these fees.

Any gift card issued by a credit card company can be used as a method of payment when buying from Apple online. During checkout, if you are paying with a gift card issued by a credit card company, you can combine it with one credit card.

PayPal

When you place an order with PayPal you will be redirected to the PayPal website. There you will then need to login with your PayPal username and password.

If your order consists of multiple deliveries, your PayPal account will be charged separately for each shipment.

Apple Gift Cards

The Apple Gift Card was introduced in 2020 and is now the gift card to use in purchasing products, accessories, apps, games, music, movies, TV shows, iCloud, and more from Apple. Apple Gift Cards can be used in the Apple Store, the Apple Store app, apple.com, the App Store, iTunes, Apple Music, Apple TV, Apple Books, and other Apple properties.

You can use Apple Gift Cards to pay for products, subscriptions, and services from Apple online. Or spend Apple Gift Cards at the Apple Store or by calling 1-800-MY-APPLE. You cannot pay for an Apple Gift Card with an Apple Gift Card or Apple Account Balance. Apple Gift Cards can be used only in the country or region in which they were purchased.

You can use up to eight Apple Gift Cards at a time when you purchase online from Apple, or if you’re placing an order by calling 1‑800‑MY‑APPLE. You can use your gift card(s) with one credit card and your Apple Account Balance to pay for your purchase.

Any value on an App Store & iTunes Gift Card or Apple Store Gift Card in your possession is valid.

To redeem any Apple Gift Card or App Store & iTunes Gift Card into your Apple Account Balance, simply enter or scan the PIN. We send electronic Apple Gift Cards to the card recipient via email. Using this email, the recipient can easily redeem the card’s value to their Apple Account Balance for online purchases or use the PIN at an Apple Store, on apple.com, and in the Apple Store app.

For physical Apple Gift Cards, the PIN can be found on the gift card insert. On previous-generation Apple gift cards, reveal the PIN by peeling or scratching off the covered area on the back of the card. For electronic gift cards, the PIN can be found in the email. Please keep the card in your possession until the order has been processed and delivered.

Apple Gift Cards and Apple Account Balance are subject to applicable terms and conditions. Learn more >

How to Use Apple Gift Cards

Apple Gift Cards can be used to pay for products and accessories as well as apps, games, music, movies, TV shows, iCloud storage, and more. Apple Gift Cards can be used on apple.com, in the Apple Store app, by phone, or in person at the Apple Store. You can also redeem Apple Gift Cards into your Apple Account Balance to buy products, apps, content, and services online from Apple. Apple Gift Cards can be used only in the country or region where they were purchased.

In an Apple Store, simply present the physical card or email to the cashier at time of payment. If you are using your Apple Gift Card over the phone at 1‑800‑MY‑APPLE, you’ll need to provide the PIN (located on the back of the card insert or in the gift card email). Remember to keep the card in your possession until your item(s) have been delivered.

You can use up to eight Apple Gift Cards at Apple.com or when placing an order over the phone at 1‑800‑MY‑APPLE. You can use up to eight Apple Gift Cards for one transaction when you purchase at an Apple Store. You can use your Apple Gift Card(s) with one credit card as well as with your Apple Account Balance to pay for your purchase. Apple Gift Cards cannot be used to purchase another Apple Gift Card.

Checking Your Apple Gift Card Balance

You can check your gift card balance online by entering the PIN from any Apple gift card. See the Apple Account Balance section for details on how to redeem your gift card into your Apple Account Balance for online shopping, apps, content, and services.

How to Use Apple Store Gift Cards

The Apple Store Gift Card has been replaced with the Apple Gift Card. Of course, any value remaining on an Apple Store Gift Card in your possession is still valid. Apple Store Gift Cards can only be used to purchase products classified as finished goods — including iPhone, iPad, Mac, Watch, Apple TV, AirPods, HomePod, and accessories like headphones, cases, cables, adaptors, and much more. You can only purchase physical products with an Apple Store Gift Card on apple.com, in the Apple Store app, and at the Apple Store.

Apple Store Gift Cards are not eligible to be redeemed into your Apple Account Balance and cannot be used to purchase content or services (e.g., music, movie, apps, iCloud)

How to Use Apple Gift Cards and App Store & iTunes Gift Cards

Both the Apple Gift Cards and App Store & iTunes Gift Cards (previous generation) can be redeemed into your Apple Account Balance. Additionally, you can apply your gift card by entering the PIN during the payment step in checkout on apple.com or in the Apple Store app, or when shopping via 1-800-MY-APPLE. Apple Gift Cards can’t be used with Apple Pay, PayPal, or split credit card payments.

Lost or Stolen Cards

To report a lost or stolen Apple Gift Card (or any previous-generation Apple gift card), please contact Apple at any Apple Store location or by telephone at 1‑800‑MY‑APPLE. Replacement cards will be issued after Apple verifies that the lost or stolen card has not been redeemed and you present your original purchase receipt. Apple is not responsible for lost or stolen gift cards.

Apple Account Balance

Redeem Apple Gift Cards or add money directly into your Apple Account Balance anytime. Then use the balance to pay for Apple products, accessories, apps, games, music, movies, TV shows, iCloud, and more. You can check your Apple Account Balance online.

To use your Apple Account Balance to buy products on apple.com or in the Apple Store app, make sure you are signed in with your Apple ID. Then simply choose an amount to apply to your purchase during the payment step in checkout. You can use the funds from your Apple Account Balance in combination with one credit card and up to eight Apple Gift Cards. See Payment for details on using more than one payment method.

You can redeem Apple Gift Cards and App Store & iTunes Gift Cards into your Apple Account Balance on iTunes, Apple Music, Apple TV, or the App Store. Visit any of these Apple apps or sites and tap your Apple ID account avatar or choose Account from the main menu. Select “Redeem Gift Card or Code” or “Redeem,” then scan or enter the gift card PIN. The funds will appear in your Apple Account Balance to use for shopping, listening, watching, playing, working, and more.

Please note that your Apple ID Balance is now your Apple Account Balance.

Tax rate

In accordance with state and local law, your online purchases from Apple will be taxed using the applicable sales tax or seller’s use tax rate for your shipping address, or the Apple Store address where the item is picked up.

The tax listed during checkout is only an estimate. In California and Rhode Island, sales tax is collected on the unbundled price of the iPhone.

Your invoice will reflect the final total tax, which includes state and local taxes, as well as any applicable rebates or fees.

Tax-exempt orders

To place an order on behalf of a tax-exempt organization or individual, please call an Apple Store Specialist at 1‑800‑MY‑APPLE . You will need to provide proof of state tax-exempt status for the state where the product is being shipped. The organization or individual name on the order must exactly match the state tax-exempt certificate. Federal tax exemption certificates are not applicable.

Note, for corporate tax-exempt purchases, only corporate-issued credit cards for the applicable tax-exempt organization will be accepted as a method of payment (i.e., no cash, personal check, or personal credit cards will be accepted).

Education Pricing

Apple offers special pricing to students, teachers, administrators, and staff members. We also offer special pricing for home-schooling programs, pre-kindergarten, and purchases made on behalf of students.

If you live in the U.S., visit the U.S. Apple Store for Education to place your order for reduced prices on the full range of Mac computers, plus select third-party products. Please note that only orders placed on your country’s Apple Education site are eligible for the special education pricing.

U.S. Government Pricing

Apple offers special pricing to local, state, and federal government employees and agencies. Visit our online Apple Government Stores (Opens in a new window) to view reduced prices. Please note that only orders placed on our online Apple Government Stores (Opens in a new window) are eligible for the government pricing.

Shop for yourself

Federal Employee Store

Apple’s Federal Government Employee Purchase Program (Opens in a new window) offers special pricing for the following U.S. Federal Government employees who want to purchase Apple products for personal use:

- Current and retired

- Contractors

- Family members

Current, former, retired members, and family members of the following government entities are eligible:

State and Local Government Employees

Apple’s State and Local Government Employee Purchase Program (Opens in a new window) offers special pricing for employees of State and Local Government Agencies who want to purchase Apple products for personal use.

Shop for your agency

GSA Schedule and Federal Contracts

Federal SmartPay Store

Use Apple’s Federal SmartPay Store (Opens in a new window) to purchase Apple and third-party products using a federally issued SmartPay credit card.

State and Local Government Store

Use Apple’s State and Local Government Store (Opens in a new window) to purchase Apple and third-party products using terms with Apple or via procurement card.

Promotions, Rebates, and Coupons

Visit the Product Promotions (Opens in a new window) homepage for a list of limited-time offers. You can also view the Product Promotions FAQ (Opens in a new window) to learn more about how to qualify, request an Apple rebate, and any Terms and Conditions for each promotion.

Promotional pricing is usually applied either at the time of your online purchase, or as a rebate after you receive your product. Rebates may also be available as a special offer from leading Macintosh software and accessory manufacturers, as well as from Apple directly.

Check Eligibility & Request a Rebate

To determine eligibility or to request an Apple rebate, visit the Product Promotions (Opens in a new window) homepage and view the Product Promotions FAQ (Opens in a new window) .

Check the status of a rebate

Once you have submitted the requested proof of purchase documents for your rebate, you can check your rebate status (Opens in a new window) online. You’ll need some combination of the following pieces of information:

- Claim number

- Email address

- Daytime Phone

Be sure the information entered is exactly as submitted with your rebate claim.

Stay in the know

Want to be informed of new promotions and receive eCoupons? Subscribe to eNews (Opens in a new window) .

More ways to shop: Find an Apple Store or other retailer near you. Or call 1‑800‑MY‑APPLE .

Copyright © 2021 Apple Inc. All rights reserved.

SALES & REFUND TERMS AND CONDITIONS (“TERMS”)

U.S. Sales and Refund Policy

Thanks for shopping at Apple. We appreciate the fact that you like to buy the cool stuff we build. We also want to make sure you have a rewarding experience while you’re exploring, evaluating, and purchasing our products, whether you’re at the Apple Online Store, in an Apple Retail Store, or on the phone with the Apple Contact Center. (To make it visually easier on both of us, we’ll refer to these entities as the “Apple Store” in this policy.)

As with any shopping experience, there are terms and conditions that apply to transactions at an Apple Store. We’ll be as brief as our attorneys will allow. The main thing to remember is that by placing an order or making a purchase at an Apple Store, you agree to the terms set forth below along with Apple’s Privacy Policy (Opens in a new window) and Terms of Use (Opens in a new window) .

Standard Return Policy

We fundamentally believe you will be thrilled with the products you purchase from the Apple Store. That’s because we go out of our way to ensure that they’re designed and built to be just what you need. We understand, however, that sometimes a product may not be what you expected it to be. In that unlikely event, we invite you to review the following terms related to returning a product.

For any undamaged product, simply return it with its included accessories and packaging along with the original receipt (or gift receipt) within 14 days of the date you receive the product, and we’ll exchange it or offer a refund based upon the original payment method. In addition, please note the following:

- Products can be returned only in the country or region in which they were originally purchased.

- The following products are not eligible for return: electronic software downloads, subscriptions to the Software-Up-To-Date program, Apple Store Gift Cards, and any Apple Developer Connection products.

- For returns to an Apple Retail Store for cash, cash equivalent, and check transactions over $750, Apple will mail a refund check to you within 10 business days.

- Should you wish to return ten or more of the same product, you must return to the Apple Store where originally purchased.

- In the case of items returned with a gift receipt, Apple will offer you an Apple Gift Card.

- Opened software cannot be returned if it contained a seal with the software license on the outside of the package and you could read the software license before opening its packaging. As an exception, you may return Apple-branded software if you do not agree to the licensing terms; however, you may not retain or otherwise use any copies of returned software.

- Apple provides security features to enable you to protect your product in case of loss or theft. If these features have been activated and cannot be disabled by the person in possession of the phone, Apple may refuse the return or exchange.

- For complete details on how to return a product purchased at the Apple Store please visit the Returns & Refunds (Opens in a new window) page.

Return of AppleCare+ under an iPhone Upgrade Program

Should you return the AppleCare+ portion of your iPhone Upgrade Program, please note that you will lose your Upgrade Option as set forth under the terms of the iPhone Upgrade Program (Opens in a new window) .

iPhone, iPad and Watch Returns — Wireless Service Cancellation

Wireless carriers have different service cancellation policies. Returning your iPhone, iPad or Watch may not automatically cancel or reset your wireless account; you are responsible for your wireless service agreement and for any applicable fees associated with your wireless account. Please contact your wireless service provider for more information.

Apple Watch Returns

Apple Watch from the Edition collection may only be returned or exchanged if it’s in its original, undamaged and unmarked condition after passing inspection at Apple’s offsite facility. Depending on your original form of tender, a check, wire transfer, or refund to your debit/credit card will be issued within 10 business days provided the returned item is in its original condition.

Additional Apple Product Terms

The purchase and use of Apple products are subject to additional terms and conditions found at https://www.apple.com/legal/sla/ (Opens in a new window) and https://www.apple.com/legal/warranty/ (Opens in a new window) .

Making unauthorized modifications to the software on an iPhone violates the iPhone software license agreement. The common term for modifying an iPhone is jail-breaking, with a particular emphasis on the second part of that term. That’s why we strongly, almost emphatically, recommend that you do not do so. Really. Should you be unable to use your iPhone due to an unauthorized software modification, its repair will not be covered under the warranty.

Pricing and Price Reductions/Corrections

Apple reserves the right to change prices for products displayed at/on the Apple Store at any time, and to correct pricing errors that may inadvertently occur. Additional information about pricing and sales tax is available on the Payment & Pricing (Opens in a new window) page. In the event you have been charged more than the posted price for a product in an Apple Retail Store, please see a Manager for a refund of the overcharge.

Should Apple reduce its price on any Apple-branded product within 14 calendar days from the date you receive your product, feel free to visit an Apple Retail Store or contact the Apple Contact Center at 1-800-676-2775 to request a refund or credit of the difference between the price you were charged and the current selling price. To receive the refund or credit you must contact Apple within 14 calendar days of the price change. Please note that this excludes limited-time price reductions, such as those that occur during special sales events, such as Black Friday or Cyber Monday.

Price protection is only available for up to 10 units of a particular product. Additionally, we may require that you have the product with you or otherwise have proof of possession when requesting price protection.

Prices shown are in U.S. dollars. If you are paying for your order with an international Visa, MasterCard, or American Express credit card, please note that the purchase price may fluctuate with exchange rates. In addition, your bank or credit card issuer may also charge you foreign conversion charges and fees, which may also increase the overall cost of your purchase. Please contact your bank or credit card issuer regarding these fees.

Order Acceptance/Confirmation

Apple may, in its sole discretion, refuse or cancel any order and limit order quantity. Apple may also require additional qualifying information prior to accepting or processing any order. Once we receive your Online or Call Center order, we’ll provide you with an email order confirmation. Your receipt of an order confirmation, however, does not signify Apple’s acceptance of your order, nor does it constitute confirmation of our offer to sell; we are simply confirming that we received your order. The Apple Store reserves the right at any time after receiving your order to accept or decline your order for any reason. If Apple cancels an order after you have already been billed, Apple will refund the billed amount.

Shipping & Delivery

Please review the Shipping & Pickup (Opens in a new window) page to learn about how and when you will receive the products you purchased from the Apple Store. Since the actual delivery of your order can be impacted by many events beyond Apple’s control once it leaves our facilities, Apple cannot be held liable for late deliveries. We will, however, work with you to ensure a smooth delivery.

As Apple takes care of the dispatch of the products you purchase on the Apple Store, the risk of loss of, or damage to, product(s) shall pass to you when you, or a person designated by you, acquires physical possession of the product(s). Title in the product(s) shall pass to you when the product(s) is picked up by the carrier from our warehouse. At this point, you will receive the Shipment Notification Email. If there are any issues with delivery, please contact Apple to resolve.

In-Store Pickup and Return

Apple offers in-store pickup for many of the items available on the Online Store. Certain products and payment methods, however, may not qualify for in-store pickup. Only you or the person designated by you may pick up the item(s) purchased. A government-issued photo ID and order number will be required for pickup. Apple will notify you when your order is ready and the date by which you need to pick up your items. We’ll also send you a reminder or two, just in case it slips your mind. If you don’t pick up your order, Apple may cancel it. Please click here (Opens in a new window) for complete details about in-store pickup.

Pickup Contact

If you select in-store pickup, you may designate a third party to pick up your order. You must provide the name and email address of the third party. Please note that certain products and payment methods are not eligible for in-store pickup by a third party. The third party will need to bring a government issued photo ID and order number for pickup. Apple is not responsible for actions taken by the third party once your item(s) have been picked up.

Consumers Only

The Apple Store sells and ships products to end-user customers only, and we reserve the right to refuse or cancel your order if we suspect you are purchasing products for resale.

U.S. Shipping Only

Products purchased online from Apple will only be shipped to addresses within the U.S. and are subject to U.S. and foreign export control laws and regulations. Products must be purchased, sold, exported, re-exported, transferred, and used in compliance with these export laws and regulations. To purchase Apple products online from outside of the U.S., please click here for international store information.

Product Availability and Limitations

Given the popularity and/or supply constraints of some of our products, Apple may have to limit the number of products available for purchase. Trust us, we’re building them as fast as we can. Apple reserves the right to change quantities available for purchase at any time, even after you place an order. Furthermore, there may be occasions when Apple confirms your order but subsequently learns that it cannot supply the ordered product. In the event we cannot supply a product you ordered, Apple will cancel the order and refund your purchase price in full.

Gift Cards

For Apple Store Gift Card Terms and Conditions, please click here (Opens in a new window) .

Looking for something?

We thought so. The page you’re looking for, however, is no longer available at apple.com.

We do have some similar information to share with you.

Источник